Shift in BTC Options: Market Sentiment Reassessed

The recent downturn in the cryptocurrency market has led to a notable shift in trader sentiment, as the once-popular $120,000 bitcoin (BTC) options bet has ceded its status to the $100,000 call option. This transition indicates that traders are recalibrating their bullish expectations amid the market’s fluctuations.

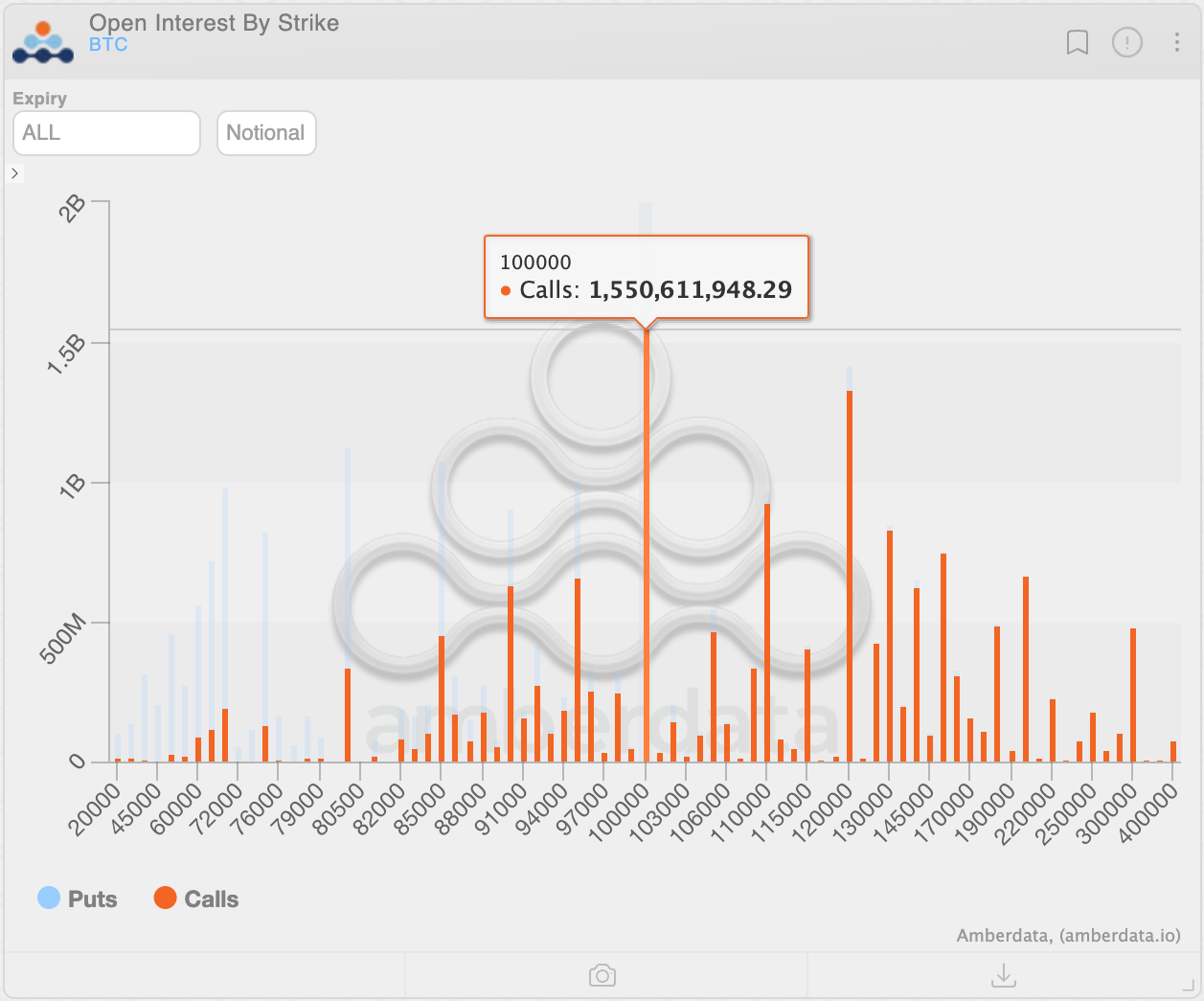

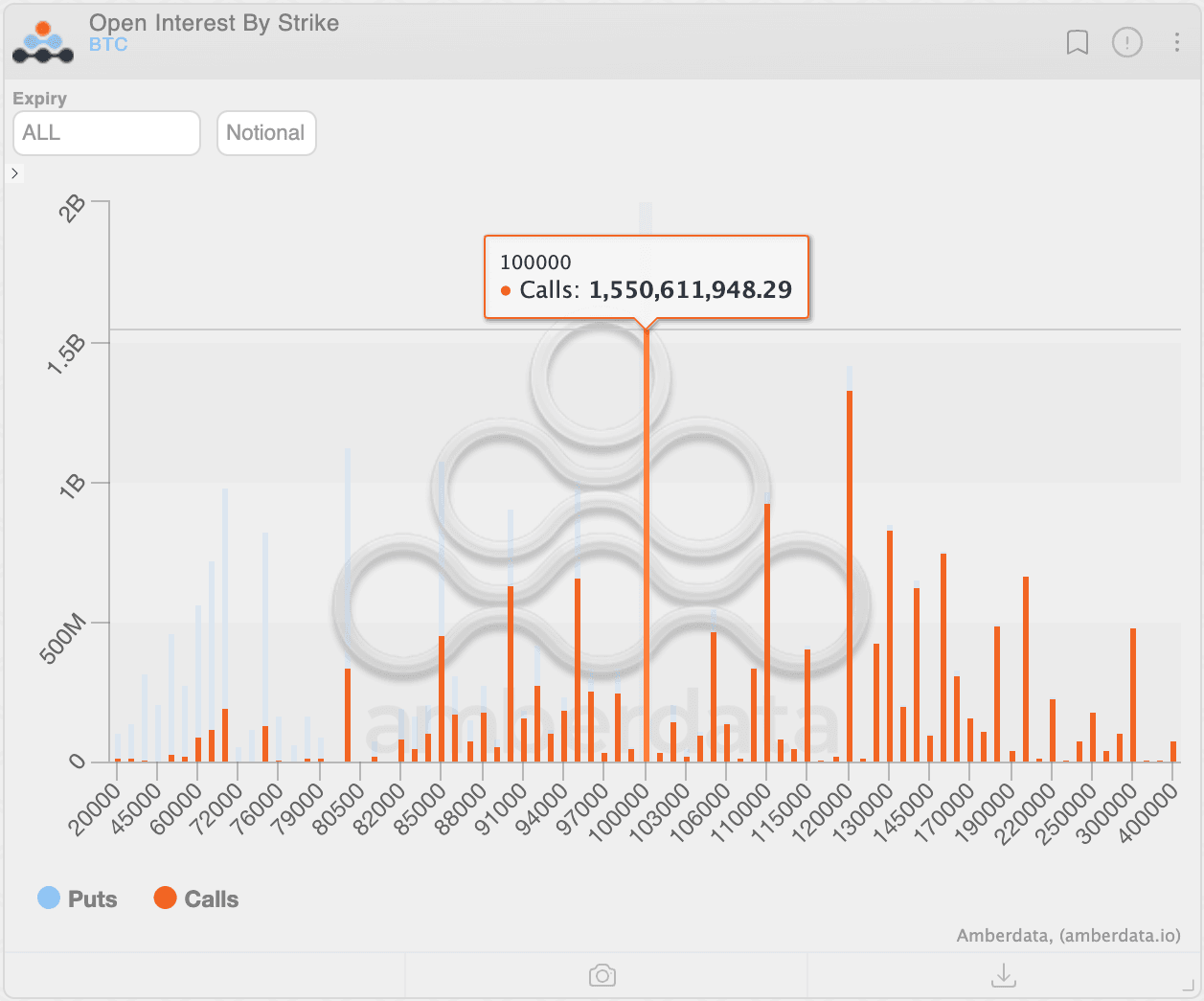

As of now, the $100,000 call option has emerged as the most sought-after BTC options contract on the exchange, featuring a notional open interest of $1.55 billion. This figure represents the total dollar value of active options contracts at a specific time. In contrast, the $120,000 call option, which was the market leader until last month, now occupies the second position with a notional open interest of $1.33 billion.

A call option provides the buyer with the right, but not the obligation, to purchase the underlying asset at a predetermined price within a specified timeframe. Thus, a buyer of a call option is generally seen as having a bullish outlook on the market. Consequently, a significant accumulation of open interest in higher strike out-of-the-money calls, such as the $100,000 and $120,000 options, is indicative of prevailing bullish sentiment among traders.

Recent data on open interest distribution in BTC options, particularly those listed on Deribit, reveals this shift clearly. The movement towards the $100,000 strike suggests that traders are opting for a more cautious approach following the recent price plunge below $80,000. This may also reflect a broader reassessment of their bullish outlook as market conditions evolve.

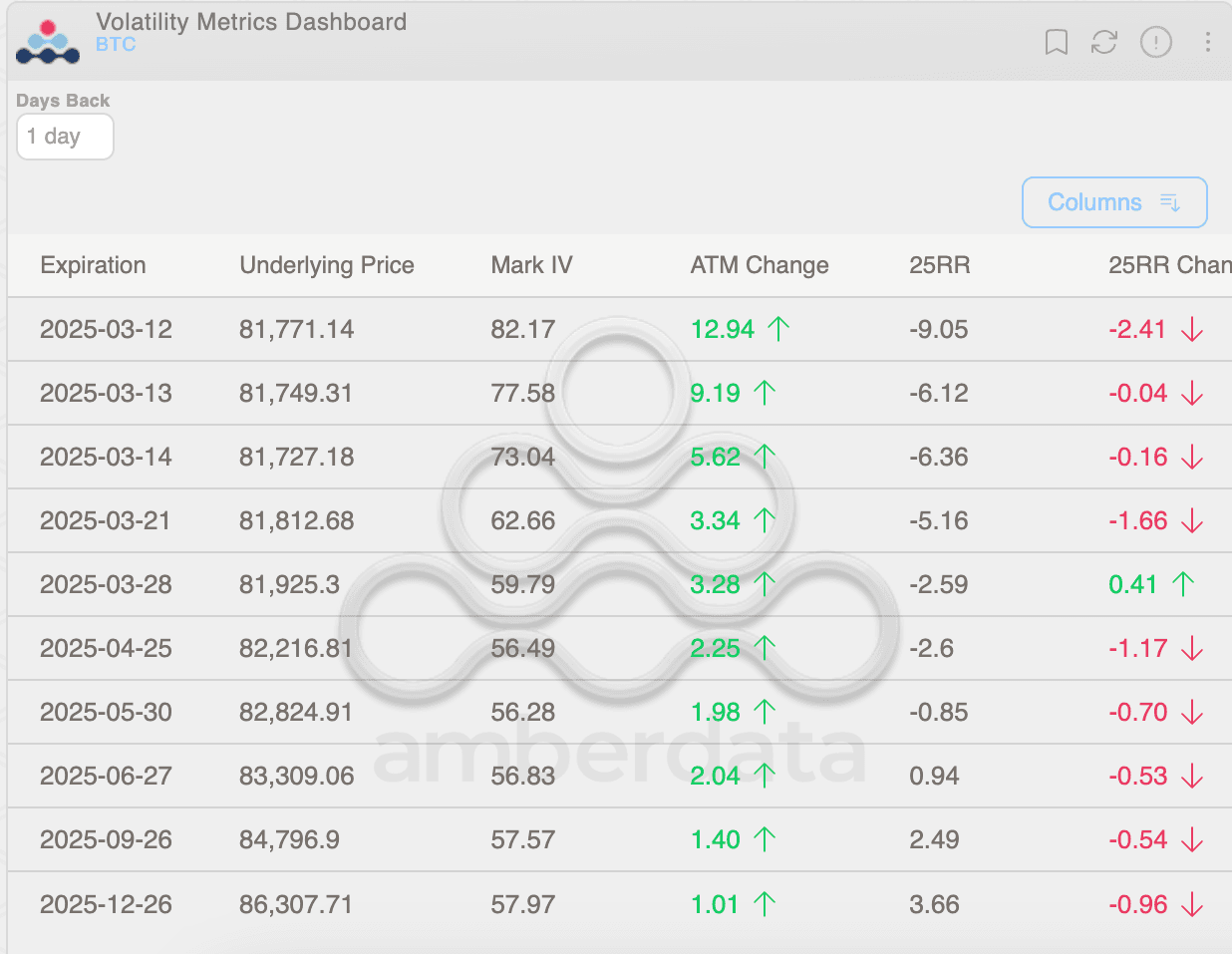

Moreover, the 25-delta risk reversals—which assess the disparity between implied volatility (demand) for higher strike calls versus lower strike puts—are signaling negative readings. This suggests a bias towards protective put options leading up to the expiry at the end of May, indicating heightened concerns regarding a potential extended price decline in the market.

Despite these cautious sentiments, the pricing remains optimistic for call options beyond May. Additionally, the total dollar value of call options currently open stands at over $16 billion, which is nearly double the $8.35 billion in put options. This significant difference underscores the ongoing bullish sentiment that persists among traders in the BTC options market.