Bitcoin Experiences Significant Price Correction

Recently, Bitcoin (BTC) experienced a notable decline, falling just below the $98,000 mark, representing nearly a 10% retracement from its all-time highs. This sudden drop has left many investors speculating about the sustainability of the ongoing bull market. Analysts suggest that the dip may be linked to concerns surrounding China’s DeepSeek Artificial Intelligence model, which is reportedly competing with the U.S. industry at an astonishingly lower cost.

Since the election of President Trump, Bitcoin has surged from $66,000 to reach new all-time highs of $109,000. However, during this bullish rally, BTC has witnessed corrections of up to 15% on two separate occasions, alongside several other instances of double-digit pullbacks. Therefore, the recent 10% decline appears to be consistent with previous market behavior during a bull run.

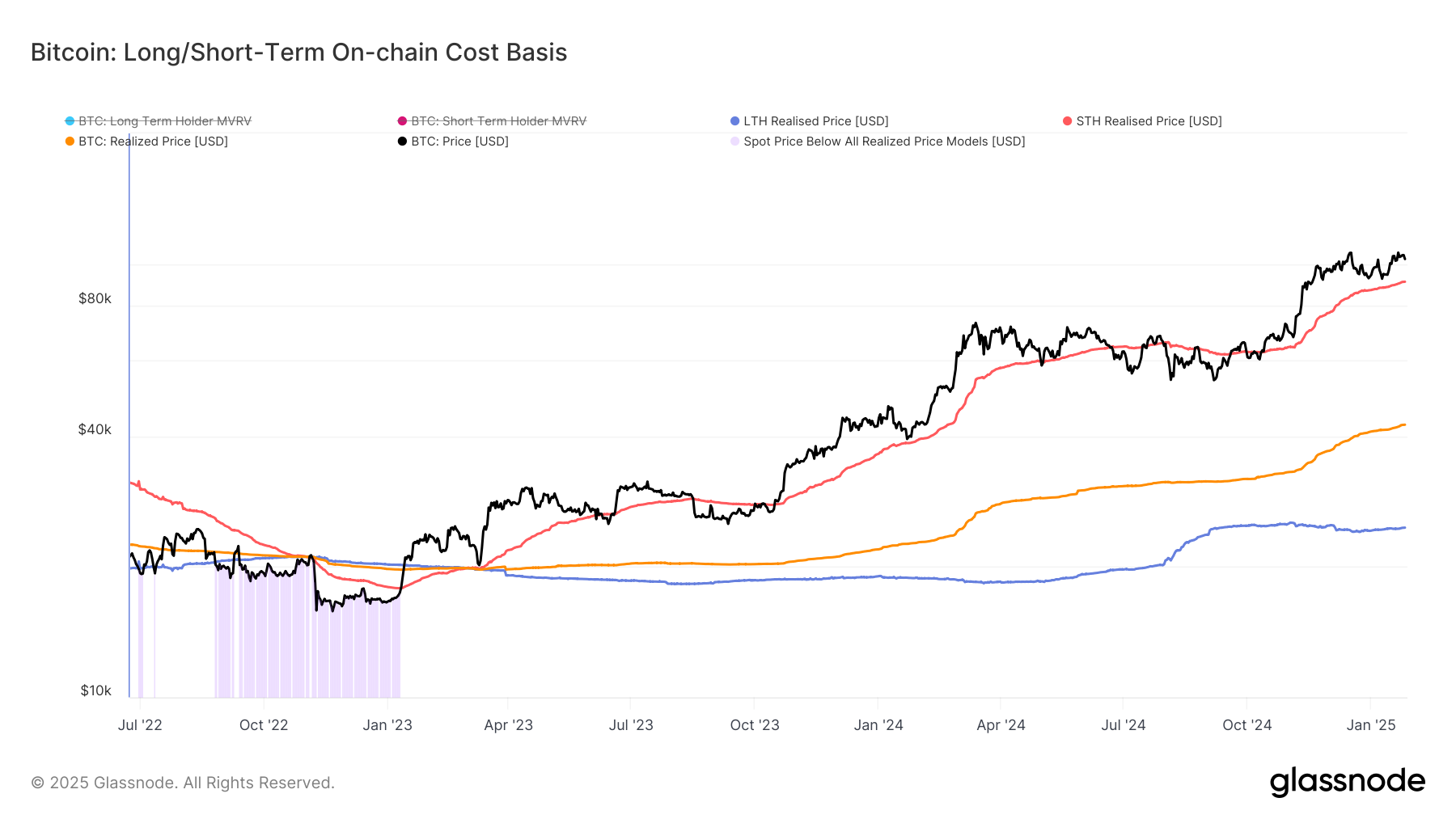

A crucial metric to monitor during bullish market conditions is the short-term holder cost basis, which indicates the average on-chain cost for Bitcoin that has been transferred within the last 155 days. Currently, this level hovers around $91,000. A fall below this threshold could potentially cast a shadow on the ongoing bull market. Furthermore, bearish sentiment is beginning to grow, as evidenced by the negative funding rates for Bitcoin that have recently emerged.

Notably, Arthur Hayes, the co-founder of Bitmex, has voiced predictions of a potential correction targeting the $70,000 to $75,000 range before Bitcoin could ascend to a staggering $250,000. Additionally, CoinDesk’s Omkar Godbole has reported that Bitcoin might dip to $75,000 if it triggers a bearish reversal pattern known as a ‘double top’. This drawdown in the crypto market is not an isolated occurrence; it mirrors broader trends in U.S. markets, with Nasdaq futures witnessing declines of up to 4%.