A spike in transactions on the Bitcoin blockchain involving Ethereum-style tokens and non-fungible token (NFT)-like “inscriptions” has driven up congestion on the network, pushing the average fee rate to the highest in nearly two years while showering miners of the cryptocurrency with extra revenue.

On Wednesday, the average fee per Bitcoin transaction rose to $7.25, the highest since July 2021. For comparison, the rate so far this year had fluctuated between roughly 50 cents and $4, data from BitInfoCharts shows.

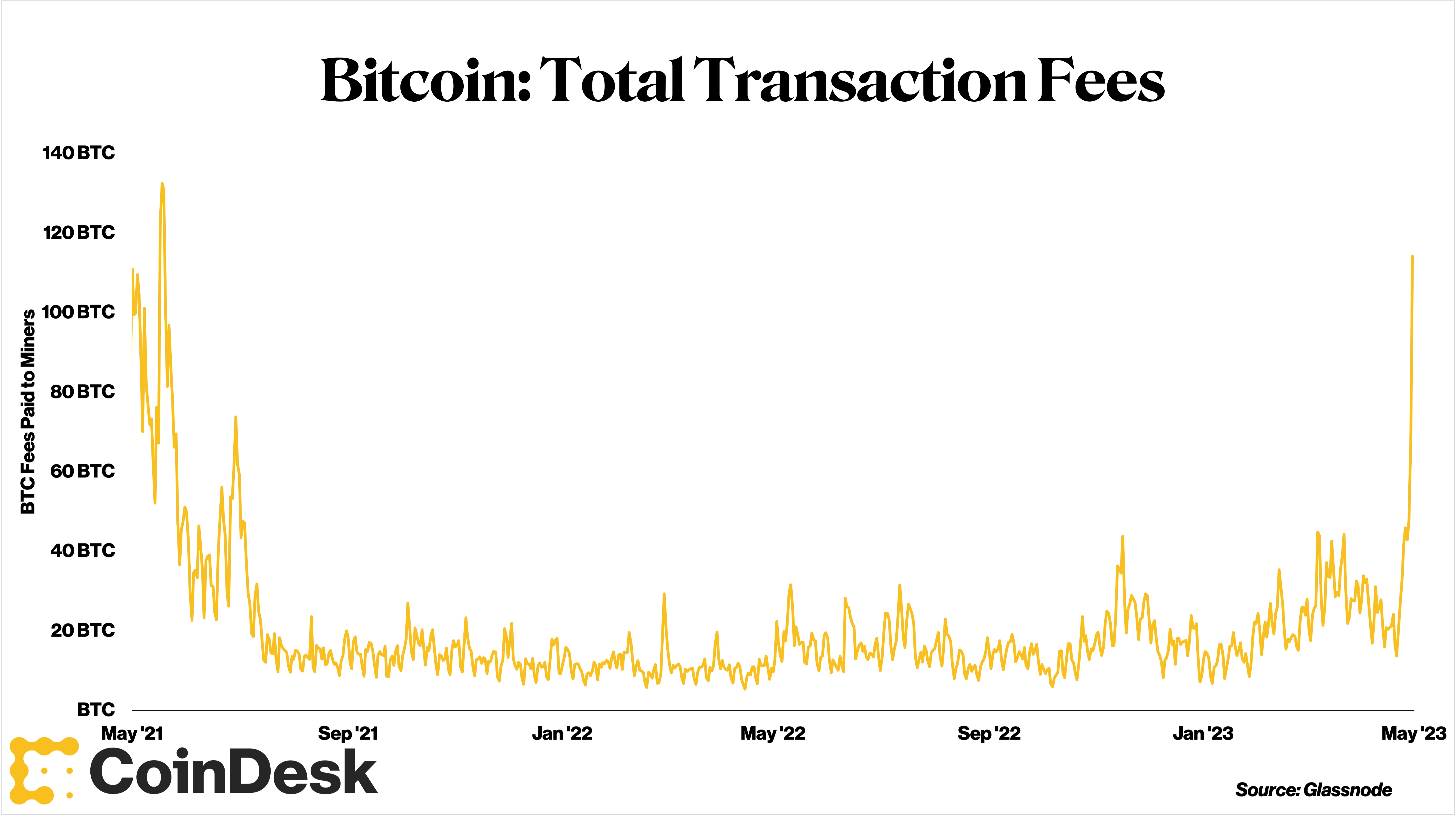

With transaction activity also surging, total fees on Bitcoin have also jumped.

Per blockchain analytics firm Glassnode, Bitcoin’s total transaction fees, which are paid by users to miners, jumped to around 124 BTC or roughly $3.5 million, on May 3, representing a 484% increase in the past 14 days.

“This current fee spree is an anomaly,” wrote Colin Harper, head of content at Luxor Technologies, a full-stack Bitcoin mining pool.

Bitcoin: Total Transaction Fees (Glassnode)

In recent days, a token type called BRC-20 (a play on Ethereum’s ERC-20 token standard), which facilitates the issue and transfer of fungible tokens on the Bitcoin blockchain, has accounted for about 6% of all Bitcoin activity since its inception in early March, according to pseudonymous analyst and yield farmer Dynamo DeFi. This year has also seen the rise of Ordinals inscriptions, which are similar to NFTs and could be images or text strings inscribed into Bitcoin-based transactions. Both activities require transaction fees.

“Inscriptions are the primary driver here,” said Harper. “Biggest difference now between this jump in transaction fees and past ones with inscriptions is that BRC-20 standard is a new way to inscribe. Adoption of this standard is driving fees up.”

“The increase in transaction volume of that token standard has driven up demand for Bitcoin blockspace,” said Jimmy Zhang, who works in the business operations and strategy department at blockchain data firm Artemis.

Kydo, vice president of Stanford Blockchain Club, told CoinDesk via direct messages on Telegram that “Blockspace is the core commodity on any blockchain. People have found a new use case and the usage skyrocketed. BTC is more than money now.” Kydo said they only use the one name publicly because of privacy concerns.

Miners who secure and maintain the Bitcoin network are beneficiaries of the recent increase in BTC transaction fees because they are rewarded in BTC fees for processing users’ transactions.

Harper predicts the increased transaction fees currently occurring in the ecosystem are “a temporary phenomenon, though, and that transaction fees will revert back to a manageable mean soon.”

Kydo said they think the current phenomenon will last a while, “given how much people like NFTs.”

Recommended for you:

- What Hic et Nunc’s Resurrection Says About Decentralized Infrastructure

- NFTs IRL: How Digital Collectibles Are Forging Offline Experiences

- Mysten Labs to Buy Back Equity, Token Warrants From FTX Bankruptcy Estate for $96M

The price of BTC has increased 1.2% in the past 24 hours to $28,884, at press time. The average transaction fee on Bitcoin is $7.25. According to data website cryptofees.info, Bitcoin’s seven-day average fee stands at roughly $2 million, second only behind Ethereum’s $12.5 million. BNB Smart Chain is next with about $575,000.