The Resurgence of the Kimchi Premium Amid Market Turmoil

The notorious Kimchi premium, a term that gained notoriety during the trading frenzy led by Sam Bankman-Fried, has re-emerged, reflecting significant levels despite a recent downturn in the bitcoin (BTC) market. This resurgence occurs amid a broader market decline triggered by escalating U.S. tariffs, which some analysts interpret as a bearish signal for the immediate future.

As of Monday morning in Asia, the Kimchi premium, which denotes the disparity between bitcoin prices on South Korean exchanges and those on global platforms, surged to over 10%. This rise comes on the heels of a 6% drop in BTC prices over the previous 24 hours.

The strategy behind this arbitrage opportunity involves purchasing bitcoin on international exchanges and subsequently selling it on South Korean platforms, thus securing a risk-free profit in Korean won. However, capitalizing on these gains can be challenging due to South Korea’s stringent capital controls. Despite this, the premium often serves as a barometer for market sentiment, reflecting broader trading dynamics.

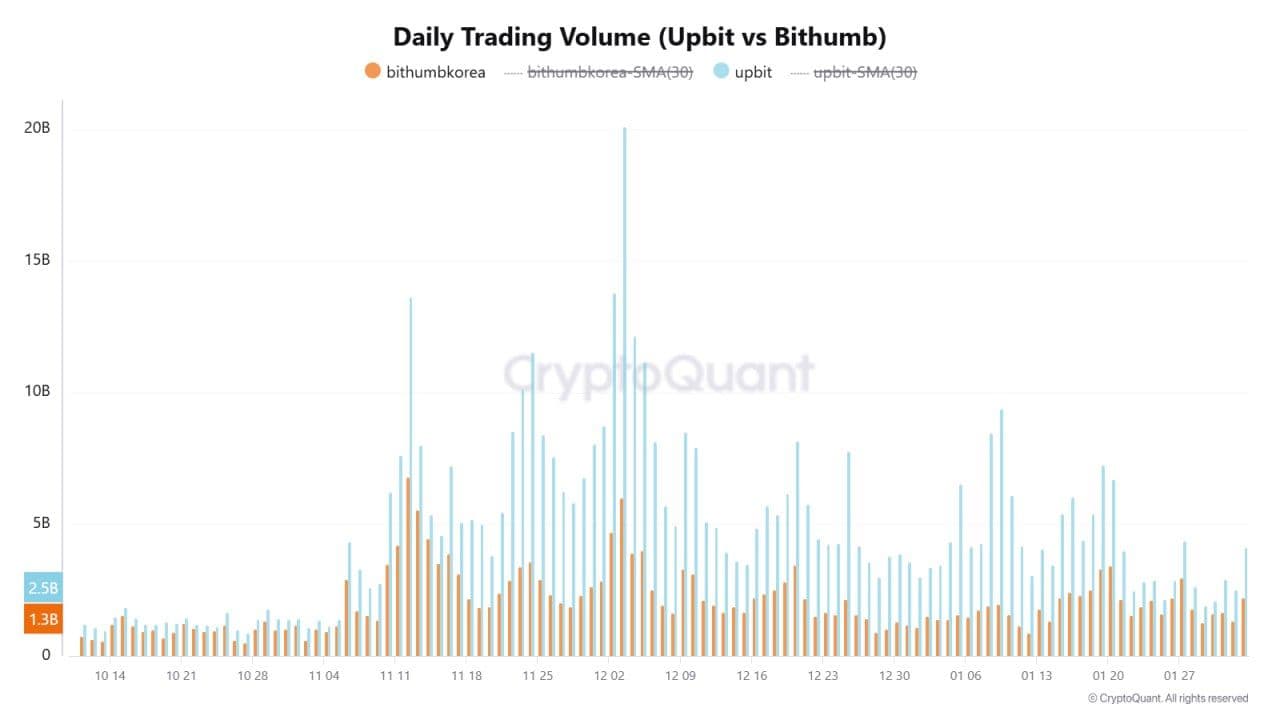

In recent days, trading volumes on prominent South Korean exchanges, such as Bithumb and Upbit, have seen a notable decline, suggesting a reduction in retail trading activity. Additionally, the balances of dollar-denominated stablecoin tether have experienced a downward trend on both exchanges, coupled with reports of withdrawal delays.

According to Bradley Park, an analyst at DNTV Research based in Seoul, “It seems that most retail investors are either fully invested in the spot market or have withdrawn their funds to participate in decentralized exchange (DEX) activities.” Park elaborated that in the current climate, the Kimchi premium does not indicate an overzealous buying trend among retail investors. Instead, it appears to have risen as a passive reaction to the uncertainties surrounding a robust dollar environment.

Park further explained, “The Kimchi premium can experience significant surges when trading volumes increase. However, it can also play a role in stabilizing prices when asset values on overseas exchanges plummet. In this context, this trend is likely a negative sign for bitcoin in the short term.”