Upcoming Expiration of Bitcoin Options Contracts

Approximately $5 billion in bitcoin (BTC) options contracts are poised to expire on Deribit this Friday at 08:00 UTC, contributing to an already volatile landscape in the cryptocurrency market. Throughout 2025, bitcoin has experienced a prolonged consolidation, which has led to a steady decline in Deribit’s Volatility Index (DVOL). However, following a sharp drop in bitcoin’s price, the DVOL surged to 52 before retreating back below 50. This fluctuation signals a temporary spike in market uncertainty.

The recent plunge below $90,000 has resulted in the majority of options contracts becoming out-of-the-money (OTM), leaving traders facing considerable unrealized losses. An option grants the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a designated time frame.

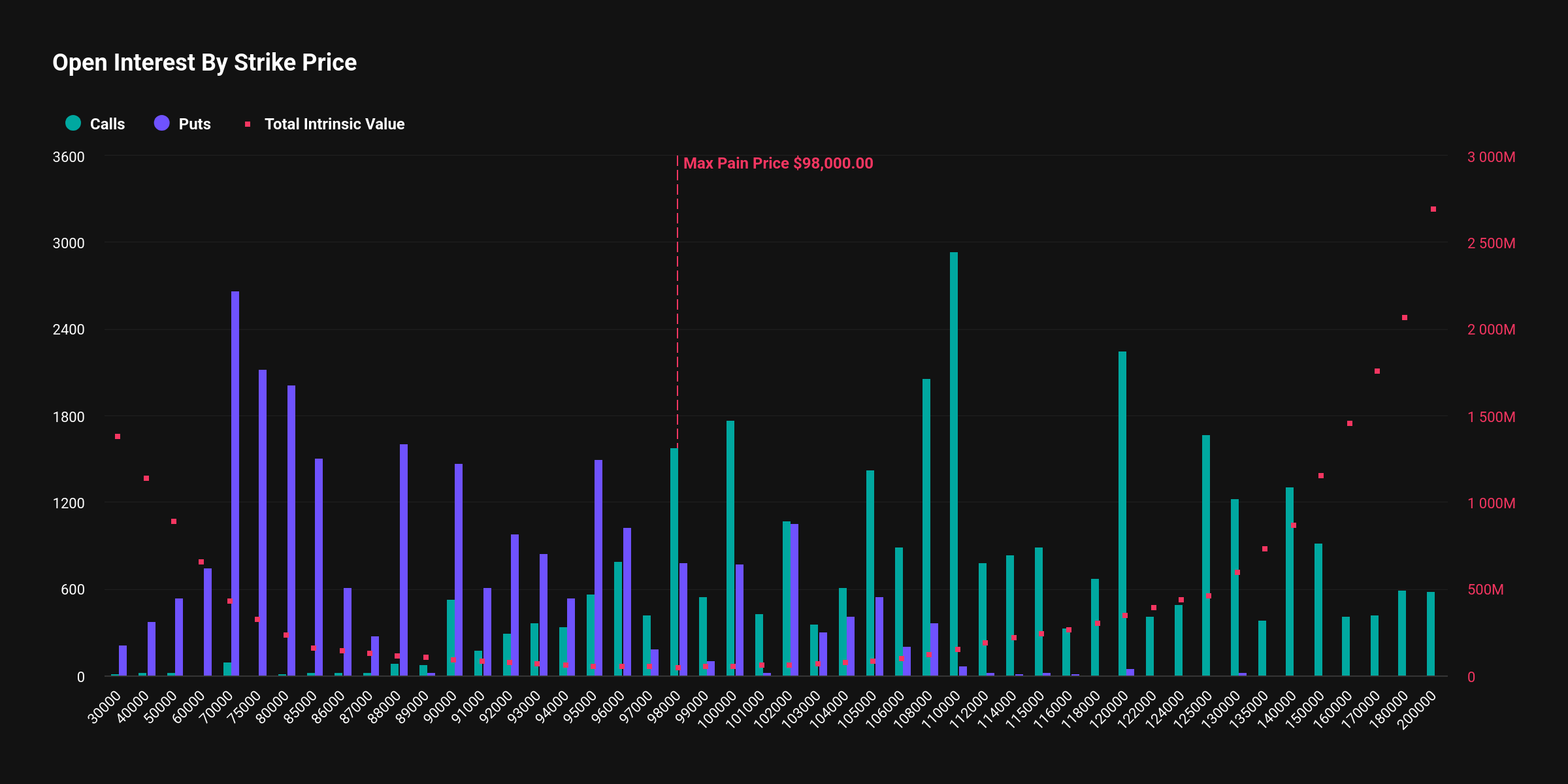

According to data from Deribit, out of the $5 billion in notional value set to expire, $3.9 billion (or 78%) is categorized as OTM, indicating that these contracts will expire worthless. Notably, almost 100% of call options—bullish bets—are OTM, as the bitcoin price has significantly declined in recent days, leaving investors with substantial unrealized losses. Conversely, the remaining $1.1 billion (or 22%) is deemed in-the-money (ITM), predominantly comprised of puts. ITM puts are defined by their strike prices exceeding the current spot price, thus retaining intrinsic value.

Interestingly, the concept of max pain is currently set at $98,000, which is notably $10,000 higher than the current spot price. Max pain refers to the price point at which option sellers, often institutional players, can achieve maximum profit while buyers incur the most significant losses. Given that the max pain price is substantially higher than the present spot price, this may encourage options sellers to attempt to drive the bitcoin price upward as it approaches this pain threshold.

As highlighted by PowerTrade, “With the end of the month approaching, bitcoin options traders should take note. Max Pain for February 28 sits at $98,000, with a massive $5 billion notional value. This means the highest open interest is clustered at this level, incentivizing market makers to keep bitcoin close to this price. Expect increased volatility and potential price gravitation toward this level.” Let’s observe whether the so-called max pain theory holds true in the coming days.