Bitcoin’s Performance in February: A Closer Look

In February, Bitcoin faced significant challenges, leading to a notable decline in its risk-adjusted returns, as highlighted by research from Ecoinometrics. Over the past year, Bitcoin’s total returns have surprisingly aligned with those of gold, a classic safe-haven asset. However, when accounting for risk, Bitcoin is exhibiting characteristics more akin to a major stock index rather than a traditional store of value.

The concept of risk-adjusted returns is crucial for investors, as it evaluates an asset’s profitability in relation to its price volatility. A higher ratio indicates a strong performance with reduced fluctuations. Recently, Bitcoin has experienced a series of dramatic price movements, exacerbated by trade war uncertainties, escalating geopolitical tensions, and President Trump’s inconsistent messaging regarding government policies on cryptocurrencies. As a result, Bitcoin has seen a mild downturn so far in 2025, contrasting sharply with gold, which has appreciated by over 11% year-to-date.

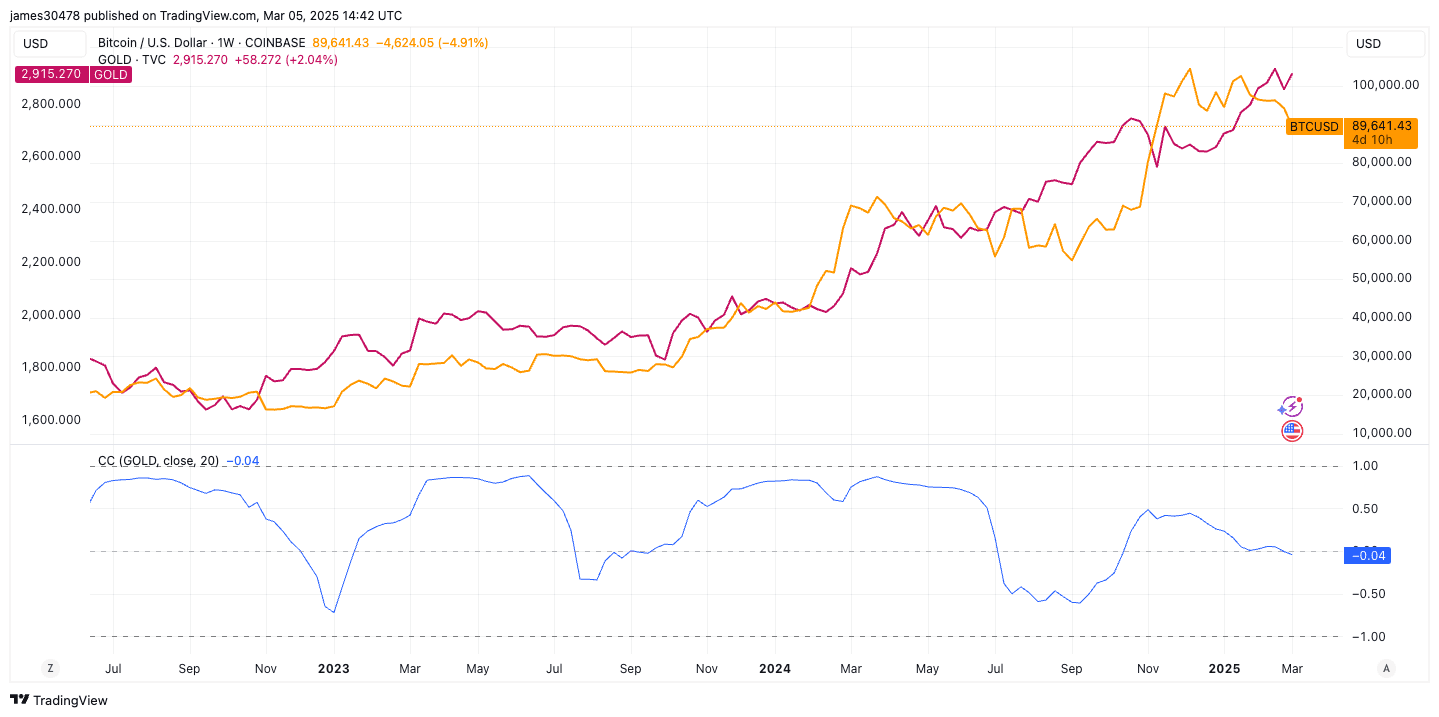

James Van Straten, an analyst at CoinDesk, noted, “Bitcoin and gold are completely uncorrelated at the moment; on a 20-day moving average over a five-year timeframe, the correlation is negative.” He further explained, “Typically, when the correlation turns negative, it suggests that Bitcoin is nearing a bottom, as observed in early 2023, the summer of 2023, summer 2024, and currently. Historically, BTC tends to rebound and align with gold’s performance.”

This shift in correlation could have significant implications for Bitcoin’s attractiveness to institutional investors, who often seek assets with favorable risk-reward profiles. While Bitcoin’s long-term narrative as “digital gold” remains robust, its recent short-term performance indicates a tendency to behave more like equities rather than a safe-haven asset. This evolution in behavior invites further scrutiny and analysis as market dynamics continue to unfold.