Bitcoin’s (BTC) quiet July continued as Thursday morning’s report of stronger than expected Q2 GDP growth and softer than expected inflation did little to move crypto prices in either direction. At print time, bitcoin was marginally lower over the past 24 hours at $29,150, slightly underperforming the CoinDesk Market Index (CMI), which was higher by 0.2%. As July grinds to a close, bitcoin appears poised to post its second losing month of 2023.

The U.S. economy expanded by 2.4% in the second quarter of 2023, the government reported today, soundly beating expectations of 1.8% growth and up from 2% growth the previous quarter. The 2.4% figure is the government’s preliminary estimate and will be revised more than once in coming months.

The PCE price index embedded in the GDP report showed prices rising by 2.6% in Q2 versus expectations of 3.0% and down from 4.1% in Q1. Initial jobless claims were fewer than expected, with 221,000 Americans claiming unemployment against forecasts for 235,000.

The TLDR of it all is that the economy is growing, inflation is slowing but elevated and the labor market remains robust. WIth the exception of the numbers themselves, little has changed in that regard in the last few months.

What does any of this mean for crypto assets?

At the moment, digital assets in general and bitcoin in particular appear to be mired in an exceedingly tight trading range. As discussed on Monday, bitcoin’s reaction to macroeconomic data has been mild. While this doesn’t obviate the need for investors to monitor economic trends, it likely does serve as a sign that a significant surprise is likely needed to move prices substantially.

Since breaching the lower range of its Bollinger Band on July 25, the bitcoin price has advanced just .002%, with its 20 period moving average of $30,000 remaining a likely price target.

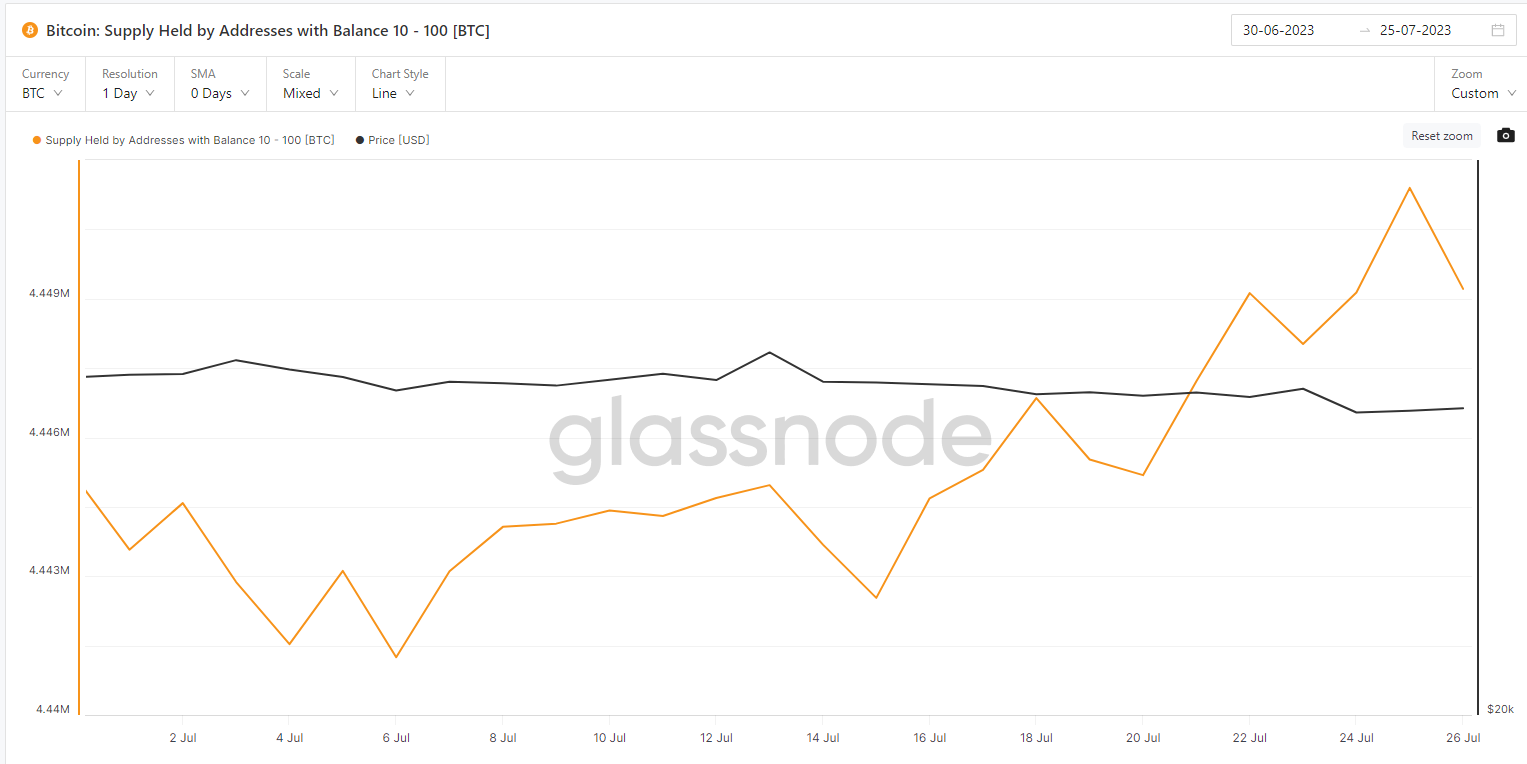

Signs of stagnation exist when looking at the trajectory of wallet balances as well. The total circulating supply of bitcoin held by addresses across multiple “size buckets” has been flat, according to analytics firm Glassnode.

In July, the supply held by addresses with a balance between 10-100 BTC, grew by 0.001%. For addresses with a balance between 100-1000 BTC, supply fell 0.004%. And for those smaller investors with a balance between 0.1 and 1 BTC, supply grew 0.005%.

The silver lining in all of this for bullish investors is that while prices seem stuck in a rut, there doesn’t appear to be any bearish catalysts on the horizon either.

One area of opportunity that investors may be eyeing is the discrepancy in performance between bitcoin and ether. While still tightly correlated, BTC has outperformed ETH by 21% thus far in 2023, possibly driven by expectations that a spot bitcoin ETF could soon be available in the U.S.

Ether also currently appears to lack a bearish catalyst. Meanwhile its overall supply continues to decline, falling by 4,800 tokens over the most recent seven days.

This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our Ethics Policy.