After what had been a relatively slow week, bitcoin’s (BTC) price fell sharply late Thursday as over $62 million in BTC long positions were liquidated during the Asian overnight trading session.

Bitcoin’s descent was rapid and concentrated, occurring during the 01:00 UTC (8:00 p.m. ET) trading hour. Negative reactions to viability concerns surrounding crypto bank Silvergate (SI) appeared to be the driving force behind the decline, which saw BTC fall $1,000 in minutes to $22,500 while ETH declined to $1,570.

Trading volume had been relatively mild on the week, prior to last night’s quick sell-off.

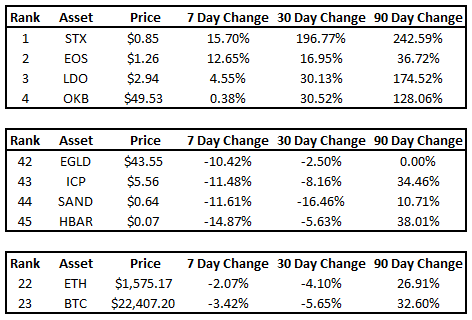

Bitcoin and ether (ETH) remain higher foro the year to date by 32% and 26%, respectively. However, both assets are now trading below their 20-day moving averages. On a technical basis, the Relative Strength Index (RSI) levels for BTC and ETH declined 36% and 22% since Feb. 23, highlighting a slowdown in momentum.

Volatility waned slightly over the same time period, with the Average True Range falling 5% for bitcoin and 2% for ether. The ATR is a market volatility indicator.

In comparison to crypto assets with a market cap of $1 billion or more, BTC and ETH’s performance landed it 10th and 14th among the group, respectively.

(Messari)

Correlations between crypto and traditional financial assets have loosened as well, with the correlation coefficient involving BTC, ETH and the S&P 500 sitting at -0.15.

The correlation coefficient ranges between 1 and -1, with the a higher positive read indicating a direct pricing relationship between assets, and a lower negative read implying an inverse relationship. A readout close to zero implies a very weak relationship over the time period being measured.

Stacks (STX) was the standout on the week, with its price advancing 15% over the most recent seven days, and 290% year to date.

STX is the native token for Stacks, the bitcoin layer 2 protocol which allows developers to build and deploy decentralized finance apps and non-fungible tokens (NFT) on the Bitcoin network.

Making an early bid for crypto story of the year, the STX token’s increase in price has been driven by the emergence of Ordinals, a protocol that allows NFTs to be included in bitcoin transactions. The extension of the Bitcoin network’s utility beyond peer-to-peer transactions will likely be impactful to both STX and BTC.

The week’s laggards were SAND and HBAR, down 12.4% and 14.9%, respectively.

Economically, it was a relatively quiet week, with Wednesday’s ISM Manufacturing data and Thursday’s Initial Jobless Claims data being the primary data points of note. Neither had a significant impact on crypto prices.

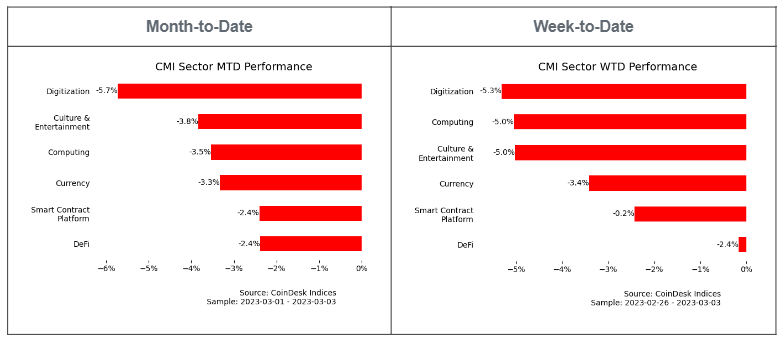

Week-to-date performance among the CoinDesk CMI sectors shows negative numbers across the board.

The Digitization sector, which led in the prior week, fell to the bottom of the rankings. The DeFi sector, which trailed all last week, moved to the top. Members of the CoinDesk DeFi index include AAVE, Compound (COMP) and Uniswap (UNI).

(CMI)