The entire crypto market was hopeful about today’s FED decision! Now what are the levels that can act as resistance in major altcoins including Bitcoin and BNB? Crypto analyst, Rakesh Upadhyay, examines the charts of the top 10 cryptocurrencies to find out.

An overview of the cryptocurrency market

US stock markets rose after the CPI announced on June 13 fell short of expectations. However, Bitcoin and altcoins failed to recover. This is a sign that crypto investors are focusing on crypto-specific issues. It also shows that investors are not buying on positive macroeconomic news.

However, there is a glimmer of hope for the bulls. Because Bitcoin is still above the $25,000 support. cryptocoin.com MicroStrategy co-founder Michael Saylor said that regulatory pressure from the SEC could be bullish for Bitcoin. Saylor expects Bitcoin dominance to reach 80% in the future as “mega institutional money” flows into crypto after “confusion and anxiety” subsides. While Saylor’s views may be reassuring to Bitcoin bulls, investors need to keep in mind that MicroStrategy has a large position in Bitcoin. Therefore, their views are likely to be biased.

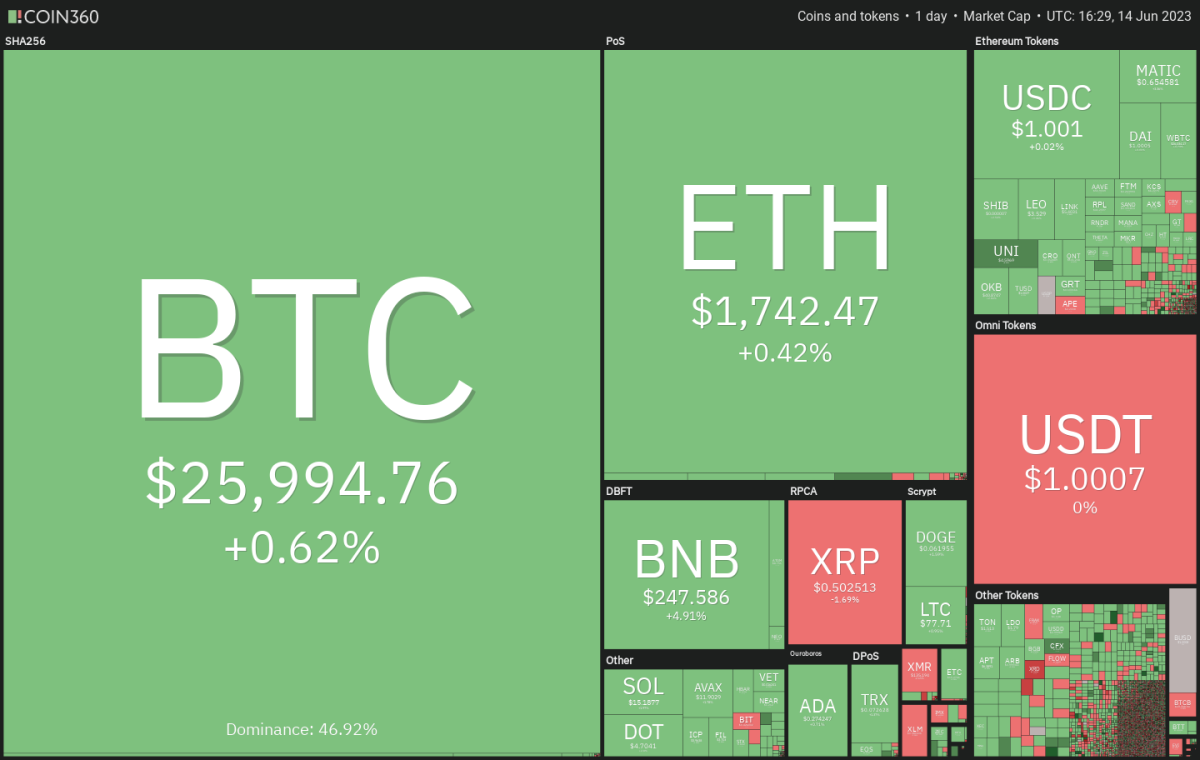

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Investors hate uncertainty and often stay on the sidelines until clarity emerges. The same is likely to happen in the cryptocurrency markets in the near term. A trend move is only likely to start after investors feel some regulatory clarity. In uncertain phases, traders may consider reducing their position size to avoid whiplash.

BTC, ETH, BNB, XRP And ISLAND analysis

Bitcoin (BTC) price analysis

Bitcoin approached the 20-day exponential moving average (EMA) of $26,531 on June 13. However, the long wick on the candlestick indicates that the bears are selling at higher levels.

The price has been stuck between the 20-day EMA and the key support at $25,250 for the past few days. This shows that the bulls are buying the dips, but the bears are not willing to give up their advantage. The downward sloping moving averages are a sign that the bears are gaining the upper hand. However, the positive deviation in the relative strength index (RSI) indicates that the selling pressure is decreasing. If the buyers push the price above the 20-day EMA, it is possible for BTC to rise to the resistance line of the descending channel. Buyers will need to break through this roadblock to signal the start of a march towards $31,000. Instead, if the price drops from the current level and sinks below $25,250, it will indicate that the bulls have given up. BTC is likely to drop first to the support line of the channel and eventually to the psychologically important $20,000 level.

Ethereum (ETH) price analysis

ETH’s shallow bounce from strong support at $1,700 points to a lack of demand at higher levels. A tight consolidation near a support level increases the risk of a breakout.

Therefore, buyers will need to push the price above the moving averages quickly. If they do, it is possible for ETH to rally to $1,928 first and then make a move towards the overhead resistance of $2,000. Contrary to this assumption, if the price turns down from the current level or moving averages, it will indicate that the bears are selling on every small rally. It is also possible for this to drop ETH below $1,700. There is a minor support at $1,600. However, if this doesn’t hold, the decline is likely to extend to $1,352.

Binance Coin (BNB) price analysis

BNB bounced off the strong $220 support once again on June 12. Thus, it showed that the bulls are aggressively holding this level.

BNB started a recovery on the 38.2% Fibonacci retracement that is likely to face stiff resistance at the $252 and $265 breakout levels. If the price turns down from either level, it will show that the bears see the relief rally as a selling opportunity. It is possible for the BNB price to slide back to $220 later on. On the contrary, if the bulls push and sustain BNB price above the $265 breakdown level, they are likely to trap the aggressive bears. There is a minor resistance at the 20-day level ($272) of the EMA. However, it is possible to exceed this level.

Ripple (XRP) price analysis

Buyers pushed XRP above the overhead resistance of $0.56 on June 13. However, they were unable to sustain higher levels.

XRP fell sharply, forming a long wick in the candlestick of the day. The bears are trying to further strengthen their positions by pulling the price below the 20-day EMA ($0.50). Below this level, the next important support to watch out for is the 50-day simple moving average (SMA) at $0.47. If this level gives way, it is possible that the selling pressure will increase. Thus, XRP is likely to decline to the next major support level, near $0.41. On the contrary, if the price bounces off the 50-day SMA, it will signal range-bound movement for a few days.

Cardano (ADA) price analysis

ADA’s recovery stalled near the $0.30 breakdown level. This shows that the bears are keeping the level fiercely.

If the bulls fail to push the price above $0.30, ADA is likely to decline. Thus, a slide to the $0.24 support is likely. A strong rebound from this level is likely to hold ADA at $0.24 to $0.30 for a few days. If buyers push the price above $0.30, it will indicate that this decline may be over in the near term. It is possible for ADA to rise to the 20-day EMA ($0.32) and then the 50-day SMA ($0.36) later.

DOGE, SOL, MATIC, LTC and DOT analysis

Dogecoin (DOGE) price analysis

DOGE has been hovering above the $0.06 level since June 11. But the fact that the bulls haven’t been able to initiate a meaningful bounce is a minor downside.

Failure to break above the 20-day level ($0.07) of the EMA could lead to a new round of selling by the bears. If the $0.06 support is broken, DOGE is likely to drop to the vital $0.05 support. Buyers are expected to fiercely defend this level. On the upside, the first sign of strength will be a break and close above the 20-day EMA. This will increase the likelihood of a relief rally to $0.08, where the bulls will again face strong resistance from the bears.

Solana (SOL) price analysis

SOL is witnessing a tough fight between the bulls and bears near the critical support of $15.28.

The bulls are struggling to hold the price above $15.28. But they can take a little solace in knowing that they don’t let SOL go under $15. Oversold levels on the RSI suggest that a relief rally is possible. However, the bulls will need to break through the $16.20 barrier. If they do, it is possible for the SOL to start a bullish move towards the 20-day EMA ($18.16). Conversely, if the price turns down from the current level, it will show that the bears are in control. If the price dips below $15, SOL is likely to retest the intraday low of $12.80 on June 10.

Polygon (MATIC) price analysis

MATIC declined below the $0.69 support. Thus, it reached the psychologically important $0.50 level on June 10.

The bulls bought the dip and are attempting to start a recovery that will likely face stiff resistance at the $0.69 breakdown level. If the price turns down from this level, it will show that the bears have turned the level into resistance. It is possible that this will lead to a retest of the support at $0.50. On the contrary, if the bulls push the price above $0.69, MATIC is likely to reach the 20-day EMA ($0.76). A break above this level will indicate that the bears have lost control. It is possible that MATIC will try to rise to $1 later.

Litecoin (LTC) price analysis

LTC turned down from the moving averages and broke below the support line of the symmetrical triangle formation on June 10. This showed that the bears outweighed the bulls.

LTC is attempting to bounce off the horizontal support at $75. However, the failure of the bulls to push the price back into the triangle indicates that the bears are selling on minor rallies. This increases the possibility of further drop below $75. The next major support on the downside is $65. Alternatively, if the price turns up from the current level and re-enters the triangle, it will indicate that the recent breakout could be a bear trap. Positive momentum is possible after the bulls propel the price above $91.50.

Polkadot (DOT) price analysis

The DOT recovered from the strong support at $4.22 on June 10, showing that the bulls are trying to stop the decline.

The relief rally could reach the 20-day EMA ($4.98), where the bears are likely to sell aggressively. If the price turns down from this level, DOT is likely to retest the $4.22 support. A break below this level could start a move towards $4 and then $3.50. On the contrary, if the bulls push the price above the 20-day EMA, it will indicate that the bears may lose control. It is possible for the DOT to rally to $5.15 and then to $5.56. Sellers will remain in control until buyers overcome this barrier.