Steel will be the strongest trade in the first quarter of 2024, according to Bank of America’s metal analysts. Additionally, base metals will rise in the second half of the year. However, the summer months will be the time to shine for gold. In this direction, analysts point to a target level.

The yellow metal will shine in the summer!

In their recently published 2024 Metals and Mining Outlook Report, BofA analysts say that the war in the Middle East will continue to support gold in the near term. Despite this, “the yellow metal ultimately remains an interest rate-dependent trade. Therefore, when the Fed announces a definitive end to the hike in the second quarter, new buyers will come to the market,” they say. Analysts predict that if the Fed reduces interest rates sooner, gold will finish 2024 at $ 2,400. In this context, analysts make the following assessment:

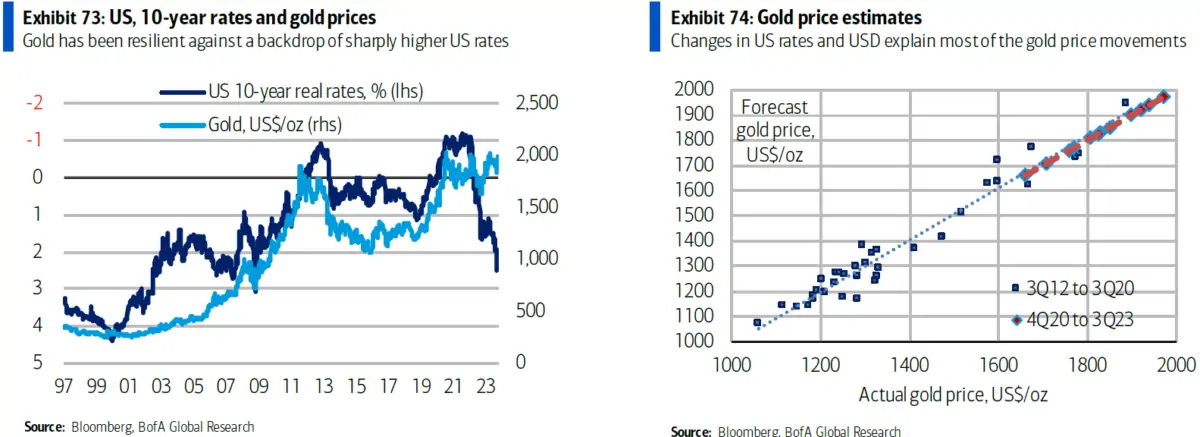

Gold prices have held up against sharply rising US interest rates in recent weeks. Chart 73 highlights that a visible gap has widened between assets. A development that market participants are increasingly noticing. While acknowledging this divergence, this chart comes with an important caveat: Chart 74 shows that our traditional gold price model, which operates on US 10-year real interest rates and the dollar, continues to perform well.

The next rise will probably be in 2024

Analysts explain how these seemingly contradictory factors can both be true. In this regard, “This model takes into account changes in gold prices, exchange rates and USD, not levels. As a result, interest rates and USD are important. Also, changes in direction are more important than actual levels. Therefore, the next rise will likely occur in 2024 as the Fed lowers interest rates.” they say. BofA notes that geopolitics are important, but interest rates remain key to gold prices. They explain their views on this subject as follows:

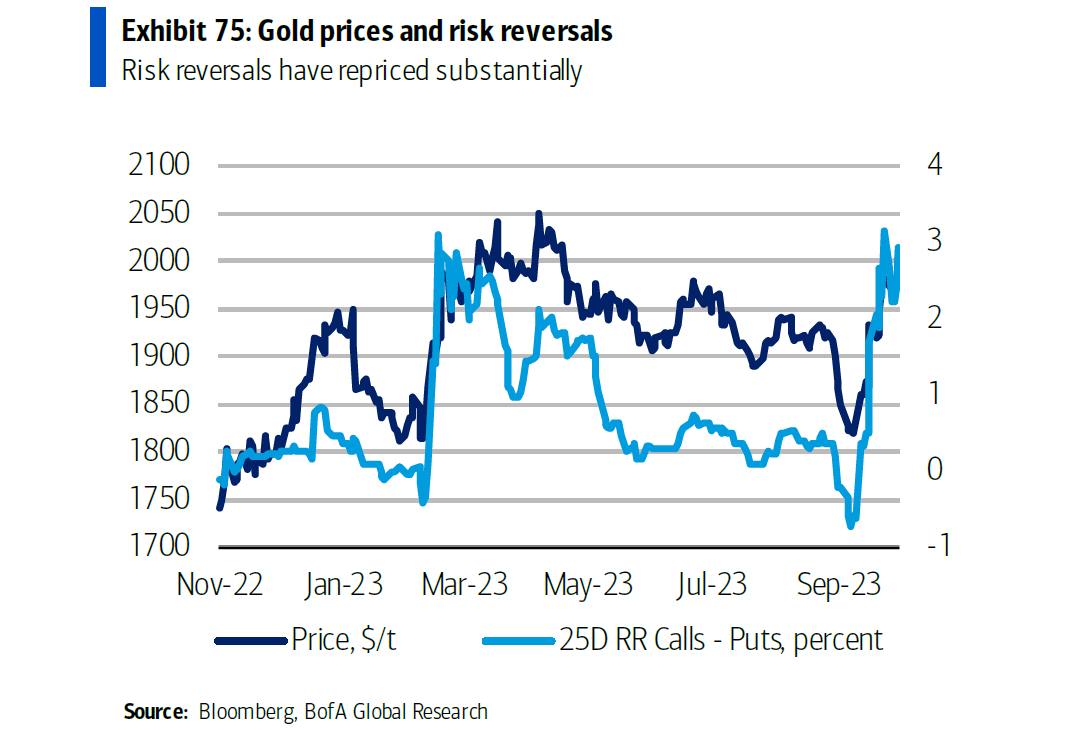

As the conflict between Hamas and Israel escalated, gold rose. The repricing of gold has been seen especially in the options space. Additionally, risk reversals rose noticeably, confirming buying on the upside.

It is unlikely that gold will rise until interest rates drop!

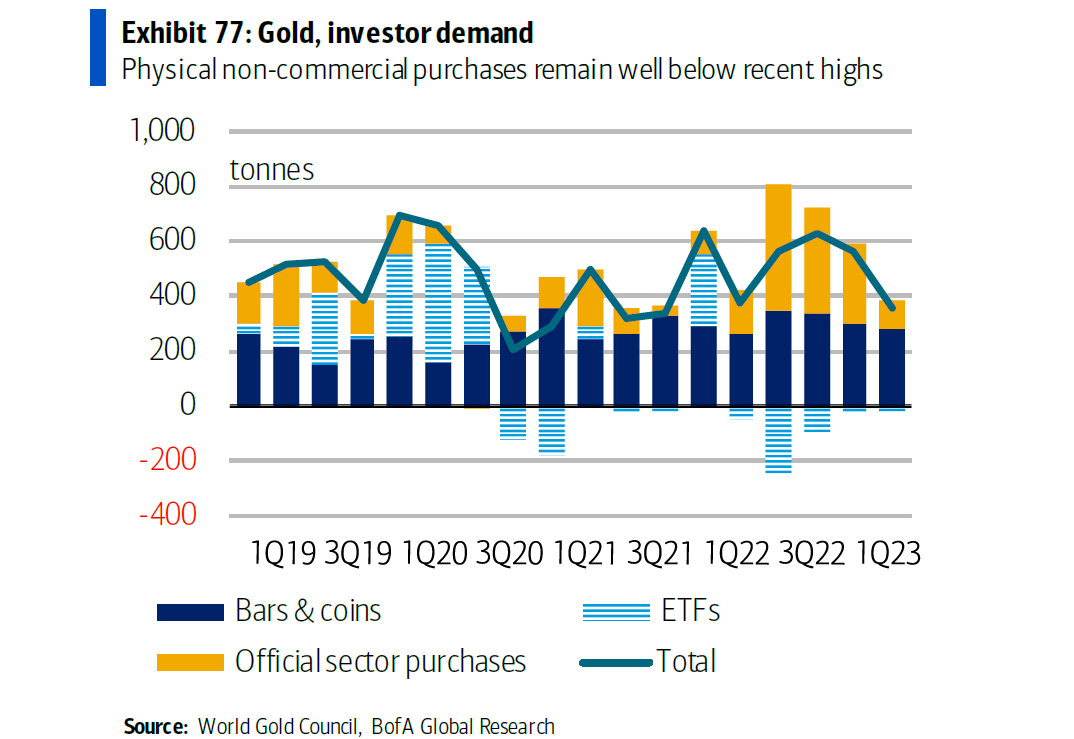

According to analysts, however, open-side taking has been much more muted. Analysts note that overall investor purchases, seen in demand for physical gold ETFs, remain well below levels seen since the beginning of the Covid pandemic.

According to analysts, this confirms the view that “beyond an oil-related price increase, the next sustained rise in gold prices is unlikely to occur until interest rates begin to fall.”

It is possible for the gold price to rise as high as $2,400, but…

Tudor’s Paul Tudor Jones argues that we are “going through the most threatening and challenging geopolitical environment he has ever seen” and that this is occurring while the United States is in its weakest financial position since World War II. So he says gold should probably make up a larger percentage of portfolios than it has historically. While the impact of armed conflict and gold prices “is not always obvious,” analysts believe the Middle East conflict has the potential to push gold to all-time highs thanks to its relationship with oil. Analysts explain the following predictions:

All else being equal, if this unknown happens, the gold price could rise as high as $2,400.