BitMEX Founder Arthur Hayes and popular Twitter analyst Michaël van de Poppe explain their predictions for tier-1s like AVAX and NEAR.

Van de Poppe sees comeback for AVAX

Renowned crypto analyst Michaël van de Poppe says rally for AVAX and NEAR is imminent. In his current analysis, he noted that the RSI data has given the green light as AVAX continues to decline. The analyst says the bulls are in the spotlight as the RSI is starting to rise. This means a recovery in the short term for the buyer side. In his recent tweets, Van de Poppe talked about the possibility of this move reaching psychological resistance:

A targeted return of $17 and potentially $20 is expected from here as the markets heat up.

Avalanche (AVAX) is currently trading around $15.5. This price represents a nearly 90% drop from the ATH price of $146.22.

Injective (INJ)

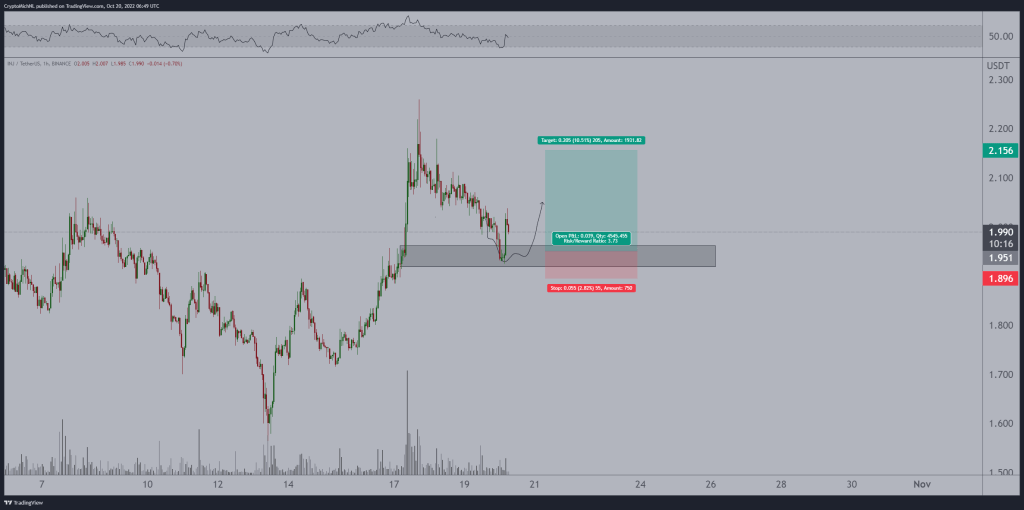

After looking at the Injective (INJ) chart, the analyst says that the short-term corrective trend for INJ price is about to end. According to Poppe’s chart, INJ price will pick up momentum after finding support from the $1 zone:

INJ was hit in that area and is bouncing strong. Imagine if the markets finished this correction today/tomorrow and turned up again, then this will show strength.

Last week, INJ price exploded over 40% in about five days before we could see a deep correction. It is currently trading at $1.87, down 3% from the last 24 hours.

Van de Poppe shared the scenario where the XRP price will touch $0.51

According to the analyst, if the XRP price can hold the $0.44 support, it will gain momentum towards the $0.51 region. However, he adds that if he loses this level, the next support is $0.40.

The last altcoin on the analyst’s radar was Near Protocol (NEAR), one of the strongest Ethereum competitors. Van de Poppe says bulls need to retrace a critical level to avoid a drop. Otherwise, NEAR will keep falling. In Poppe’s words:

Retracing $3.10 activates a continuation at $4 as it has been a bearish retest so far.

BitMEX co-founder Arthur Hayes says these altcoin projects are out of luck

In a new interview with Crypto Banter, Arthur Hayes says that although they offer better trading opportunities in the next cycle, L1 Blockchains do not have the long-term potential to surpass ETH in terms of market cap:

It would make sense to invest in one or more of these now, as they are expected to rise quickly. At the moment, I don’t think anything comes close to competing with Ethereum. Not everything is determined by transactions per second or other metrics. This is purely a developer skill.

Citing Solana as an example for this, Hayes said that he is facing the problem of finding investors in the next bull. However, he adds that the high processing capacity will keep Solana in the field for a while:

If you think about it, every other layer-1 has teams that basically copy and paste everything created on Ethereum first. No problem with that either. Going in Solana for a few cents and seeing $200 is a great investment…But what will they bring to the market in the next cycle? Ethereum’s only transaction fees are high and it’s a slow network. Others are just fast on paper… I don’t think any of them can beat Ethereum yet as they don’t have the mindset of the developers.

cryptocoin.comAs you follow, Solana was interrupted 6 times, the last one at the beginning of October.