Crypto experts at Santiment have observed an increase in large-volume transactions in altcoins Lido DAO (LDO), Illuvium (ILV), Holo (HOT), and Tron (TRX). Typically, sudden whale movements in an asset’s network are indicative of outliers or impending surge in crypto prices.

What do the holo, LDO and ILV whale movements mean?

Brian Quinlivan, a marketing expert and crypto analyst at Santiment, has observed large altcoin transactions as crypto markets begin to recover. Market participants are currently awaiting Friday’s US PCE announcement. In this environment, Bitcoin, Ethereum and assets with large market caps started to recover. The three major altcoins that saw an increase in whale activity were LDO, ILV, and HOT. Lido Dao recorded several major value transfers on its network throughout 2023. Some of the value transfers are attributable to movements between self-storage LDO wallets.

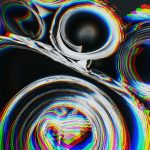

Lido DAO trading volume and supply on exchanges

Lido DAO trading volume and supply on exchangesInterestingly, the supply on exchanges, a key metric for LDO, is just under 6%, a relatively strong figure for an altcoin. Even though the supply is below 6%, it means there is relatively low selling pressure on the asset. ILV, an ERC20 token on the Ethereum Blockchain, had a massive spike above $106 in February 2023. Since then, the price of the asset has slumped below $47. Also, stock market supply increased steadily, reaching 14.5% in May.

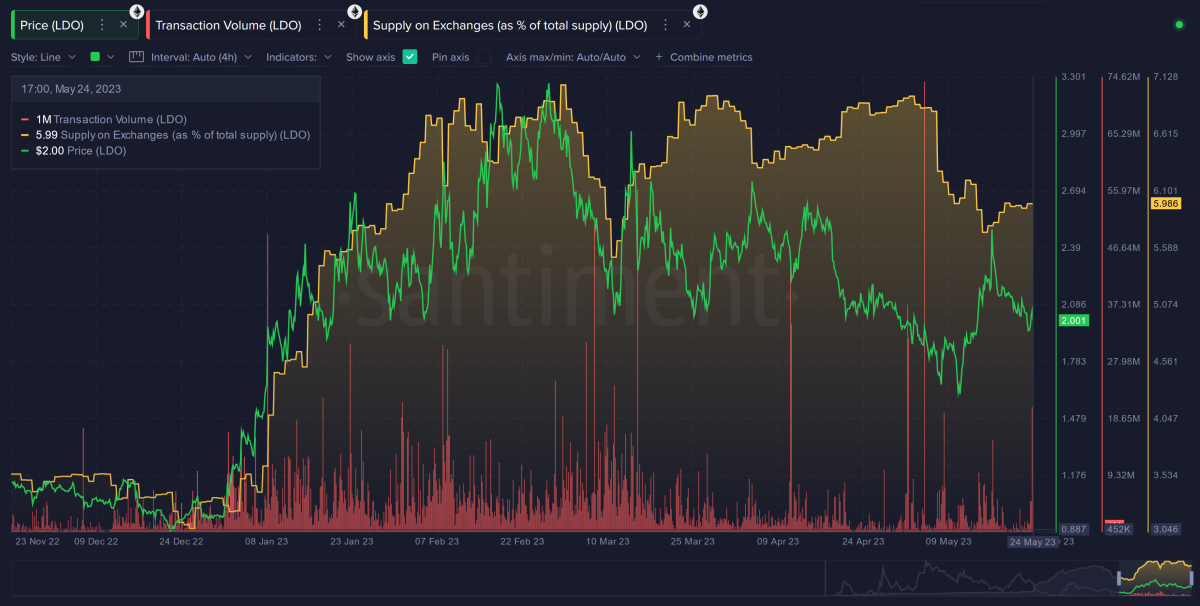

ILV trading volume and supply on exchanges

ILV trading volume and supply on exchangesSantiment’s experts consider the current price a reasonable bottom for ILV. The token is probably heading towards a recovery in its price. Similar to Illuvium, Holo observed large transfers of whale activity in its network once or twice each month.

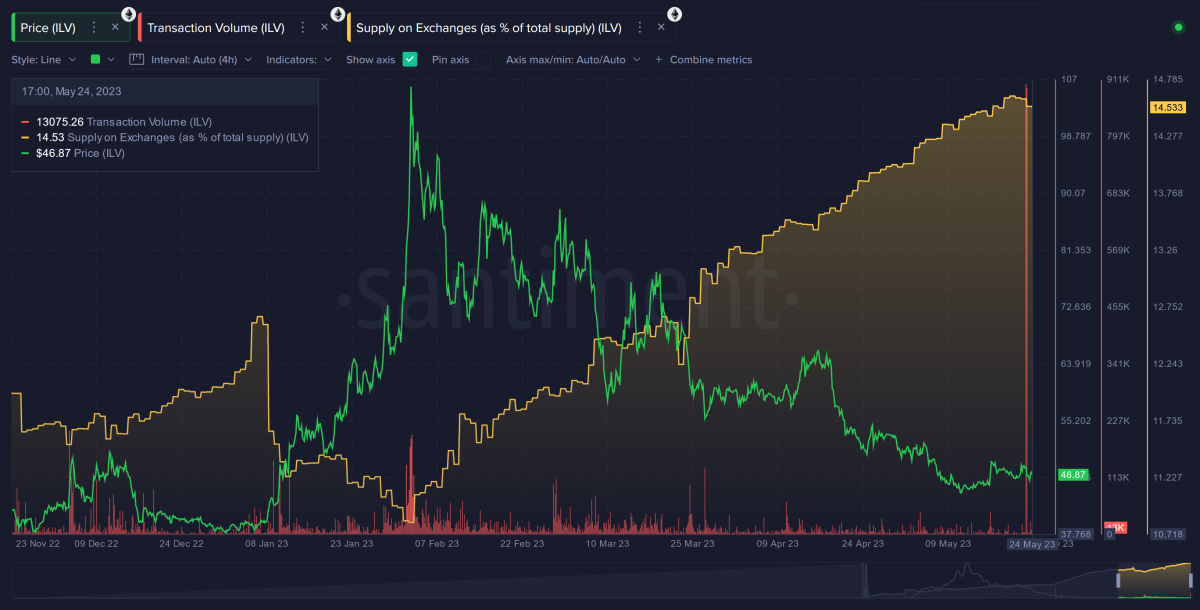

HOLO trading volume and supply on exchanges

HOLO trading volume and supply on exchangesBut the recent surge in whale activity has not had a significant impact on the supply of HOT on exchanges.

TRON TVL on the rise despite the drop in staker count

cryptocoin.com As we reported, Justin Sun’s TRON network has made significant gains for TVL. TRON’s TVL increased from $4.123 billion in January to $5.6 billion in May. Total Value Locked in a Blockchain represents the total value of all tokens in the network. It also gives tips on the health and adoption of the protocol.

TRON Network’s TVL

TRON Network’s TVLTRON’s rising TVL is a sign of greater adoption among market participants. There has been remarkable growth in TVL so far this year. However, despite this, the number of stakers on the TRON network has decreased recently.

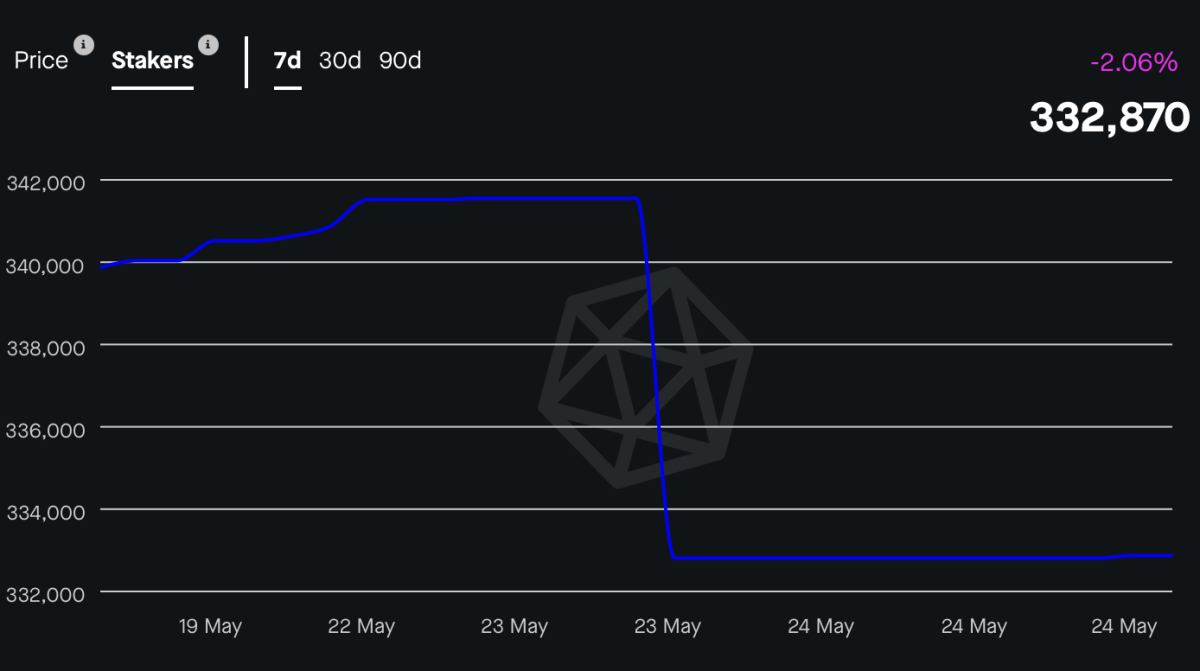

TRX stakers 7 day chart from StakingRewards.com

TRX stakers 7 day chart from StakingRewards.comThe number of stakers, which was 341,550 on Tuesday, has dropped to 332,870 at the time of this writing. This marks a 2.5% drop in the number of stakers on TRON. Users lock their tokens (stacks) to earn rewards and incentives. Therefore, the decrease in the number of stakers is an indication that the sentiment among TRX holders and network participants has changed.

The supply of TRX held by whales increases

The TRX token supply held by crypto whales was at 18.49% in June 2022. This rate increased to 47.88% in May. This significant increase is generally considered a bullish development for the token. According to data from crypto intelligence tracker Santiment, major wallet investors have consistently added TRX to their holdings over the past year despite price fluctuations.

Supply held by the largest addresses (% of total TRX supply)

Supply held by the largest addresses (% of total TRX supply)Meanwhile, the growth in the percentage of supply held by top addresses is likely to act as a catalyst for TRX price recovery. TRON has risen from $0.054 to $0.076 in the last five months. Thus, it gave its holders 40.7% earnings for the Year To Date (YTD). Still, the token is 66.53% below the ATH level of $0.231. It is possible that bullish catalysts such as whale accumulation, increase in TVL, and token adoption could trigger a rebound.