Cryptocurrency experts pointed to the rise for these 4 altcoin projects in their recent analysis! Here are the details…

Experts explained: These 4 altcoins can rise from the bottom levels!

Avalanche (AVAX)

AVAX is trading in the $15 price range today, continuing the week’s price volatility. The bears took control of the price action from April 19, 2023, pushing it as low as $18.99. Since then, AVAX’s volatility has placed it between $17 and $15 as the bulls attempt to regain control. In particular, despite the price fluctuations in the market today, the trading volume increased by 34.13 percent in the last 24 hours. It also recorded price gains on May 9, before falling over 3 percent again.

However, AVAX continued its downtrend as bears and bulls raced to control the market. It is trading below its 50-day and 200-day Simple Moving Averages (SMA), with a bearish bias in the short and long term. Also, the Relative Strength Indicator (RSI) at 35.84 is close to the oversold zone of 30 and is bearish. However, the direction of the RSI is flat, making experts think the bears and bulls are on par. AVAX’s Moving Average Convergence/Divergence (MACD) is below the signal line and is showing a negative value confirming the widespread bearish trend in the market.

According to experts, the current downtrend is similar to the previous trend between February 22 and March 13, 2023. If AVAX’s RSI moves into the oversold zone of 30, an upside pullback is possible. AVAX faced stiff resistance at $17.67, putting the asset in a downtrend. Despite trading above the $16.35 resistance yesterday, the bears pushed the price below the $15.85 support level.

Experts say that as the $15.85 support is not holding, it is possible for the asset to drop further to the $14.40 support if the bears continue. However, if AVAX enters the oversold territory, it could go higher.

On the other hand, Alibaba Group’s digital technology arm Alibaba Cloud has partnered with Avalanche and created Cloudverse Launchpad. Cloudverse will help users launch and manage Metaverse domains hosted on the Avalanche blockchain. With this partnership, the AVAX price may rise even higher, according to experts.

Lido DAO (LDO)

Although the price has been in a downtrend since the beginning of May, LDO recorded a significant increase in its daily Transaction volume. The chart below shows how total daily LDO transactions have risen above $30 million in four of the last nine trading days.

LDO’s trades exceeding 80 million last occurred on April 21, shortly before the $2.63 level. This is explained as a sign that whales are buying LDO. If previous price rallies are to continue, the current surge in high-volume trades could soon trigger the next LDO price rebound.

However, the social perception surrounding LDO has drastically dropped to negative levels in recent weeks. Weighted Sentiment shows that most LDO investors are pessimistic about LDO. The chart below shows that Lido DAO Weighted Sentiment has followed a negative trend since April 17. The value was realized as -0.67 as of 8 May.

When Weighted Sentiment remains negative for a long time as seen above, it indicates a widespread Fear, Uncertainty and Doubt (FUD) in the blockchain network. Strategic investors looking to buy the dip can seize this perfect timing to enter the market. Once the current FUD fades, LDO could reap substantial price gains before social sentiment reaches exuberant levels again.

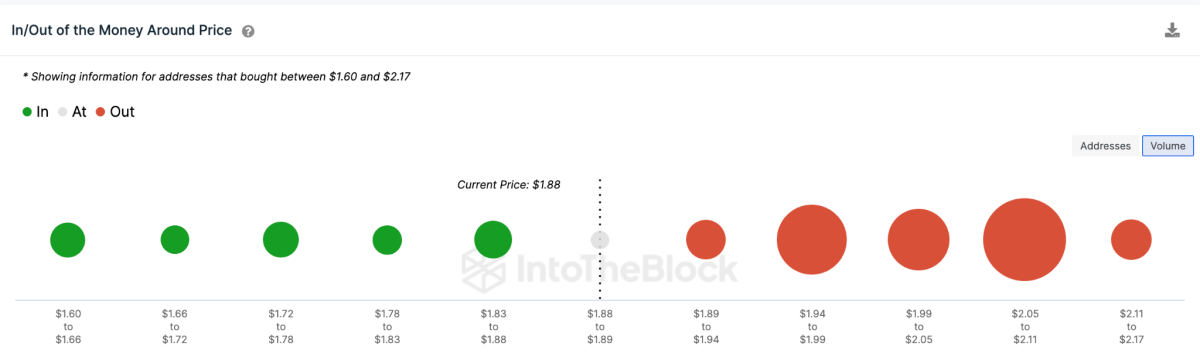

An in-depth analysis of In/Out of the Money Around Price (IOMAP) data compiled by IntoTheBlock shows that a rise to $2.11 is the most likely LDO price prediction. First, however, the bulls will need to overcome the initial bearish resistance of 364 investors who purchased 12.7 million tokens at an average price of $1.97. If LDO price rises above $1.97 as expected, traders can expect more gains until the next key resistance level of $2.08 is reached. In this region, 1,300 investors who bought 127 million altcoin LDO at a maximum price of $2.11 could slow the rally while making some profits. These traders might consider selling at a price as low as $1.95.

Conversely, bears could invalidate this view if LDO price drops below $1.83. However, the buy wall of 462 investors, who bought 11 million coins for at least $1.83, aims to prevent this. However, if this support fails to hold, LDO could face an unexpected drop towards $1.60 with resistance levels at $1.75 and $1.69 along the way.

Litecoin (LTC)

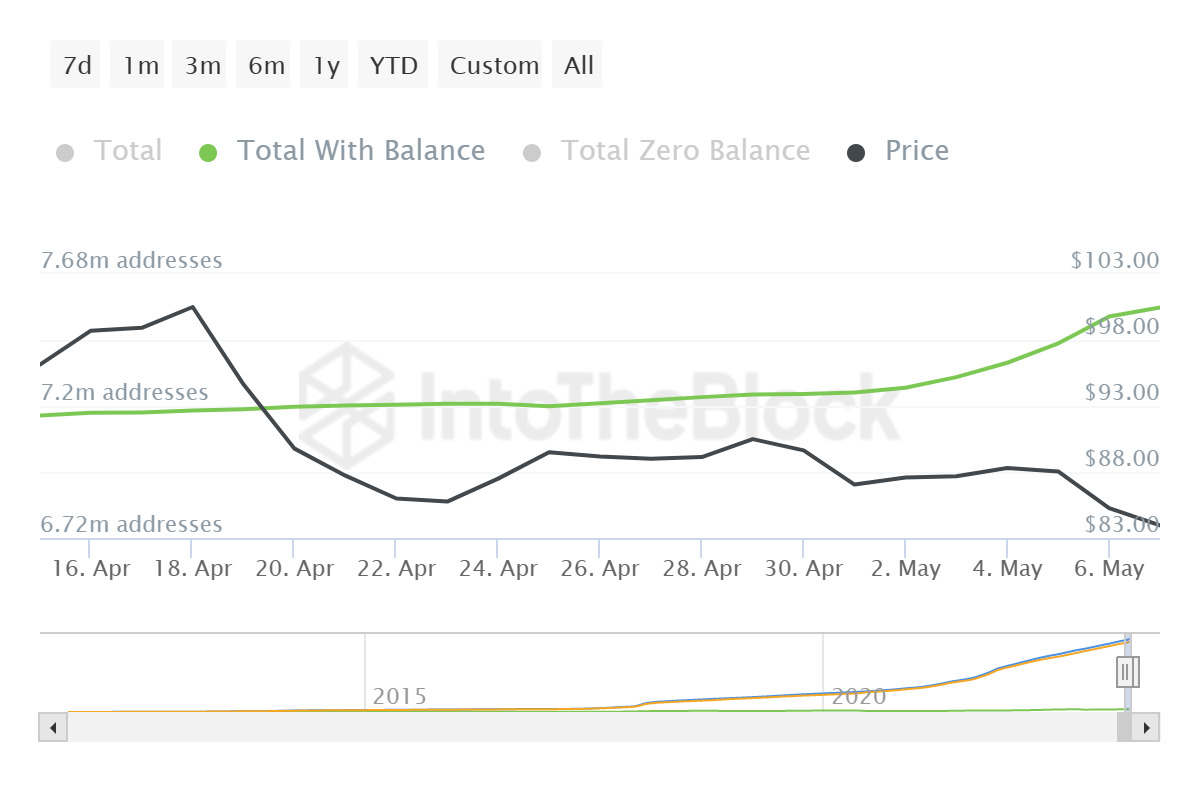

Litecoin (LTC) price dropped more than 12 percent, pushing LTC as low as $78. After BTC, LTC recorded monthly lows. But the number of investors is increasing day by day.

In the first week of May, the Litecoin network recorded the addition of 300,000 new addresses. That’s about a 300 percent jump from the average weekly rate, as over the past month the network has only added 300,000 addresses, raising the weekly average to 75,000.

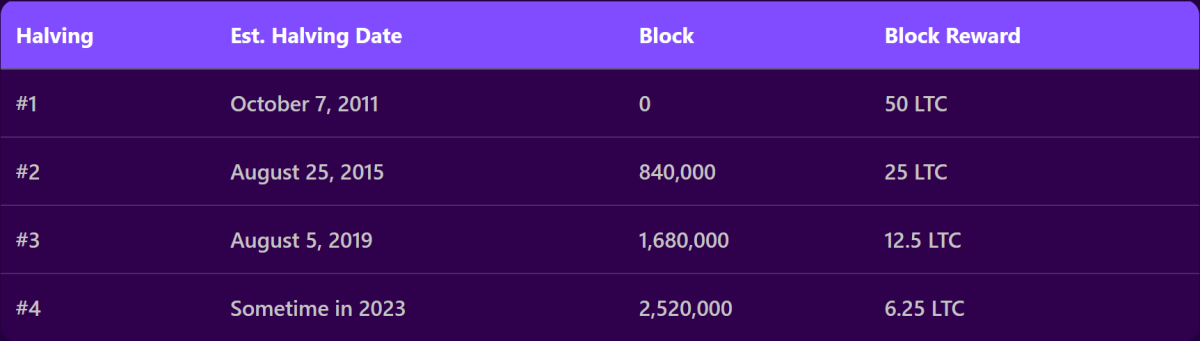

The total number of addresses holding popular altcoin LTC is currently 7.56 million and this number is likely to increase further. The reason for this is explained as the upcoming Halving event.

Investors are excited and turning to LTC due to the halving events that have resulted in bullish events in the past. However, he is preparing to make a profit by joining the network. Given that the Litecoin price is currently low, this could also mean bullish for price action, as investors can likely accumulate more. As such, the Relative Strength Index (RSI) is below 30.0, approaching the oversold territory. A move into the area followed by an exit would confirm a trend reversal, triggering a recovery rally. If this situation continues over the next few days, Litecoin price may be ready for a rally.

Uniswap (UNI)

According to experts, Uniswap price may have reached the end of the road for a bear trend as altcoin project UNI is on a recovery rally. The trend reversal comes amid the offering of a critical multi-month support level around $4.88. An increase in buyer momentum with the action of the bulls could set the tone for Uniswap price to rise and break above the immediate $5.39 barrier. In a fairly bullish case, UNI could extend north and tag early May highs around $5.63, meaning a 15 percent increase from the current price.

The Relative Strength Index (RSI) has tilted upwards, a bullish sign that indicates more buyers are flocking to the UNI market. The same level as the lows at the end of April indicates that the downside momentum has dried up. However, Uniswap V3, a major upgrade to Uniswap DEX, has been confirmed and is preparing to be deployed on the Gnosis Chain. This news could act as a bullish key catalyst for Uniswap price as users expect benefits such as improved capital efficiency and more flexible and customizable fee structures delivered through a greatly enhanced user experience.

The daily chart above shows that altcoin Uniswap price is facing relatively strong resistance at the 50, 100 and 200-day Exponential Moving Averages (EMA) at $5.71, $5.92 and $6.23 respectively. The bulls will face selling pressure from these levels.

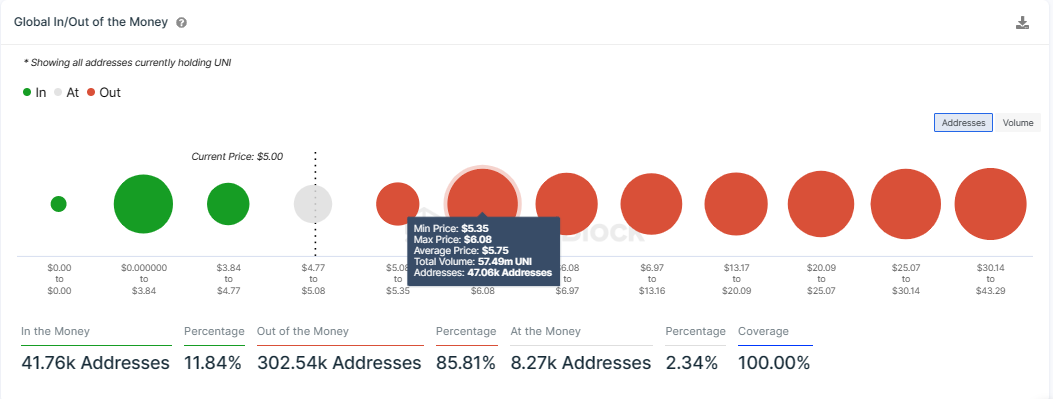

On-chain metrics from IntoTheBlock’s Global In/Out of the Money (GIOM) model highlight significant barriers to Uniswap price’s upward move. For example, barriers at $5.39 and $5.63 fall within GIOM’s $5.35 and $6.08 price range, where a large group of about 57.49 million UNIs is held by roughly 47,060 addresses.

Any attempt to push the popular altcoin UNI price above this level will face selling pressure from a group of investors who may want to take profits early. The ensuing supply pressure will force the Uniswap price to move up. This could cause UNI to bounce back to the $4.88 support level. To avoid further losses, traders may consider placing their sell stops around this area.