Most major altcoins, including Bitcoin and DOGE, are witnessing buying close to strong support levels. According to crypto analyst Rakesh Upadhyay, this also signals bullish sentiment. Can Bitcoin and altcoins continue their bullish moves, or will the recovery drop to higher levels? The analyst studies the charts of the top 10 cryptocurrencies to find out.

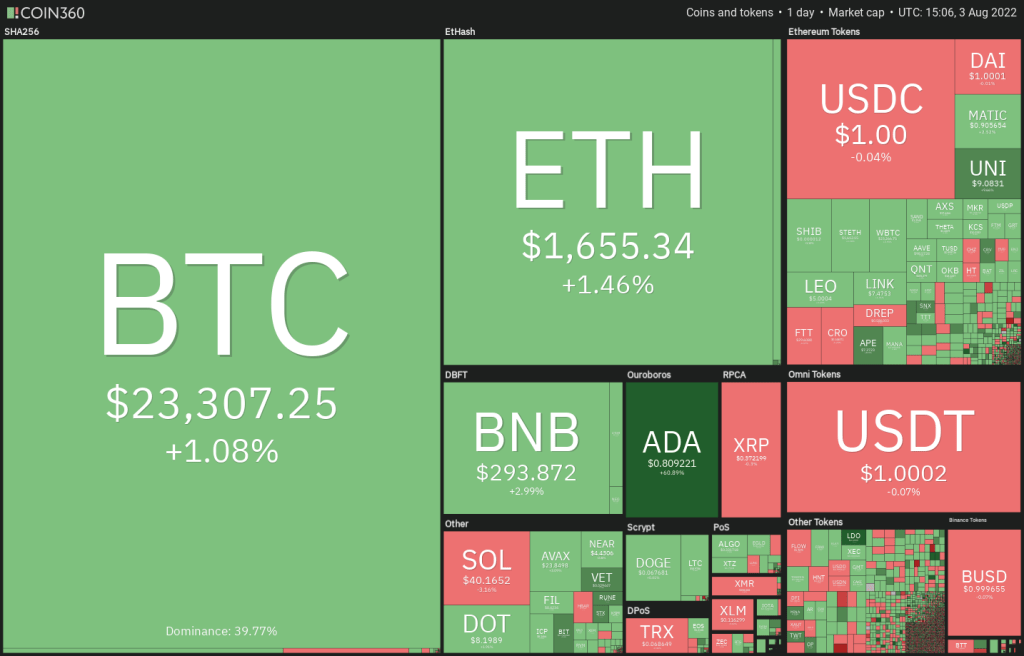

An overview of the cryptocurrency market

Bitcoin and altcoins watch US stocks higher on August 3 as traders buy the dip. Smaller investors are making the most of the bear market in Bitcoin as the number of wholecoins has increased by 40,000 since the sharp drop in June. In contrast, wallet addresses holding more than 1,000 Bitcoins have decreased by 113 since May.

However, some analysts say that Bitcoin has not yet formed a macro bottom. Trade firm QCP Capital expects Bitcoin to rise gradually for most of the third quarter amid high volatility. QCP Capital believes that the Bitcoin rally will reach a roof around $28,700. In the long run, the firm does not exclude an eventual capitulation up to around $10,000 in Bitcoin. This could also indicate a bottom for a bear market.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360However, Bitcoin miners increased their Bitcoin holdings in July following the June capitulation. They seem to be in an optimistic mode for that. According to data from on-chain analytics firm CryptoQuant, Bitcoin in the hands of miners has reached its highest levels since then. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

Bitcoin (BTC)

Bitcoin dropped to the 20-day exponential moving average (EMA) ($22,632) on August 2, which acted as strong support. The slowly rising 20-day EMA and the relative strength index (RSI) in the positive zone suggest that the bulls have a slight advantage.

Buyers will now try to push the price above the overhead resistance at $24,668. If they are successful, it is possible for BTC to rally to $28,000, where the bears could face stiff resistance. If the bulls break this hurdle, the rally is likely to extend to $32,000. If the price declines from the current level or overhead resistance, it will indicate that higher levels continue to attract bears. A break and close below the 20-day EMA is likely to bring BTC down to the 50-day simple moving average (SMA) ($21,344) and then the support line.

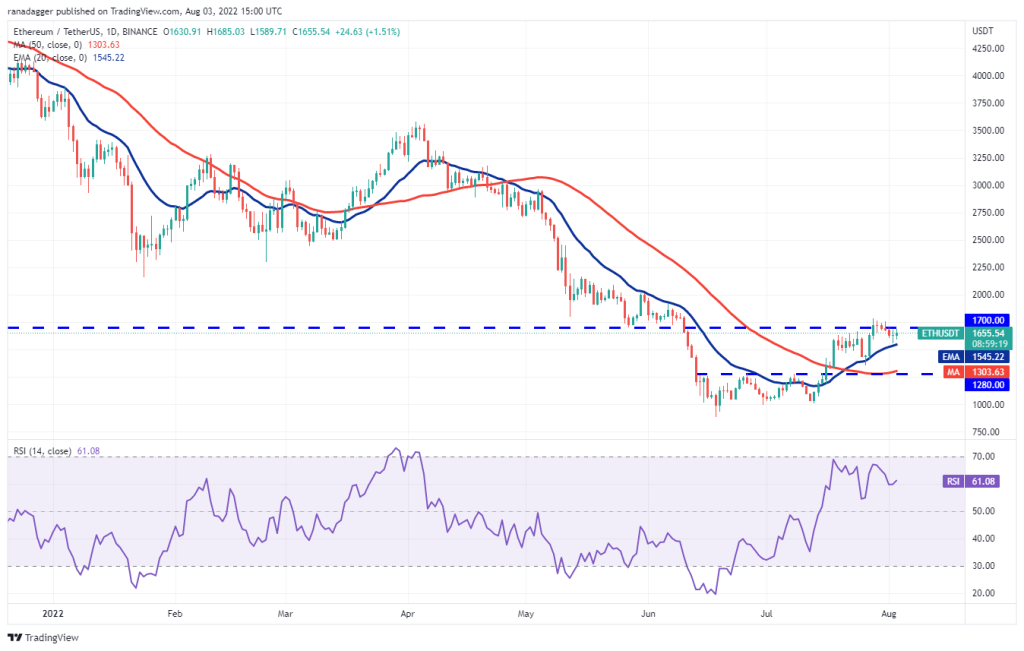

Ethereum (ETH)

ETH bounced back on August 2 and dropped to the 20-day EMA ($1,545). However, the long tail on the candlestick indicates that the bulls are buying the bearish aggressively.

The bulls will once again attempt to clear the overhead resistance zone between $1,700 and $1,785. If they are successful, it will indicate a potential trend change. It is possible for ETH to rally to $2,000 and then $2,200 later. It is possible to override this bullish view. For this, the bears will need to push the price below the 20-day EMA and sustain it. This is likely to open the doors for a drop to the strong $1,280 support. A bounce from this level is possible to keep ETH between $1,280 and $1,700 for a few days.

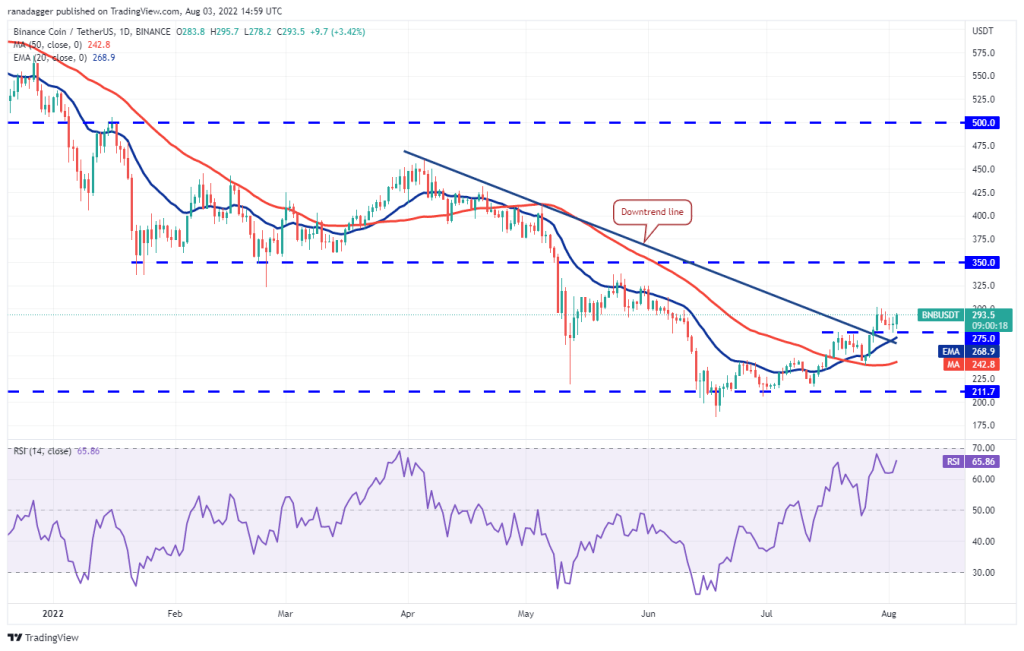

Binance Coin (BNB)

BNB bounced off the $275 support on Aug. This indicates that sentiment has turned positive and traders are buying on the dips.

The bulls will now make an attempt to push the price above the overhead resistance at $300. If they are successful, it is possible for BNB to gain momentum and rally towards the stiff overhead resistance at $350. The ascending 20-day EMA ($268) and the RSI in the positive zone indicate the path of least resistance to the upside. This bullish view is likely to be invalidated in the near term if the price drops and dips below the 20-day EMA.

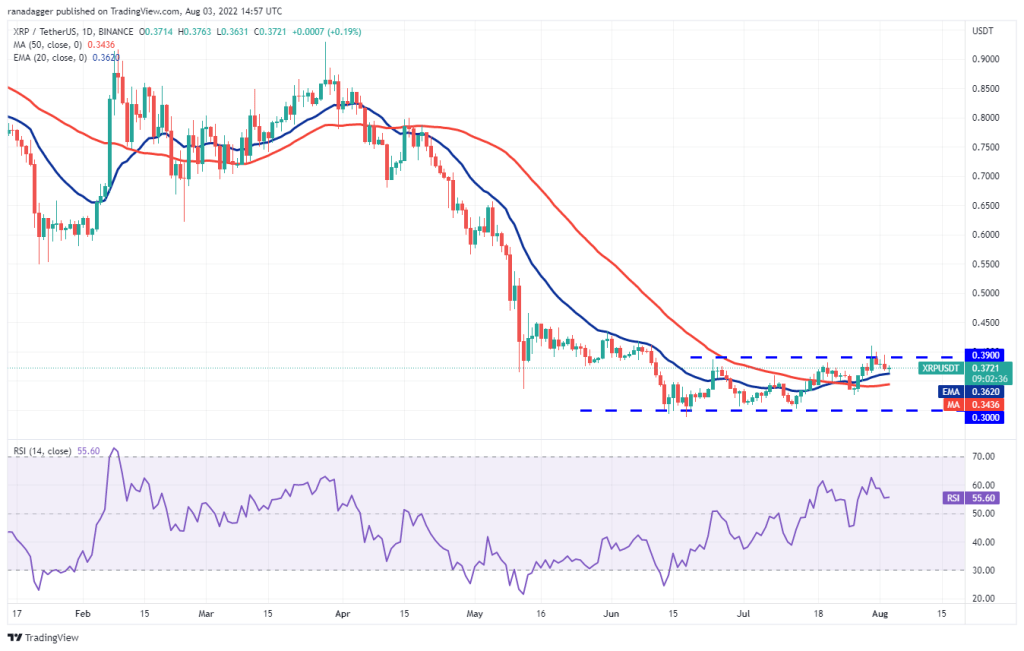

Ripple (XRP)

The long tail on XRP’s August 3 candlestick indicates that the bulls are trying to defend the 20-day EMA ($0.36). The slowly rising 20-day EMA and RSI in the positive zone point to a slight advantage for buyers.

The bulls could push the price above the $0.39 to $0.41 resistance zone. In this case, XRP is likely to mark the start of a new upward move. XRP could then rise to $0.48, where the bears can again form a strong defense. Contrary to this assumption, if the price breaks from the current level or overhead resistance, the probability of a break below the 20-day EMA increases. If that happens, XRP is likely to continue its range-bound movement for a few more days.

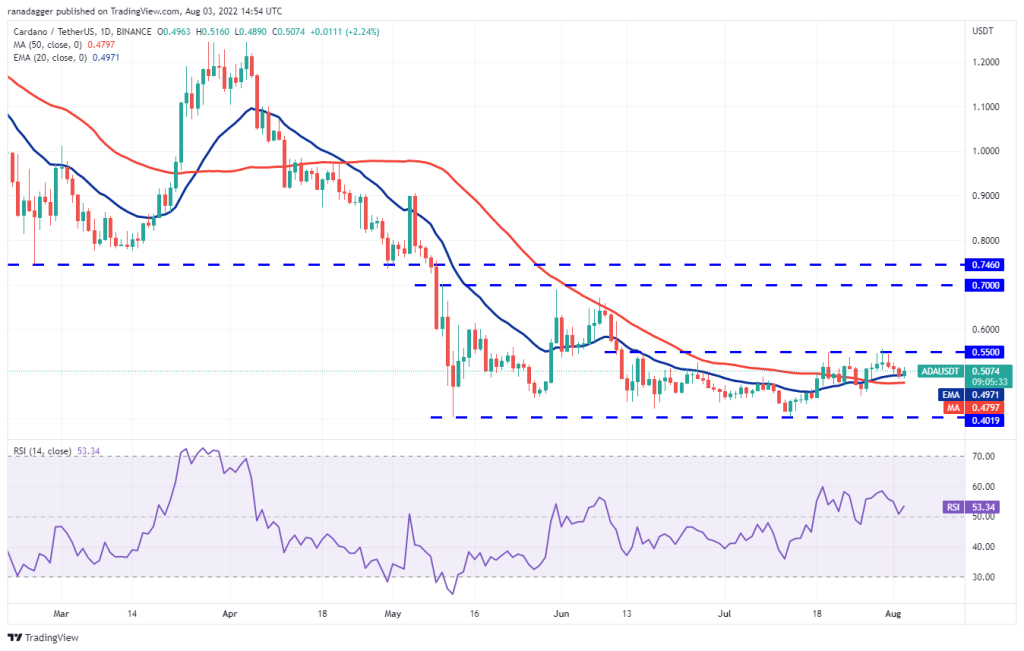

Cardano (ADA)

ADA has been in a wide range between $0.40 and $0.55 for the past few days. The bulls are currently trying to defend the moving averages.

If they are successful, it is possible for ADA to climb to the overhead resistance at $0.55. This remains an important level to watch out for. If the bulls break this hurdle, ADA is likely to rally to $0.63 and later to $0.70. Alternatively, if the price dips below the moving averages, a slide to immediate support at $0.45 is possible. A bounce from this level is likely to create a narrower range between $0.45 and $0.55. Besides, a break below $0.45 is likely to open the way for a drop to $0.40.

SOL, DOGE, DOT, MATIC and AVAX analysis

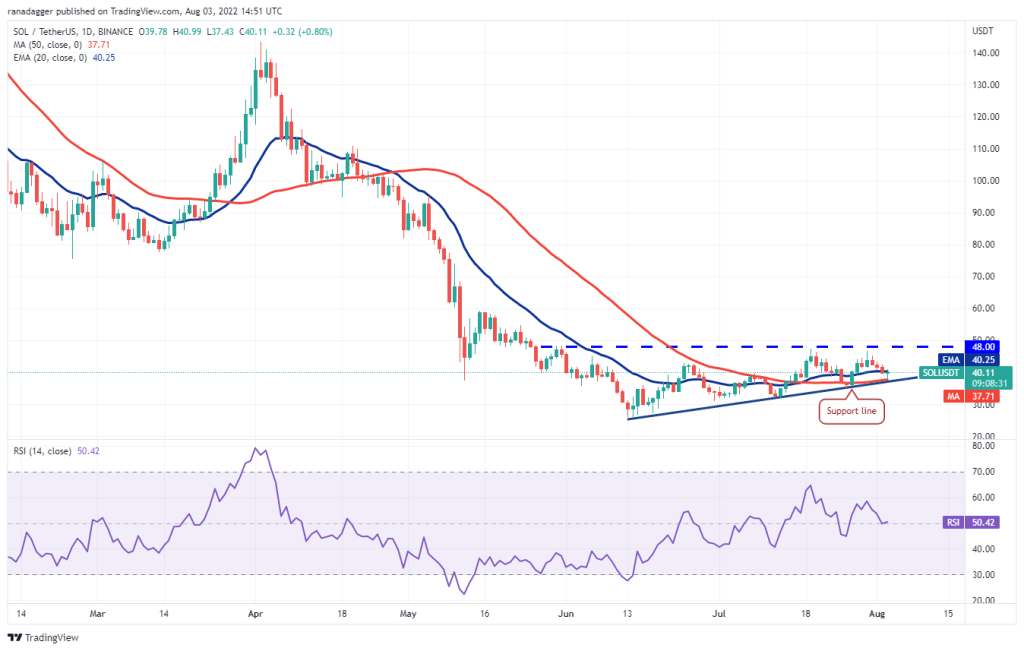

Left (LEFT)

SOL broke below the 20-day EMA ($40) on Aug. It dropped to the 50-day SMA ($37) on Aug. The long tail on the candlestick shows that the traders are defending the support line.

If the bulls push and sustain the price above the 20-day EMA, a gradual rise of the SOL up to $48 is possible. This is an important level to focus on. Because a break and close above this is likely to complete the ascending triangle pattern with a target target of $71. Conversely, if the rebound has no strength, the bears will try to push the SOL below the support line. If they succeed, the bullish setup will be rejected. So SOL is likely to slide to $31.

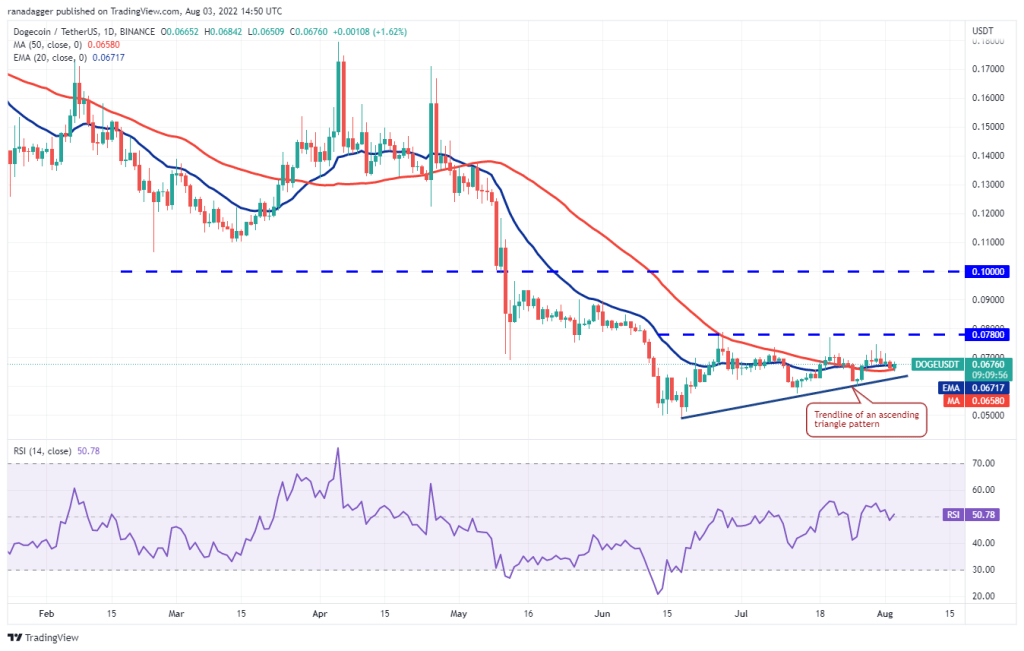

Dogecoin (DOGE)

The bulls are trying to stop Dogecoin (DOGE) pullback at the 50-day SMA ($0.07). If the rebound continues above the 20-day EMA ($0.07), a retest of $0.08 is possible.

The bulls will have to push and sustain DOGE price above $0.08 to signal the completion of the ascending triangle pattern. If that happens, DOGE could rally to $0.10 and then to the $0.11 pattern target. Conversely, if the recovery lacks strength, it will indicate demand drying up at higher levels. It is possible that this will push the price towards the trendline support. A break and close below this level is likely to invalidate the bullish setup.

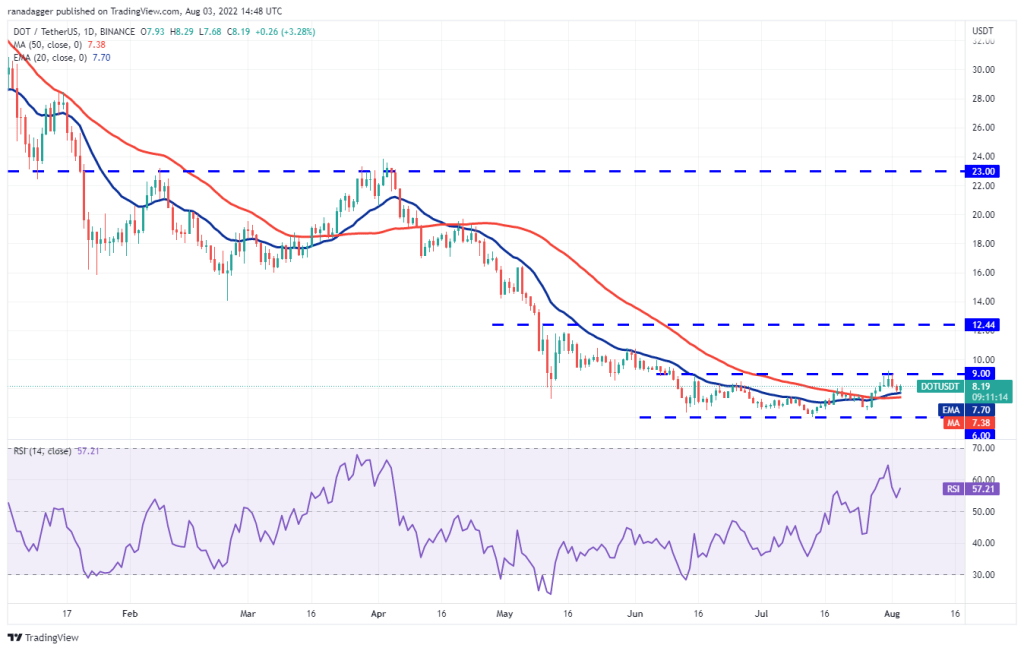

Polkadot (DOT)

DOT bounced back from overhead resistance. It then fell to the 20-day EMA ($7.70) where the bulls are trying to stop the pullback.

The slowly rising 20-day EMA and the RSI in the positive zone suggest that the bulls have a slight advantage. If the bulls push the price above the overhead resistance at $9, a rally to $10.80 and then $12 is possible. Alternatively, if the price breaks from the current level or overhead resistance and dives below the moving averages, it will suggest that the DOT could extend its stay for a few more days between $6 and $9.

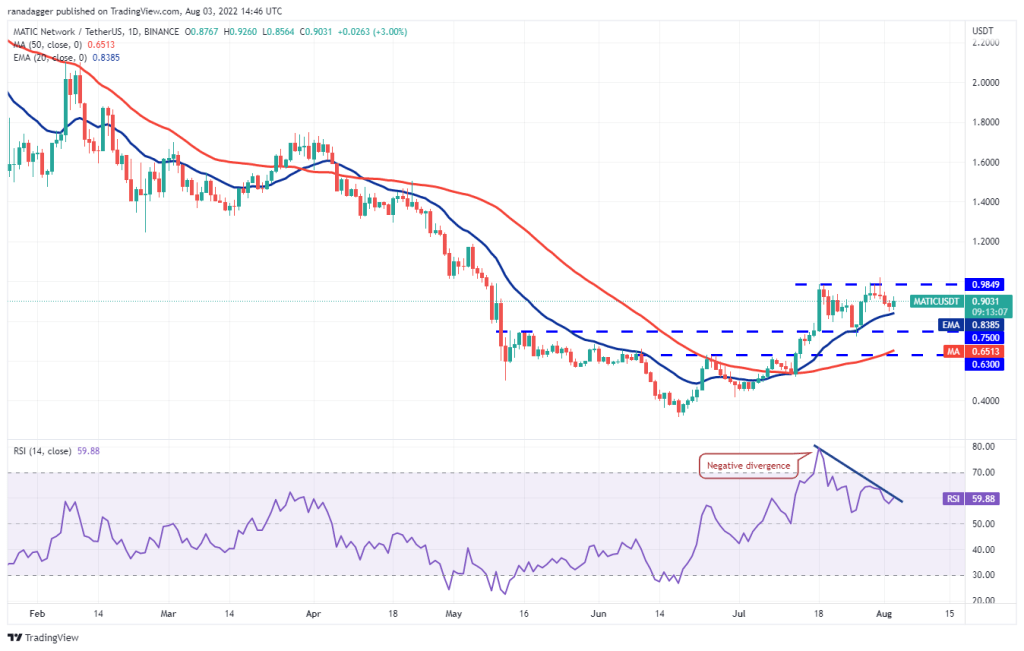

Polygon (MATIC)

MATIC bounced off the 20-day EMA ($0.84) on Aug. This shows that the bulls are buying on the lows. It is possible for the price to retest the overhead resistance area of $0.98 to $1.01 later.

While the negative divergence developing on the RSI warrants caution, the upward sloping moving averages point to the advantage for buyers. If the bulls break through the overhead resistance zone, MATIC is likely to rise to $1.26. On the contrary, if the price declines and dips below the 20-day EMA, MATIC is likely to drop to strong support at $0.75. A sharp recovery from this level is possible to keep MATIC between $0.75 and $1 for a few days.

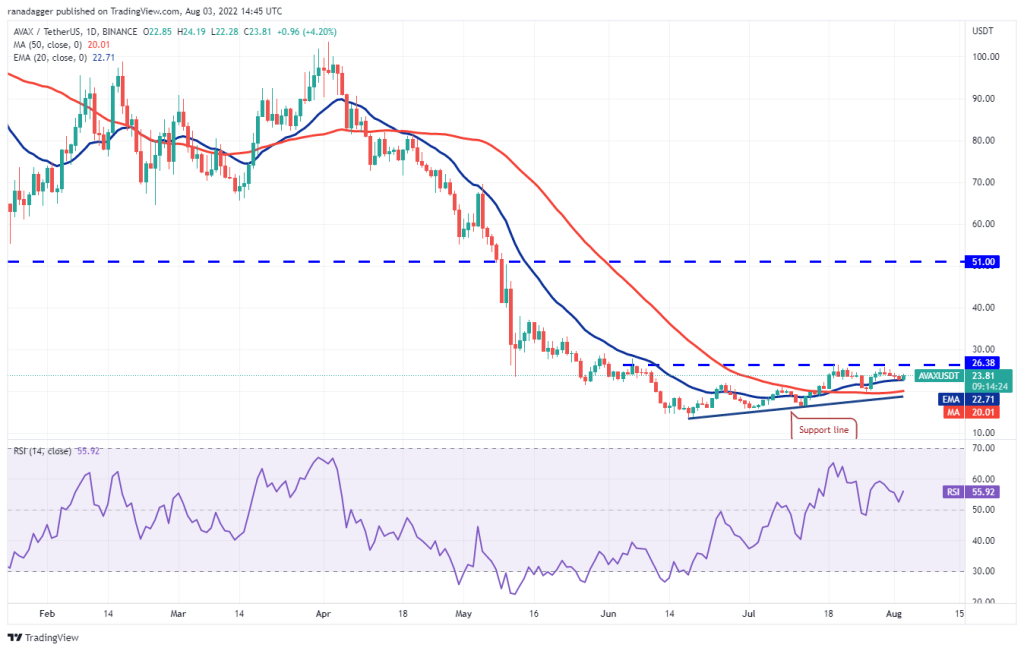

Avalanche (AVAX)

The bears tried to push the AVAX below the 20-day EMA ($22.71) on Aug. But the bulls held their ground. This shows that traders see the dips as a buying opportunity.

The bulls will try to push the price above the overhead resistance at $26.38. If successful, it is possible for AVAX to complete a bullish triangle pattern with a target of $33 followed by $38. Contrary to this assumption, AVAX is likely to slide to the support line if the price breaks from the current level or overhead resistance and dips below the 20-day EMA. This is an important level for the bulls to defend. Because a break and close below this is possible to turn the advantage in favor of the bears.