Crypto analyst Rakesh Upadhyay says Bitcoin and altcoins are facing selling at key overhead resistance levels. He also notes that he is unsure whether investors and traders will buy the current dip. Can the buyout occur at lower levels and sustain the upward move in altcoins including Bitcoin and DOGE? The analyst studies the charts of the top 10 cryptocurrencies to find out.

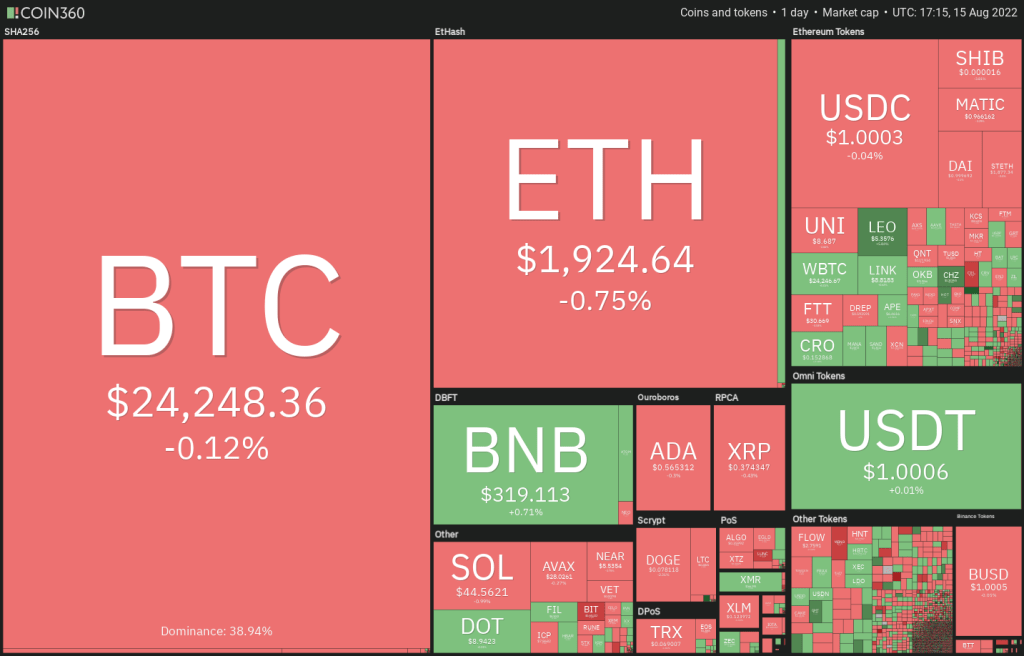

An overview of the cryptocurrency market

Bitcoin (BTC) is witnessing a tough battle between bulls and bears near the $25,000 level. A clear winner may not emerge in the short term due to the lack of catalysts and the lack of significant US macroeconomic data scheduled for this week. On the other hand, it is possible that data from Asia or Europe will increase the volatility. But they are unlikely to start a new directional movement.

By the way cryptocoin.com As you follow, Anthony Scaramucci, founder and managing partner of Skybridge Capital, advised investors to “be patient and think long-term” in an interview. Scaramucci expects Bitcoin to reward investors with a sharp rise over the next six years.

Daily cryptocurrency market performance / Source: Coin360

In addition to focusing on Bitcoin, investors are also keeping a close eye on Ethereum (ETH) ahead of the planned Merge on September 15. A whale address that participated in the Genesis ICO but remained dormant for three years transferred around 150,000 ETH on August 14. This led to differing opinions. Some speculated that the whale may have vacated its holdings after the Merge. However, others believe the transfers may have been made to stake large amounts of ETH. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

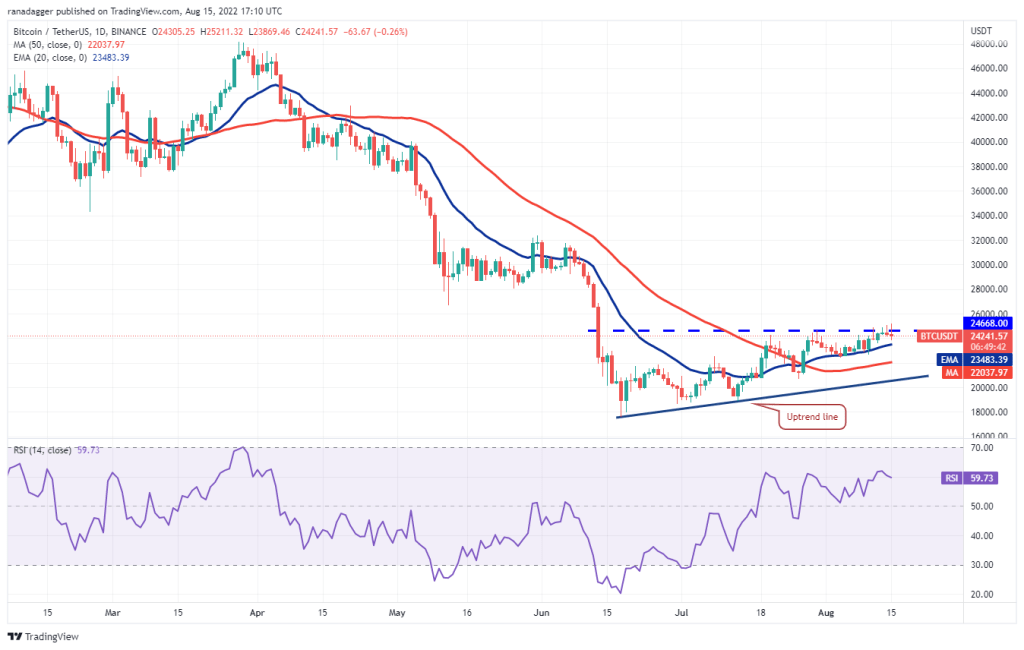

Bitcoin (BTC)

The bulls tried to sustain the rise in Bitcoin. But the bears aggressively sold at $25,211. The bears pushed the price down to the 20-day exponential moving average (EMA) ($23,483). This resulted in the formation of an extra-day candlestick pattern on August 15.

The slowly rising 20-day EMA and the relative strength index (RSI) in the positive zone point to the advantage for buyers. If the price bounces back from the 20-day EMA, it indicates that the bulls are buying dips to this level. This is likely to increase the likelihood of a breakout and a close above $24.668. If that happens, BTC is likely to start walking north towards $28,000. However, it is possible that the bears will again be strongly challenged here. Another possibility is for the bears to push the price below the 20-day EMA. If this happens, it is possible for BTC to drop to the 50-day simple moving average (SMA) ($22,037) and then to the bullish line.

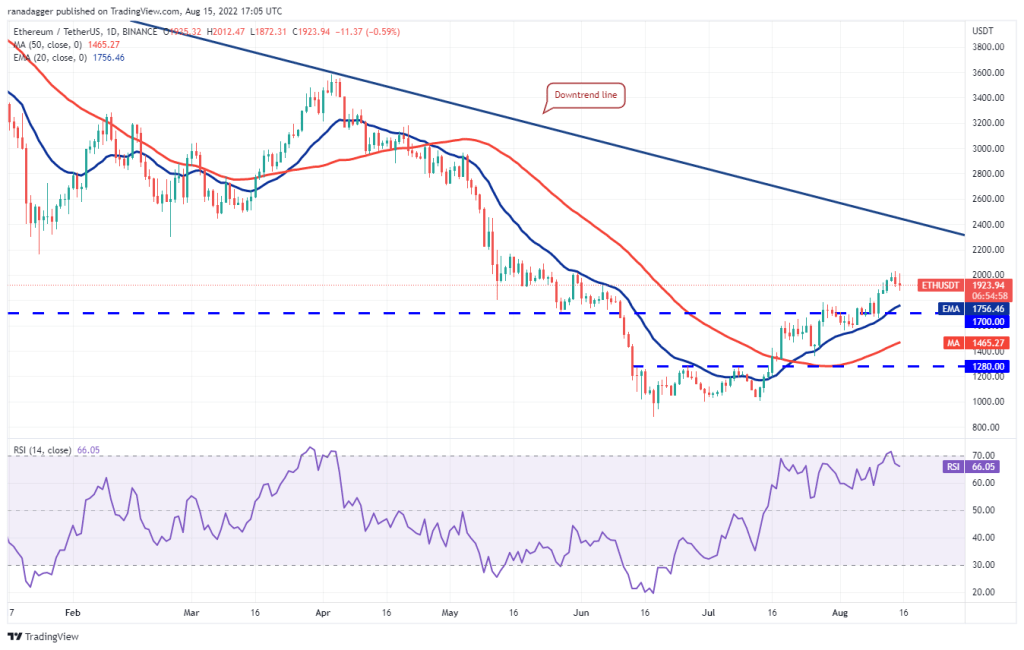

Ethereum (ETH)

ETH has repeatedly rallied above psychological resistance at $2,000 over the past two days. However, the bulls failed to sustain higher levels. This shows that bears pose a tough challenge at this level.

ETH is likely to drop to the breakout level at $1,700. This is an important level to watch out for. Because if the bulls turn $1,700 to support, a break above $2,000 will increase the likelihood. If this happens, ETH is likely to rise to the downtrend line. The rising 20-day EMA ($1,756) and the RSI in the positive zone indicate that the bulls are in control. To invalidate this bullish view, the bears will need to push the price below the 20-day EMA and sustain it. This is likely to push ETH down to the 50-day SMA ($1,465).

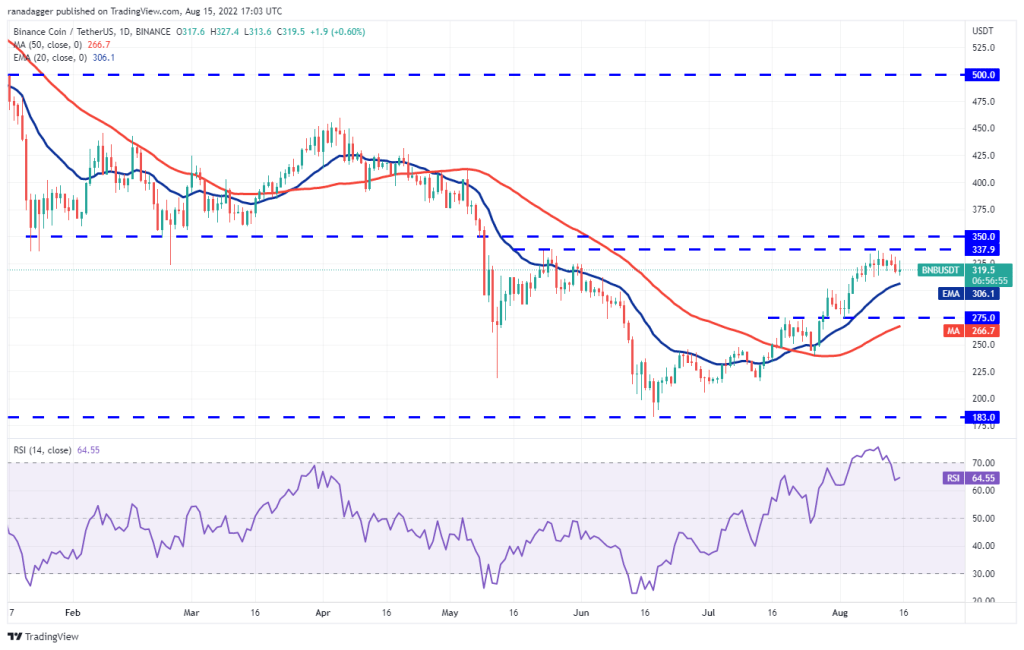

Binance Coin (BNB)

BNB’s upward move hit a hurdle at the overhead resistance at $338. The bears will now attempt to push the price down to immediate support at the 20-day EMA ($306).

If the price bounces back from this support, buyers will make another attempt to push BNB above the $338-$350 resistance zone. The rising 20-day EMA and RSI in the positive zone suggest the path of least resistance is up. This positive view could be invalidated in the short term if the price drops and dips below the 20-day EMA. If this happens, short-term traders are likely to rush to the exit. This is also likely to pull BNB to the 50-day SMA ($266).

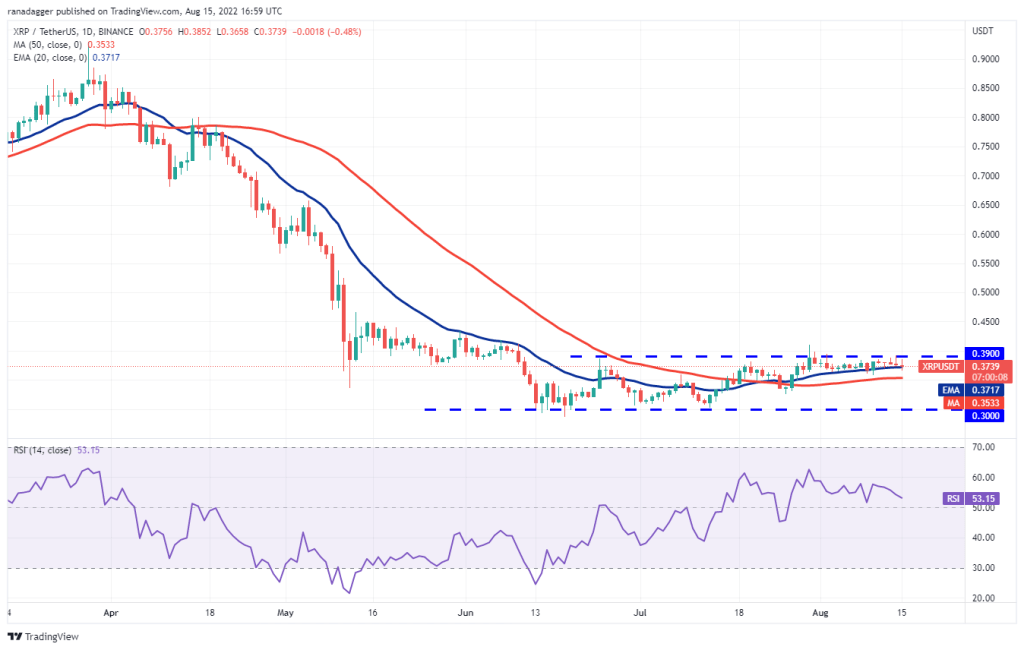

Ripple (XRP)

The bulls tried to push XRP above the overhead resistance at $0.39 on August 13 and 14. But the bears held their ground. It is possible that this has attracted profit bookings from short-term traders who have driven the price below the 20-day EMA ($0.37).

If the bears sink the price below the 50-day SMA, XRP is likely to remain range-bound between $0.30 and $0.39 for a while. The horizontal 20-day EMA and RSI near the midpoint also suggest a consolidation in the near term. Conversely, if the price bounces back from the moving averages, it will indicate that lower levels are attracting buyers. The bulls will then try to break through the general barrier again. Accordingly, it will push XRP to $0.48 and later to $0.54.

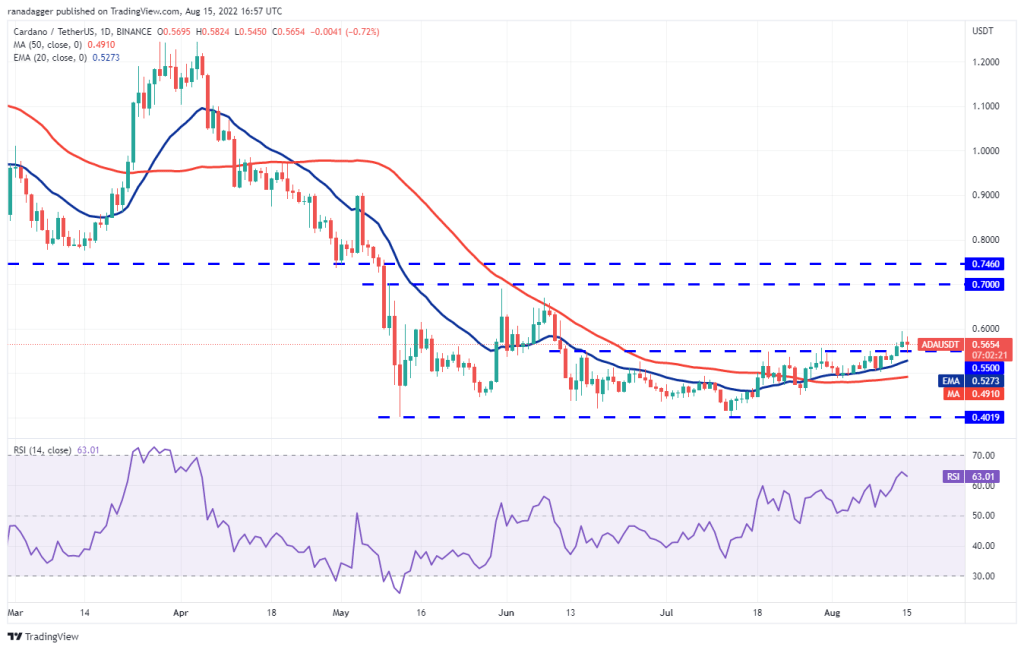

Cardano (ADA)

The bulls pushed Cardano above the overhead resistance of $0.55 on August 13. But it failed to maintain momentum on August 14. This indicates that the bears are active at higher levels.

The price fell on August 15 and reached the $0.55 breakout level. The zone between $0.55 and the 20-day EMA ($0.53) is likely to attract strong buying from the bulls. If the price bounces back from this zone, buyers will try to continue the upward move again. It will then push ADA to $0.63 and then $0.70. On the contrary, if the price declines and dips below the 20-day EMA, it would suggest that a break above $0.55 could be a bull trap. It is possible for ADA to drop to the 50-day SMA ($0.49) later.

SOL, DOGE, DOT, SHIB and AVAX analysis

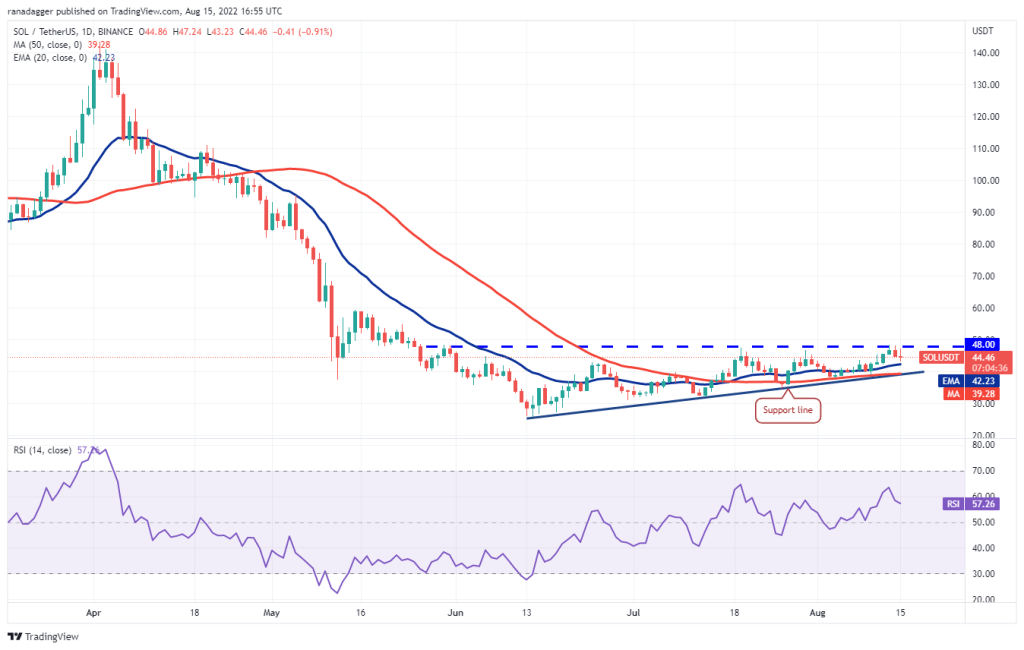

Left (LEFT)

SOL rallied to the overhead resistance at $48 on Aug. 13. However, the bulls could not overcome this hurdle. The bulls again tried to overcome the hurdle on August 15, but the bears did not give up.

If the SOL breaks below the 20-day EMA ($42), the next stop could be the support line. This is an important level for the bulls to defend. Because it is possible for a break and close below this to invalidate the ascending triangle pattern. SOL is likely to drop to $32 later. Conversely, if the price bounces back from the 20-day EMA, the bulls will again try and maintain the SOL above $48. If they succeed in this, the ascension setup will be complete. Later, SOL is likely to rise to $60.

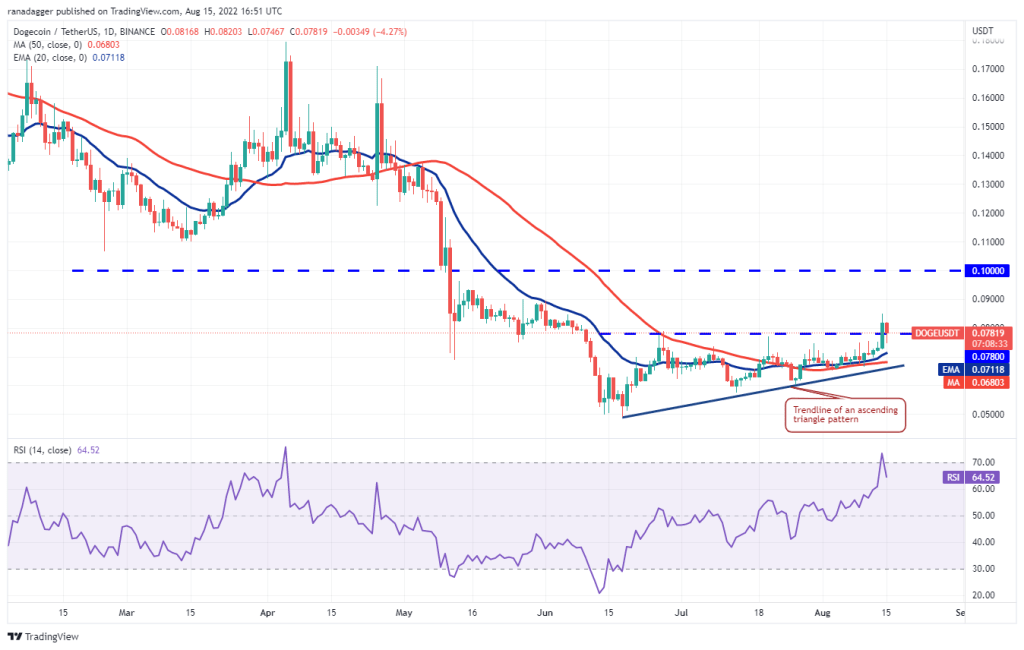

Dogecoin (DOGE)

DOGE bounced off the 20-day EMA ($0.07) on Aug. 12. It then climbed above the overhead resistance at $0.08 on August 14. With this move, he completed the ascending triangle pattern. However, the bulls failed to sustain the breakout.

The bears have sold at higher levels. In this way, it pulled the price back below the breakout level on August 15. A minor positive point is that lower levels are attracting buyers, as seen by the long tail on the day’s candlestick. If DOGE price stays above $0.08, buyers will try to continue the upward move. This will push Dogecoin (DOGE) to $0.10. Contrary to this assumption, if DOGE price breaks below the trendline of the moving averages and triangle, the bullish setup will be invalid. DOGE could drop to $0.06 later.

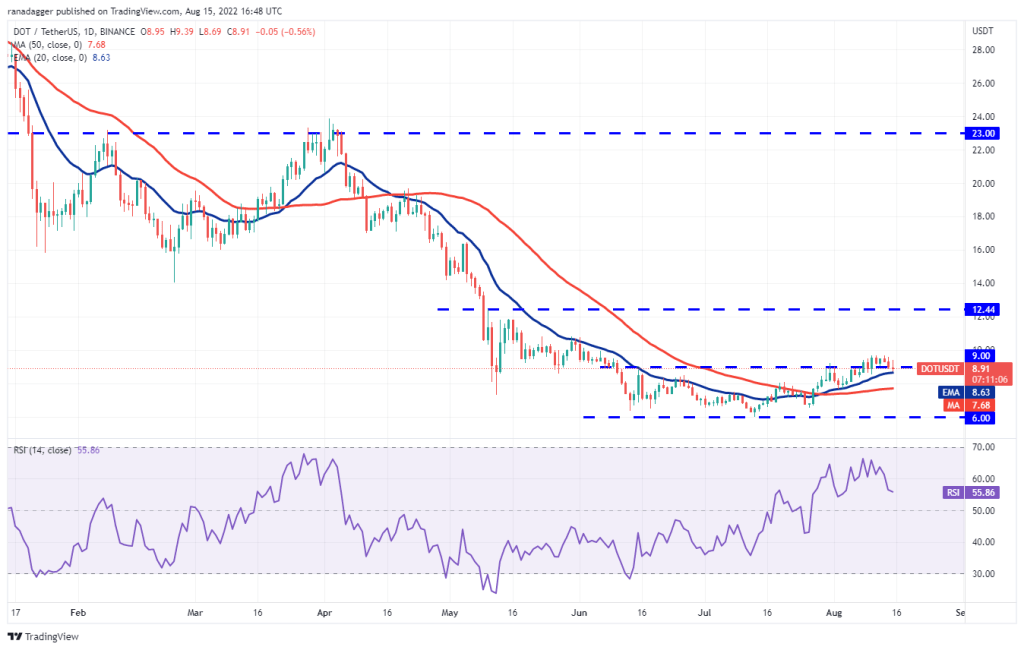

Polkadot (DOT)

The DOT broke above the overhead resistance of $9.65 on Aug. 13. However, the bulls failed to sustain higher levels. This is likely to have encouraged short-term traders to book profits.

The DOT broke below the $9 breakout level on August 14. The price then reached the 20-day EMA ($8.63) on August 15. This is an important level to focus on. Because it is possible that there is a break under it. This indicates that the bullish momentum is weakening. It is possible for the DOT to drop to the 50-day SMA ($7.68) later and stay range-bound for a while. Alternatively, if the price bounces back from the 20-day EMA, the bulls will attempt to clear the overhead resistance at $9.68. If they do, the DOT is likely to rally to $10.80 and later to $12.44.

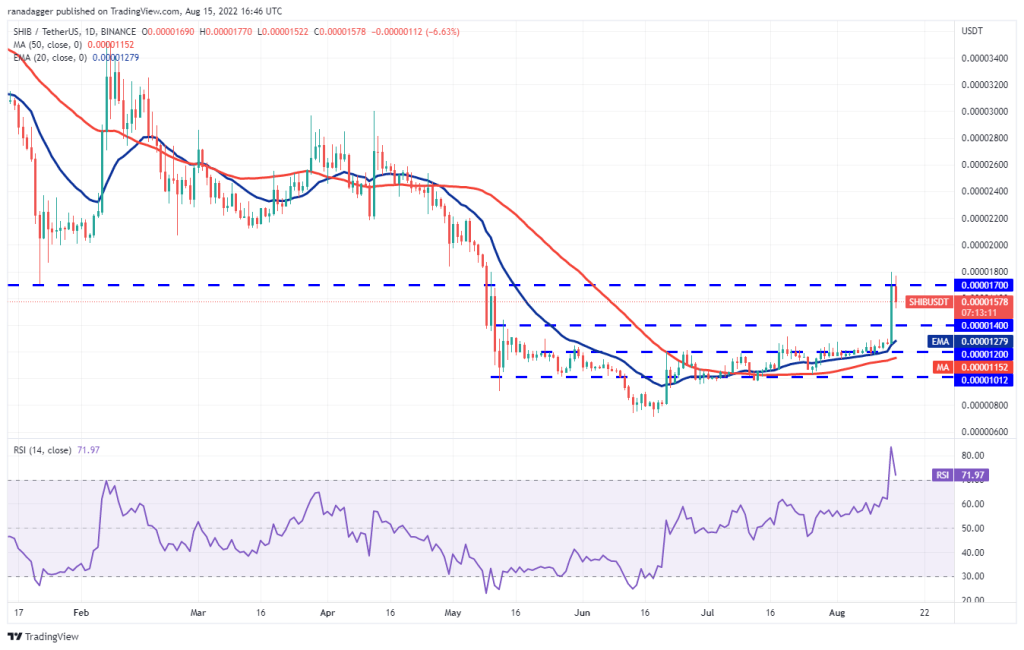

Shiba Inu (SHIB)

SHIB has been trading above $0.000012 since August 7. However, the upward movement failed to gain momentum. That changed with the sharp rally on 14 August. This pushed the price above the overhead resistance at $0.000017.

But the bears did not give up. They sold the rally above $0.000017 and pushed the price below the level on August 15. It is possible for SHIB to find support at $0.000015 and then $0.000014. If the price bounces back from both levels, buyers will again try to break through the general hurdle. If they are successful, SHIB is likely to rise to $0.000022. On the contrary, if the price dips below $0.000014, it will indicate that SHIB could oscillate in a wide range between $0.000010 and $0.000018 for a few more days.

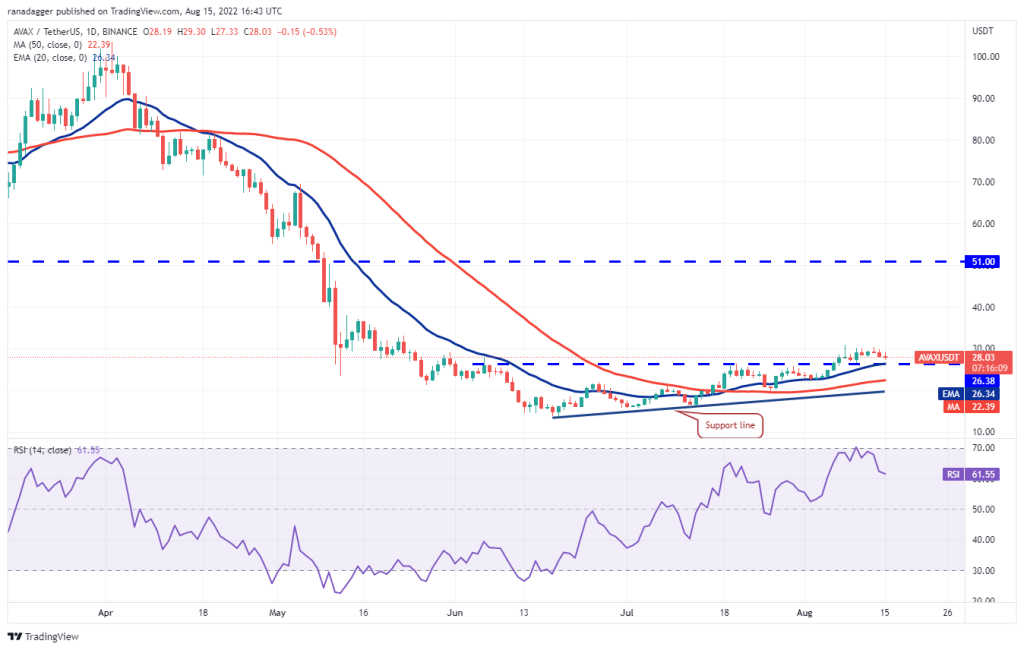

Avalanche (AVAX)

Buyers Aug 13 Inventor of AvalanDogecoin: If This Happens DOGE Might Go To The Moon! che tried to push above overhead resistance. However, the bears stopped this attempt at $30.35. This indicates that the bears are active at higher levels.

AVAX is likely to drop to the break of $26.38, which is just above the 20-day EMA ($26.34). On the other hand, bulls are expected to defend this level strongly. If the price returns to $26.38, it will suggest demand lower. It is possible for AVAX to consolidate between $26.38 and $31 some time later. If the bears sink the price below $26.38, a few aggressive bulls may fall into the trap. This is likely to drop AVAX to the 50-day SMA ($22.39). Conversely, if the price bounces back from the current level and rises above $31, it will suggest the start of a rally to $33 and then to the pattern target of $39.05.