Bitcoin (BTC), ether (ETH), sol (SOL) and many major altcoins began the Asia trading day in the red as the week opened with volatility.

Bitcoin was down as low at 5% over a 24-hour period, trading at $41,300, before recovering to $42,000, according to CoinDesk Indices data. Ether hit a low of $2,170 before climbing back up to $2,239. Solana was down to $66 before climbing back to $70. Most of these losses took place within the last 90 minutes, as of press time.

The CoinDesk Market Index (CMI) is down 4% to 1,743.

Coinglass data shows that there had been over $335 million in liquidations over the last 12 hours with $300 million in long positions getting liquidated.

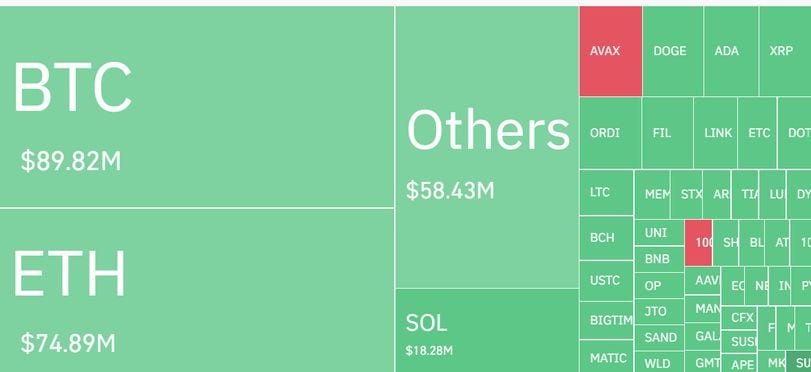

(Coinglass)

Bitcoin and Ether lead the way in the liquidation heatmap with over $89 million in bitcoin positions getting liquidated and $74 million in ether.

On-chain analyst Willy Woo wrote on X that the market may see a correction in bitcoin prices down to $39,700.

The Bitcoin CME Gap at 39.7k refers to a situation where bitcoin’s price on the Chicago Mercantile Exchange jumped, leaving a gap at $39,700, and historically, such gaps usually get filled, meaning the price often returns to this level.