According to crypto analyst Rakesh Upadhyay, EOS, STX, IMX and MKR are showing bullish signs as Bitcoin seeks direction. The analyst examines the charts of Bitcoin and four promising altcoin projects in the near term.

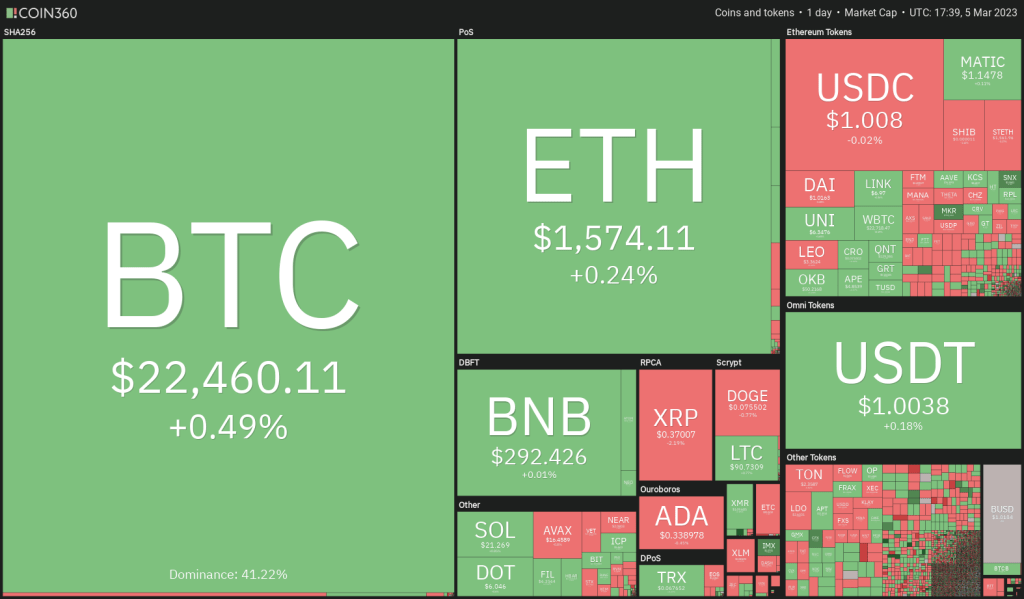

An overview of the cryptocurrency market

U.S. stock markets have rebounded strongly this week, but Bitcoin failed to do the same. This means that crypto investors stay away and may worry about ongoing problems with the Silvergate bank. cryptocoin.comAs you follow, these fears may be the reason behind the total crypto market cap dropping to nearly $1 trillion.

Behavior analytics platform Santiment says in a report released March 5 that there’s “a big boost in bearish sentiment” compared to bullish and bearish word comparison, according to its Social Trends chart. But the firm adds that ‘an overwhelming downtrend could lead to a nice jump to silencing critics’.

Crypto market data daily view / Source: Coin360

Crypto market data daily view / Source: Coin360Another short-term positive for the crypto markets is the weakness in the US dollar index (DXY), which has fallen by 0.70 in the last 7 days. This suggests that crypto markets may attempt a recovery in the next few days. As long as Bitcoin stays above $20,000, certain altcoin projects may outperform the broader markets.

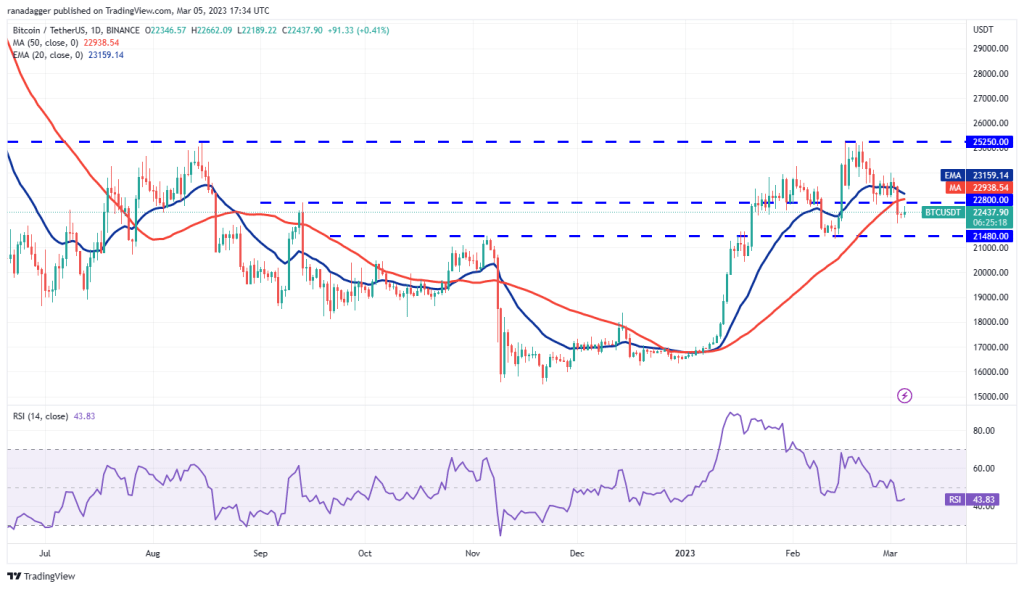

Bitcoin (BTC): In the short term, bears have the upper hand!

Bitcoin dropped below the $22,800 support on March 3. Buyers tried to push the price above the March 5 breakout level, but the long wick on the candlestick indicates that the bears are attempting to turn the $22,800 resistance.

BTC daily chart / Source: TradingView

BTC daily chart / Source: TradingViewThe 20-day exponential moving average ($23,159) has started to drop and the relative strength index (RSI) is below 44, indicating that the bears are trying to consolidate their position. Sellers will attempt to push the price below the $21,480 support. If they manage to do so, BTC could retest vital support at $20,000. If the bulls want to avoid the decline, they will have to quickly push the price above the 20-day EMA. Such a move would suggest aggressive buying at lower levels. BTC could then rally to $24,000 and then to $25,250. A break above this resistance will signal a potential trend change.

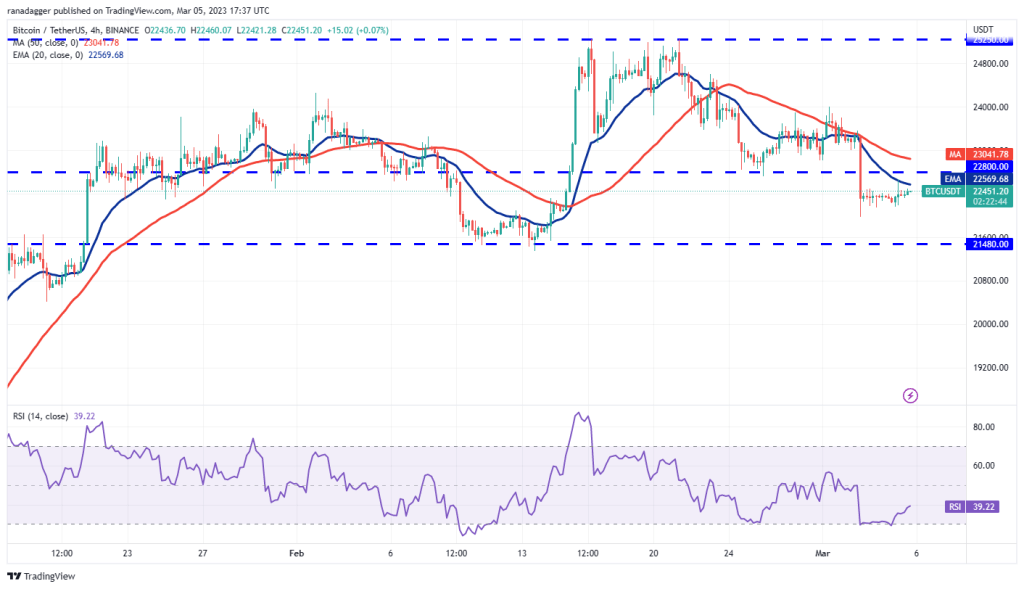

BTC 4-hour chart / Source: TradingView

BTC 4-hour chart / Source: TradingViewOn the 4-hour chart, the moving averages are turning down and the RSI is close to 39. This shows that the bears have the upper hand. If the price drops from the 20-EMA and dips below $21,971, BTC could retest the $21,480 support. Instead, if the bulls push the price above the 20-EMA, this will indicate that the bears may be losing control. BTC could then climb to the 50 simple moving average. This is an important level for the bears’ defense. Because a break above this could open the doors for a rally to $24,000.

4 altcoins signaling bullish: EOS, STX, IMX and MKR

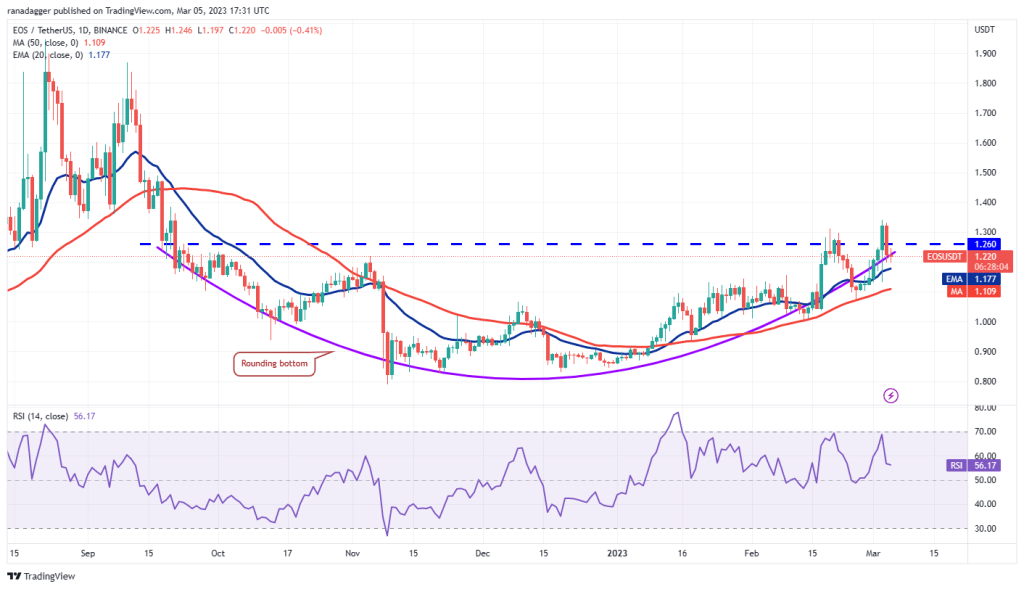

EOS (EOS): Bulls have the advantage

EOS broke above the vital resistance at $1.26 on March 3 but the bulls failed to hold higher. However, the fact that the price did not fall below the 20-day EMA ($1.17) is a positive sign.

EOS daily chart / Source: TradingView

EOS daily chart / Source: TradingViewThe gradually rising moving averages and the RSI in the positive zone point to the advantage of the bulls. The altcoin has formed a rolling bottom formation that will complete on a breakout and close above the $1.26 – $1.34 resistance zone. This reversal setup has a target target of $1.74. Important support to watch on the downside is the 50-day SMA ($1.10). Buyers have not allowed the price to drop below this support since Jan. So a break below this could accelerate the sale. The next support on the downside is at $1 followed by $0.93.

EOS 4-hour chart / Source: TradingView

EOS 4-hour chart / Source: TradingViewThe bears have pulled the price below the 20-EMA, but a minor positive is that the bulls are not allowing the EOS to slide to the 50-SMA. This indicates that lower levels continue to attract buyers. If the price rises above the 20-EMA, the bulls will attempt to break through the $1.26 barrier again. If they do, the altcoin could rally to $1.34. This positive view may be invalidated in the near term if the price turns down and falls below the 50-SMA. This could extend the decline to $1.11.

Stacks (STX): Bulls will try to maintain this level

STX surged from $0.30 on February 17 to $1.04 on March 1 and rose 246% in a short period of time. Typically, vertical rallies are followed by sharp declines and that’s what happens.

STX daily chart / Source: TradingView

STX daily chart / Source: TradingViewSTX fell to the 20-day EMA ($0.69) where it found buying support. The 50% Fibonacci retracement level at $0.67 is also close, so the bulls will try to keep the level alive. On the upside, the bears will try to sell the rallies in the region between $0.83 and $0.91. If the price turns down from this general zone, the sellers will try to deepen the correction again. If $0.67 is broken, the next support is $0.58, which is the 61.8% retracement level. Contrary to this assumption, if buyers push the price above $0.91, the altcoin could rally to $1.04. A break above this level will signal a possible resumption of the uptrend. The altcoin could then rally to $1.43.

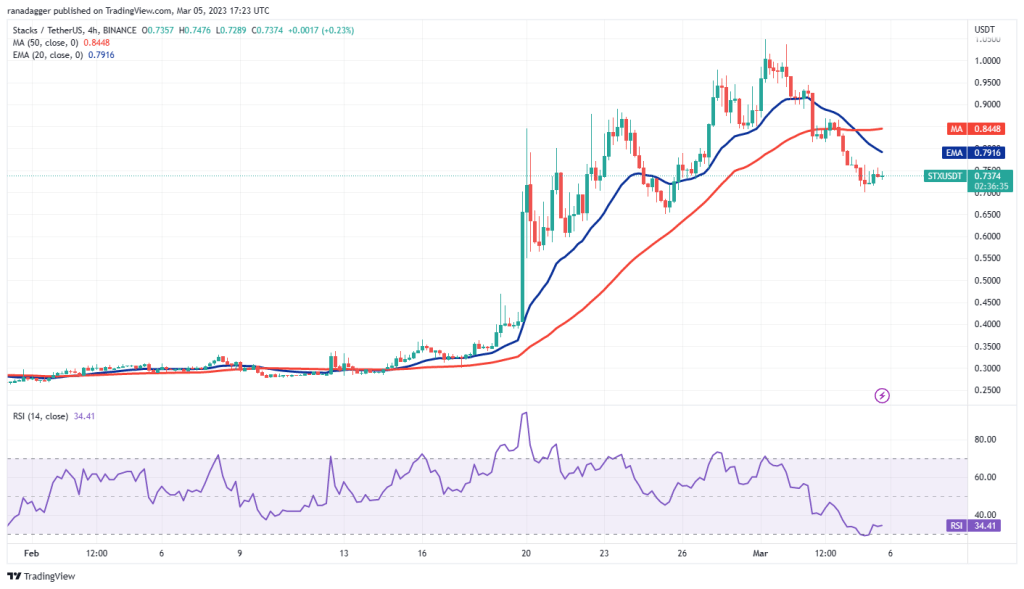

STX 4-hour chart / Source: TradingView

STX 4-hour chart / Source: TradingViewThe 4-hour chart shows that the 20-EMA is sloping down and the RSI is in the negative territory. This is a sign that the bears have a slight advantage. Sellers are likely to defend the moving averages during pullbacks. They will try to protect this place and lower the price to $0.65 and then $0.56. The bulls will try to fiercely defend this support zone. The first sign of strength would be a break and close above the 50-SMA. STX could then rally to $0.94 and then to $1.04.

ImmutableX (IMX): Solid demand at lower levels

IMX rebounded from the 50-day SMA ($0.88) on March 3 and closed above the 20-day EMA ($1), indicating solid demand at lower levels.

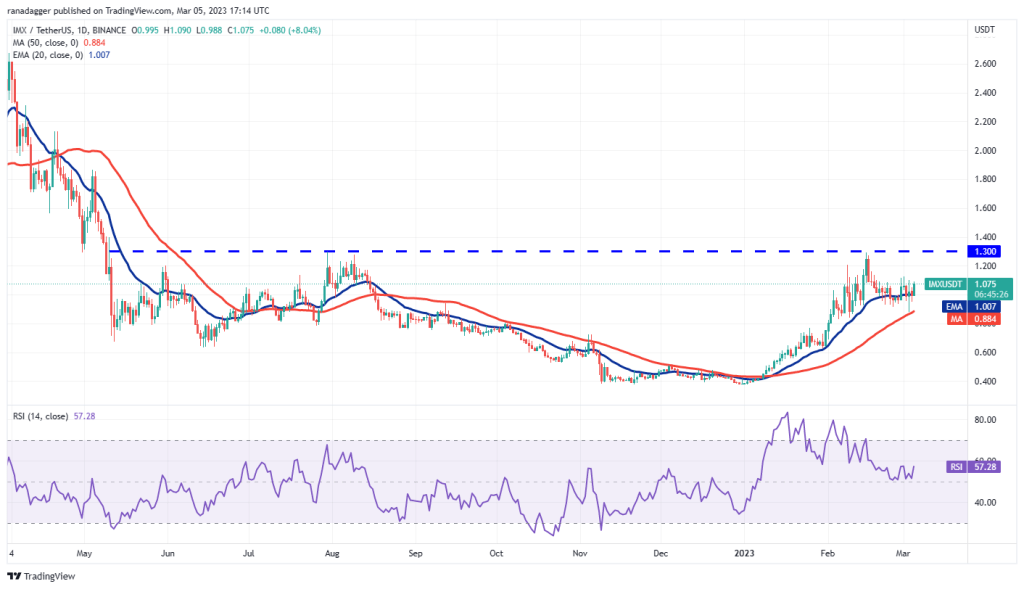

IMX daily chart / Source: TradingView

IMX daily chart / Source: TradingViewIMX could rally to $1.12 where the bears will try to stop a rebound. If buyers bulldoze, the altcoin could accelerate towards the stiff overhead resistance at $1.30. This is a very important level to consider. Because a break and close above it can signal the start of a new uptrend. IMX could rise to $1.85 later. On the contrary, if the price drops from the current level or $1.12, it will show that the bears have not given up yet. Sellers will try to push IMX back below the 50-day SMA and gain the upper hand. If they are successful, IMX could drop to $0.63.

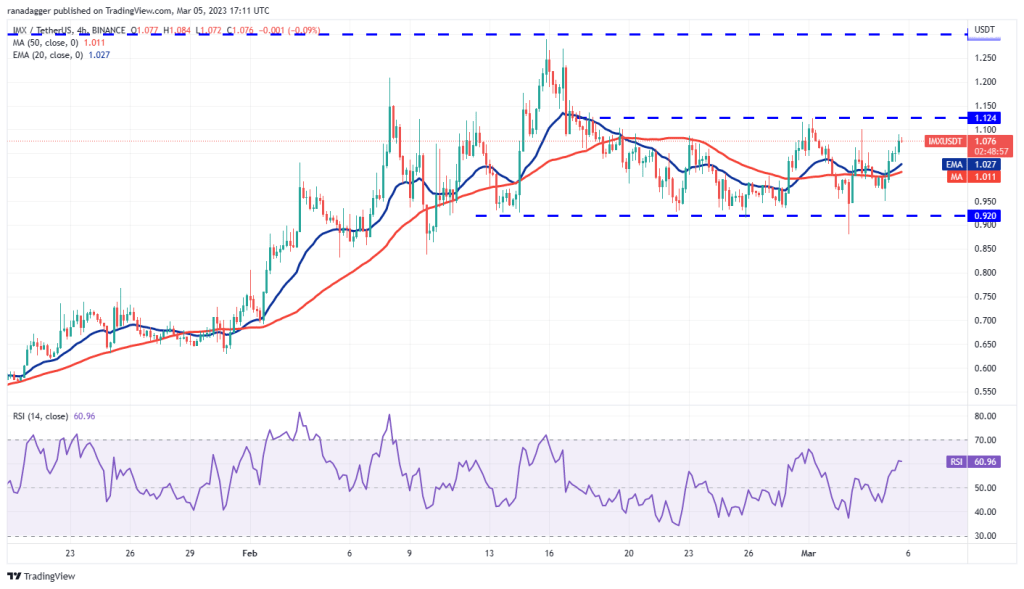

IMX 4-hour chart / Source: TradingView

IMX 4-hour chart / Source: TradingViewThe 4-hour chart shows the price fluctuating between $0.92 and $1.12. Usually, in a range, traders buy near support and sell near resistance. Price action within the range can be random and volatile. If the price rises above the resistance, it indicates that the bulls have beaten the bears. The altcoin could then rally towards $1.30. Conversely, if the bears pull the price below $0.92, IMX could turn negative in the near term. On the downside, support is at $0.83 followed by $0.73.

Maker (MKR): Drops are seen as a buying opportunity

After a short-term pullback, MKR is attempting to continue its upward move. This shows that sentiment remains positive and traders see the dips as a buying opportunity.

MKR/USDT daily chart. Source: TradingView

MKR/USDT daily chart. Source: TradingViewThe upward sloping moving averages and the RSI in the positive zone suggest the path of least resistance to the upside. If buyers hold the price above $963, MKR could start its journey towards the $1,150-$1,170 resistance zone. If the bears want to stop the uptrend, they will have to push the price below the 20-day EMA ($807). If they succeed, a few short-term traders’ stances may take a hit. The altcoin could then drop to the 50-day SMA ($731).

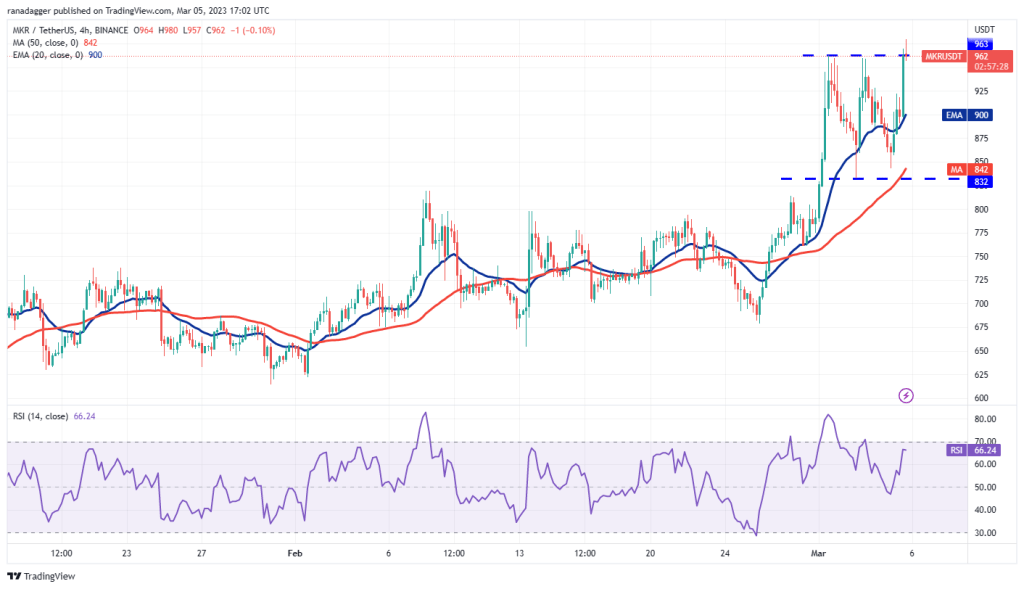

MKR 4-hour chart / Source: TradingView

MKR 4-hour chart / Source: TradingViewThe altcoin has been trading between $832 and $963 for a while, but the bulls are trying to push the price above the range. The 20-EMA has emerged and the RSI is in the positive zone, showing the bulls dominating. If the price stays above $963, MKR may attempt a recovery towards its target target of $1,094. On the other hand, if the price dips sharply below $963, it will indicate that this breakout could be a bull trap. This may prolong the consolidation for a while.