Gold price continues to rise at the highest levels of recent days. According to analysts, the dovish trend towards the Fed keeps the gold bulls hopeful. Analysts share their predictions about the route that gold will follow from now on.

Gold investors are waiting for this data

Market players are waiting for important inflation clues from the USA and the Eurozone. Gold price held steady at four-week highs in a four-day streak. However, the recent negative data from the US has increased the concerns about the Federal Reserve’s policy axis. Like this, cryptocoin.com As you follow, it was supportive for the gold price. Along the same lines, there are hopes of witnessing more incentives from key client China. However, the cautious mood ahead of high-level data and mixed activity figures from China gives hope to gold buyers.

Looking ahead, the Eurozone CPI and HICP figures for August will join risk catalysts to entertain gold investors. However, the biggest focus will be on the US Core Personal Consumption Expenditure (PCE) Price Index for August, which is expected to remain unchanged at 0.2% month-on-month, but to rise from 4.1% to 4.2% year-on-year. Should the US inflation gauge ease, gold buyers will look for softer cues from Nonfarm Payrolls (NFP) to confirm the Fed’s hawkish cycle is over. It is possible that this will increase the price of gold.

Gold f price for key levels to watch

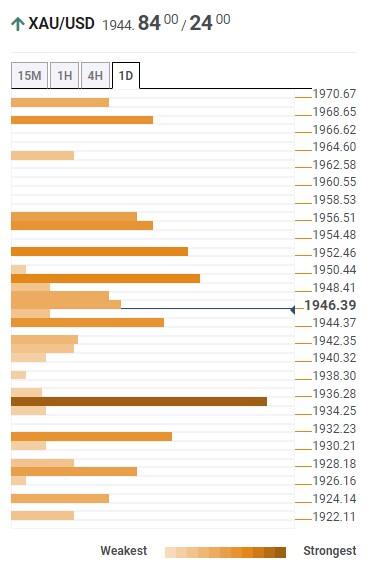

Market analyst Anil Panchal identifies key technical levels for gold via Technical Confluences Detector. The indicator shows that the gold price is fluctuating solidly beyond the $1,935-36 support confluence. It also points to more upside tracking. However, the key support cited consists of the one-day S1 Pivot Point and the one-month Fibonacci 61.8%. Also, the $1,930 level, which includes the 50-DMA and the Pivot Point one-week R1, is limiting the short-term downside of gold.

Following this, the Fibonacci 161.8% one-day convergence will join the Pivot Point S2 one-day, highlighting $1,925 as the last defense of gold buyers. On the other hand, the upper Bollinger band on the daily chart and the Pivot Point R1 one-day are limiting the Gold Price spike around $1,950. More importantly, the 100-DMA and Pivot Point one-day R2 are close to $1,957-58. So the gold bulls look like a hard nut to crack before the one-month Fibonacci run towards 23.6% surrounding $1,970. Overall, it has fewer barriers to the north for the gold price. However, it is possible that the US inflation data will test the bulls.

Technical Confluences Detector

Technical Confluences DetectorGold price forecast: Outlook is bullish in the short to medium term

Market analyst James Hyerczyk evaluates the market and technical outlook of gold as follows. Slowing economy and labor market indicators are compounded by the possibility of the Fed ending interest rate hikes. This usually bodes well for gold. Historically, low interest rates or expectations in this direction tend to increase the attractiveness of non-yielding assets such as gold.

Meanwhile, the holdings of SPDR Gold Trust, the world’s largest gold-backed ETF, have increased. This indicates that investors’ interest in the shiny metal has increased. In addition, it is possible that China’s shrinking production will further increase the attractiveness of gold as a safe haven. Taking these factors into account, the outlook for gold price is bullish in the short to medium term.

4-hour gold price chart

4-hour gold price chartThe current 4-hour price of 1944.88 is slightly below the previous price of 1945.83 dollars. The price is above both 1933.96, the 200-4H moving average, and 1916.66, the 50-4H moving average. This points to bullish momentum for the gold price. 14-4H RSI stands at 70.26. Hence, it indicates an overbought situation, which could mean a potential pullback or consolidation. Gold is trading near the main resistance area 1946.99 to 1954.88. Given these factors, current market sentiment is bullish. However, it is necessary to be careful due to the overbought RSI value.

The gold rise still has legs to go!

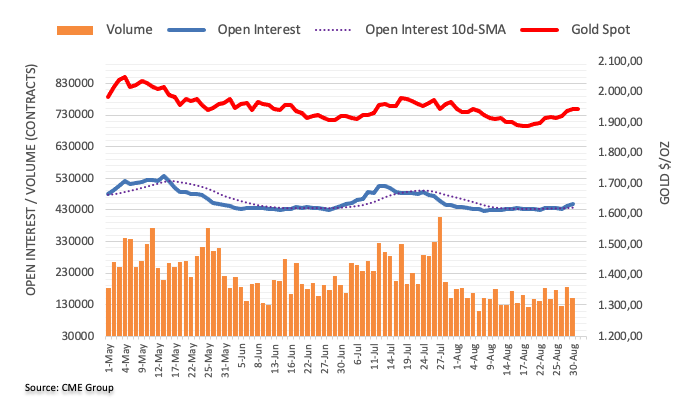

Considering the advanced data released by CME Group for the gold futures markets, the number of open interest increased by approximately 5.5 thousand contracts on Wednesday for the second session in a row. Volume, on the other hand, contracted by about 34.3 thousand contracts after the previous daily increase.

Gold price continued to recover for the third session in a row. Thus, it moved closer to the $1,950 region on Thursday. Market analyst Pablo Piovano states that the daily rise is due to the increase in open interest. According to the analyst, this is an indication that there will be extra gains in the very near term. However, the next target for gold is $1,987, the July high.