The non-farm payroll report released on Friday pointed to an increase in the unemployment rate. Also, the ISM Manufacturing Index showed continued weakness in the US industry. Following these developments, the gold price rose above 1.25% this week.

Bulls took the lead in gold surveys!

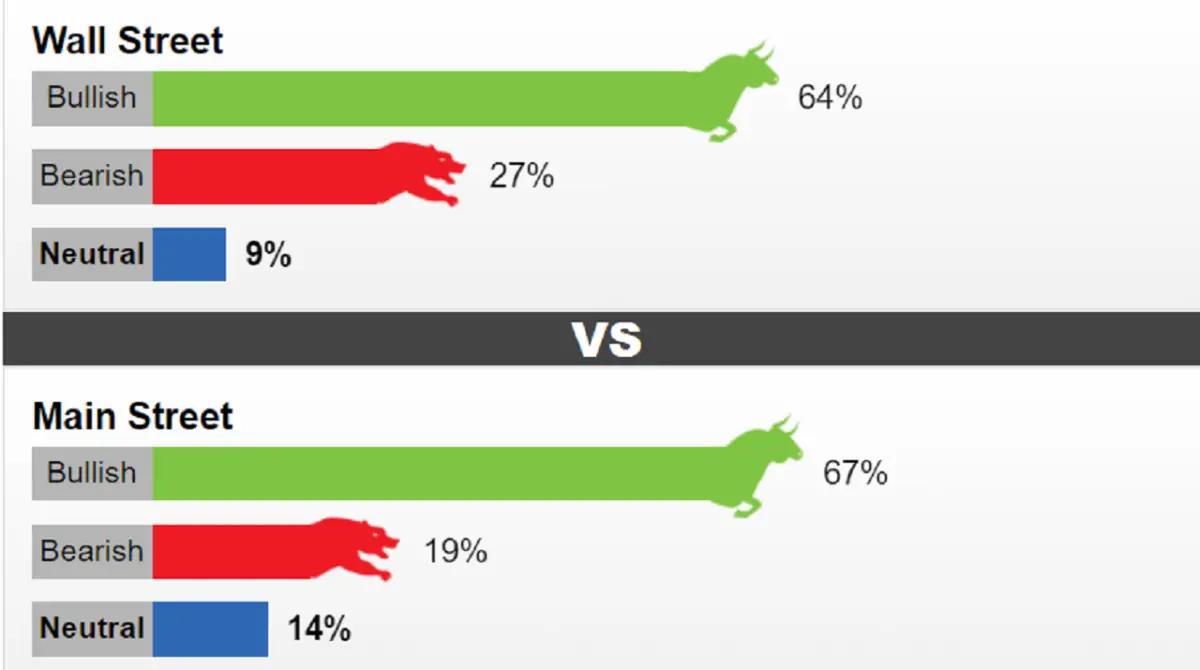

The latest Kitco Weekly Gold Survey shows that more than two-thirds of individual investors expect the price of gold to rise. After weeks of cautious and divided views, market analysts are almost as bullish as Main Street. This week, 11 Wall Street analysts voted in the Gold Price Poll. Seven analysts (64%) expect the gold price to rise next week. Three analysts (27%) predict prices will fall. Only one analyst (9%) remained neutral on gold for the week ahead.

Participants, meanwhile, cast 534 votes in online polls. 360 (67%) of the respondents think that gold will rise next week. Another 101 (19%) expect a decrease. The remaining 73 (14%) prefer to remain neutral in the near term. The latest survey shows that individual investors expect the gold price to trade around $1,962 next week.

Adrian Day: Trends are changing for gold price

Adrian Day, Head of Asset Management, predicts that gold will rise in the near term. In this context, Day makes the following assessment:

The trend for gold seems to be changing. Economic news in the US and other countries is mixed. But it mainly points to a weakening global economy. The market is already pricing in the end of interest rate hikes in the US. But the ‘longer firmer’ idea still stands.

Daniel Pavilonis predicts a lower trajectory

Daniel Pavilonis, Senior Commodity Broker at RJO Futures, thinks gold will hit a hard ceiling in the short term. According to Pavilonis, the gold price will actually continue to be capped below the highs. Therefore, the analyst predicts that it will likely continue to move lower. Based on this, Pavilonis makes the following comment:

The rationale behind this is that some data still comes out relatively strong. You look at basic services, non-residential services, there are some labor force indicators that are still pretty strong from an inflationary perspective. (…) I think inflation is starting to be ‘confirmed’ that this will continue for much longer. The Fed is unlikely to cut rates before the end of 2024. I think that’s what’s keeping the metals market from going any higher.

Marc Chandler: Gold price will continue to rise

cryptocoin.com As you follow, on the data agenda for the next week, August’s ISM Services PMI and unemployment applications will come to the fore. Marc Chandler, Bannockburn Global Forex Managing Director, expects gold to top out this week’s performance. Chandler explains the background of this expectation as follows:

I expect gold to rise again next week. Especially if it can close the week above the roughly $1950-53 area where I have a trendline from May and July highs. This is also a pullback target. US employment data will not change views on the US economy. Also, the labor market is becoming less tight. It was rejected again as the 2-year yield went above 5.0%. My next target for gold is $1,975-$85.

Sean Lusk gold price cautious about

Sean Lusk, Co-Director of Commercial Hedging at Walsh Trading, is still cautious about gold’s short-term prospects. However, he predicts a bearish trend next week due to the strength of DXY and the equity market and mixed messages from the data. In this context, Lusk shares the following assessment:

We traded at some support levels this week. But given the current situation, the jury is still out on whether there will be an ongoing rally next week. Higher stocks and higher dollar will mean lower gold price. In my view, this recent rebound in gold was due to the stock market being a bit over their heels. Therefore, there is a possibility of further pullback in metals if we continue in this environment. It will rise in the longer run. However, that doesn’t mean we can’t retest $1,900 on the downside.

Frank McGhee predicts gold will be in a downtrend

Frank McGhee, a Precious Metals Dealer at Alliance Financial, also thinks the gold price will start to trend down next week as concerns about the impact of the slowing economy and the Fed’s lack of any signs of a long-awaited pivot. Because the Fed’s “higher for longer” policy continues to apply pressure.

Adam Button: Fed center still in play, gold price going up!

Forexlive.com Chief Currency Analyst Adam Button says the pivot is in the game. “There is little chance for the Fed to raise rates in November,” Button said. But that will soon be priced in and the focus will shift to when the first rate cut will come. Gold will rise as this focus shifts.” makes the comment.

Jim Wyckoff: The bullish trend for gold has begun!

According to Kitco’s Jim Wyckoff, an uptrend is starting to form for the precious metal. “The gold price is rising steadily as it starts to rise on the daily bar chart,” Wyckoff says.