Χριστός Ανέστη! As a Greek-American, I’m celebrating Easter with my family a week later than most by roasting a full goat on a spit. You should try it at least once. It really is something else (the goat and the later Easter).

Given the holiday week, this newsletter will be a bit lighter on analysis than usual, but I have some interesting charts for you. Bitcoin’s price did relatively ok this week, and below I’ll take you through my thought process on evaluating the significance. This is how the sausage (or goat) is made.

– George Kaloudis

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Sunday.

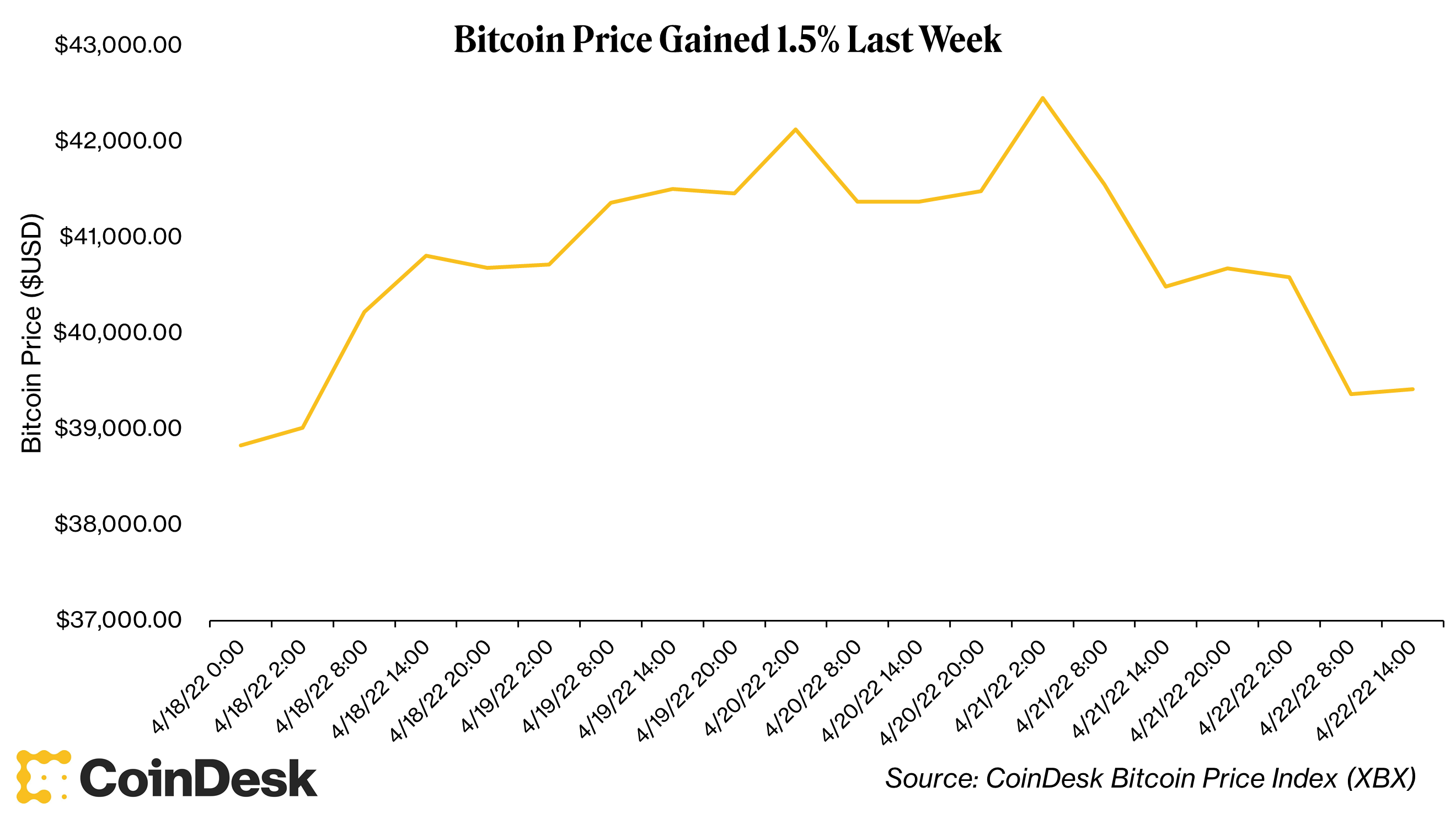

Bitcoin (BTC) put up solid numbers last week, gaining about 1.5% from Monday to Friday (I cut it at 2 p.m. EST, I was tired of watching bitcoin go from up almost 5% to only 1.5% on the week between Thursday night and Friday morning). Normally this type of move is only worth celebrating in the traditional markets.

But 2022 has been a year of a mostly uninspiring, range-bound existence for bitcoin (and it’s still in that $37,500 and $42,500 range). Let’s walk through the usual course of action I take to try and figure out what’s going on.

Weekly Price Performance of Bitcoin (CoinDesk Bitcoin Price Index [XBX])

After I see a movement in price, the next thing I do is check on market sentiment to get a feel of … well … feeling. There are two ways to do this, anecdotally and empirically. The anecdotal bit lives exclusively in my own head and is informed by the general “vibe” of my Twitter feed. The empirical bit is made up of the “Fear and Greed Index,” which aims to quantify how apprehensive or avaricious market participants are by looking at factors like volatility, volume, dominance and search engine trends. If investors are worried, the index flashes “fear” and if they’re excited (and dreaming of Lamborghinis), it flashes “greed.”

After this price movement, anecdotally, the sentiment on Twitter seemed good. People were excited about the modest run-up and weren’t really warning against anything. Empirically, the index showed “fear,” where it has been for most of April.

Fear & Green Index Showed Fear (https://alternative.me/crypto/fear-and-greed-index/)

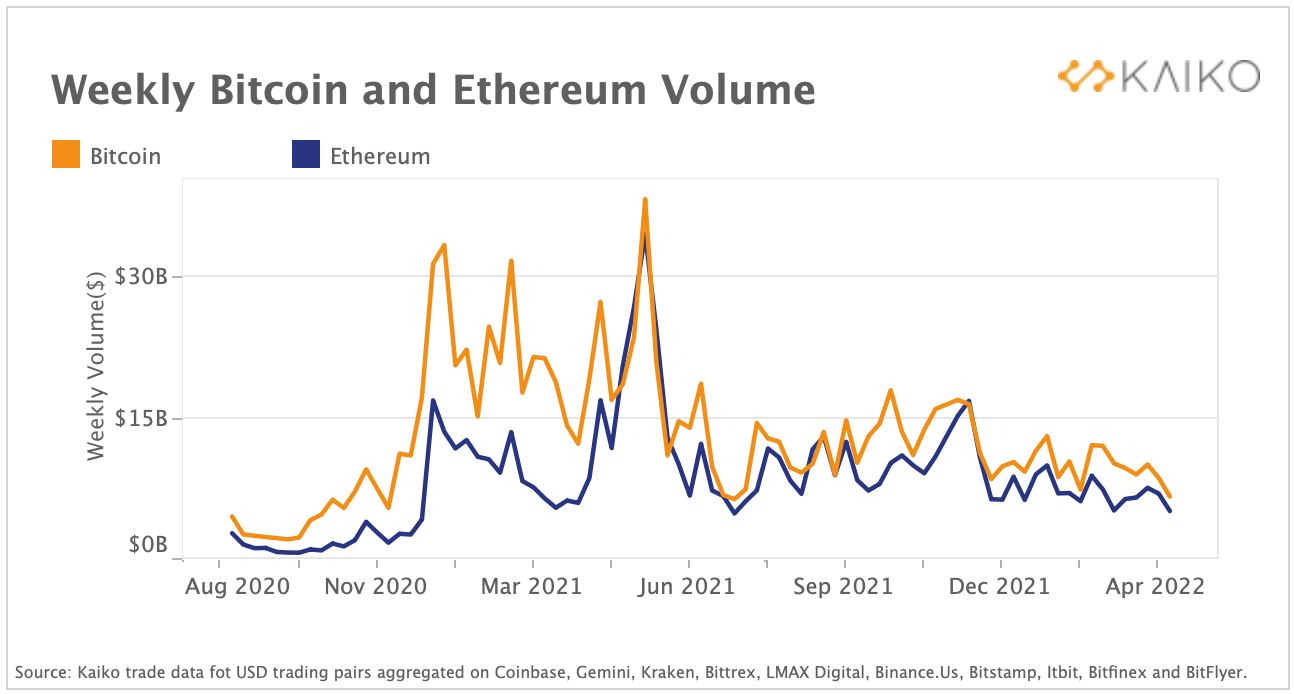

After I gauge sentiment, I look at various data feeds and look for an “interesting thing.” This week’s interesting thing happened to be about exchange volumes. According to data from Kaiko, weekly trade volume for bitcoin and ether (ETH) on major centralized exchanges fell to its lowest level since last summer’s short-lived crypto bear market. Looking at another highly traded cryptocurrency like ether in tandem acts as a gut check that it’s not something unique to bitcoin (now that would be another interesting thing).

Weekly bitcoin and ether volume (Kaiko)

Once I find an interesting thing (or things!) I try to figure out the “so what” to form a view and sound smart when my friends ask me why they’re losing or making money. I look to answer the question: Is this interesting thing something worth allocating headspace to or is it nothing to worry about?

On the surface, low trade volumes seem inauspicious, especially considering the last time they were this low was when bitcoin’s price dipped below $30,000. However, if we zoom out a tad, this looks like nothing out of the ordinary. It looks like the cyclical nature of markets and not some sort of mass exit from the market. A mass exit would, for the record, require a jump in volume as those participants unload their positions. Right now, I’m not worried. Maybe I’ll start worrying if exchange volumes fall even more.

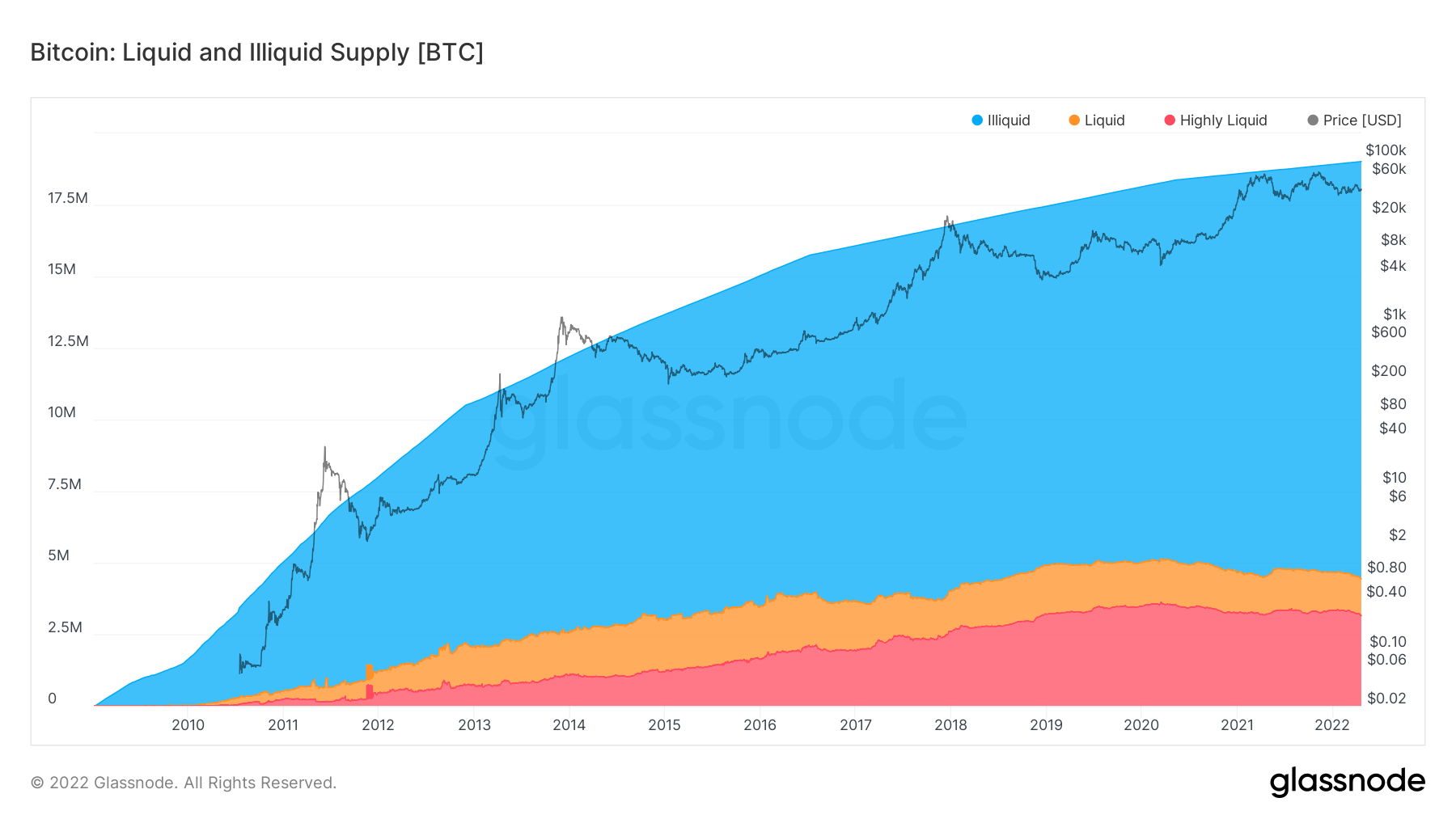

The last thing I do after having my opinion formed on the latest “interesting thing,” I zoom all the way out and check out one of my favorite charts that calms me as a bitcoiner. That chart shows the illiquid supply alongside the liquid and highly liquid supply of bitcoin. Illiquid supply represents the amount of bitcoin that hasn’t moved or been sold in a while. The chart largely speaks for itself. There’s a lot of illiquid supply out there and it has been growing.

BTC Liquid and Illiquid Supply (Glassnode)

The holders are holding. Zoom out. Think longer.

Save a Seat Now

BTC$39,844.17

BTC$39,844.17

0.31%

ETH$2,953.14

ETH$2,953.14

0.33%

XRP$0.707089

XRP$0.707089

0.78%

LUNA$90.53

LUNA$90.53

0.46%

SOL$100.96

SOL$100.96

0.63%

View All Prices

Layer 2