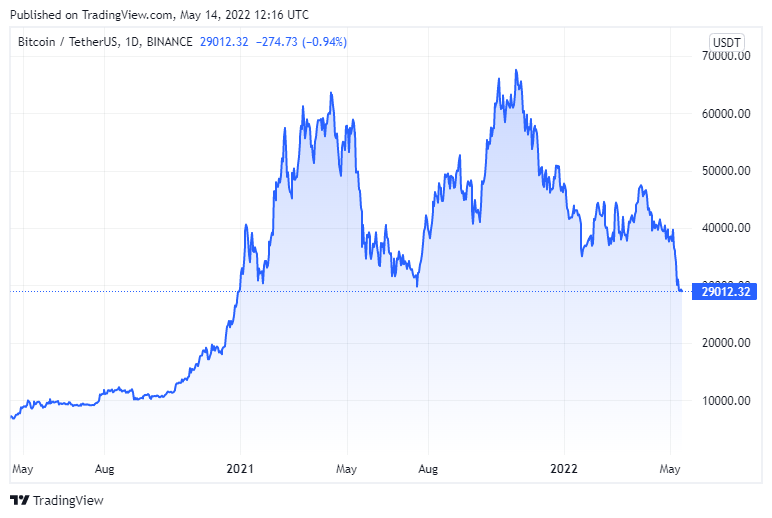

Investors are hopeful that Bitcoin can stage a relief rally in the $30,000 to $35,000 range, but selling at resistance could still keep BTC, DOGE, ADA and the market overall in a strong bear trend.

DOGE, ADA and ETH hit their lowest levels in recent months

Bitcoin (BTC) rebounded sharply after the drop to $24,000 on May 12, and some bulls’ lows showed that he opposed the herd and bought the fall. Currency balances fell by more than 24,335 Bitcoins on May 11 and 12, according to on-chain analytics platform CryptoQuant, which may indicate that the bulls have begun their hunt for the bottom.

However, macro investor Raoul Pal is unsure whether a bottom has been found. In a recent interview, Pal said that if the stock markets witness a capitulation phase, the crypto markets are also likely to experience additional declines before forming a bottom. He expects the current bear phase to end after the Fed halts rate hikes.

Bear markets are known for sharp helping rallies that are used to lighten longs or start shorts. The price eventually turns down and makes a new low. Bottoms are only confirmed in hindsight. For this reason, investors may consider saving in stages during a bear market rather than putting everything together. Investors currently want to know what key overhead levels can act as resistance. Let’s continue with analyst Rakesh Upadhyay’s current technical analysis to answer…

Weekly altcoin price analysis

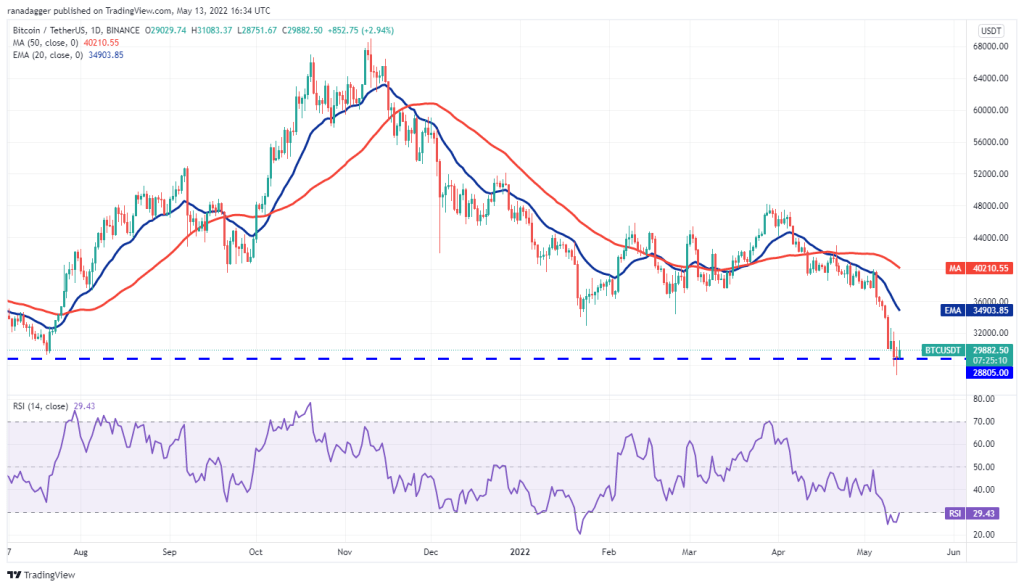

Bitcoin (BTC)

Bitcoin bounced off $26,700 on May 12, forming a candlestick pattern. According to the analyst, it indicates that selling pressure may decrease. The recovery picked up pace on May 13 and the bulls pushed the price above the psychological level at $30,000.

The relief rally may face resistance around $33,000 and again at the 20-day EMA ($34,903). If the price breaks down from the overhead resistance, the bears will make another attempt to sink the BTC/USDT pair below $26,700 and resume the downtrend. If they manage to do so, the sell-off could accelerate and the pair could drop to $25,000 and later to $21,800. Contrary to this assumption, if the bulls stop the next drop above $28,805, it will suggest accumulation on the dips. This could increase the probability of a break above the 20-day EMA. If this happens, bitcoin price could rally to $40,210.

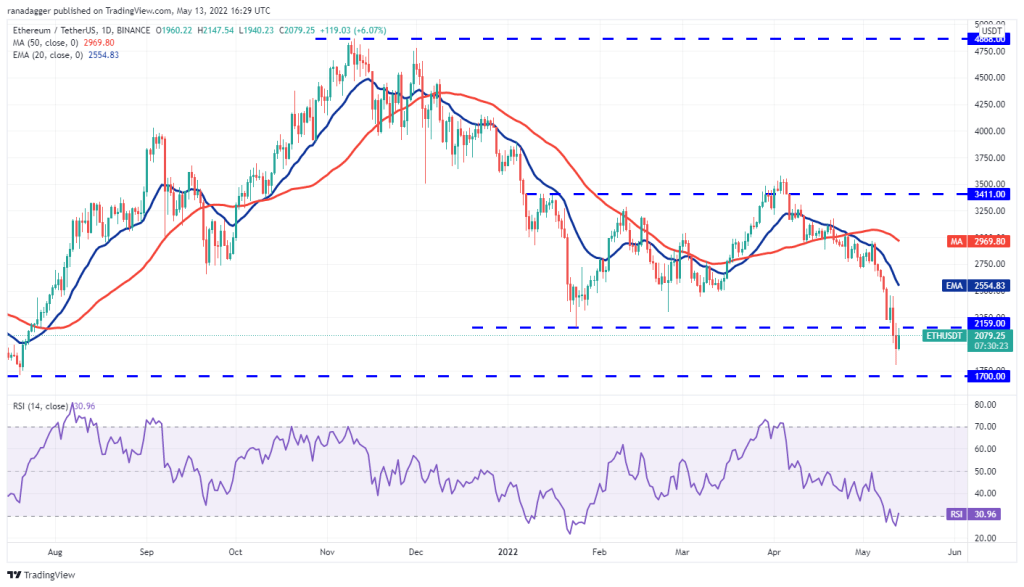

Ethereum (ETH)

Ethereum (ETH) dropped below the $2,159 support on May 11 and then dropped below the psychological level of $2,000 on May 12. The bulls took the dip to $1,800 which started a relief rally.

Buyers will now try to push the price above the breakout level at $2,159. If they are successful, the ETH/USDT pair could gain momentum and rise to the 20-day EMA ($2,554). This is an important level to dwell on because a break and close above it indicates that the bearish is coming to an end. Contrary to this assumption, if the price drops from the current level or the 20-day EMA, it will indicate that the sentiment will remain negative and traders are selling close to the general resistance levels. The bears will then try to push the pair back below $1,700.

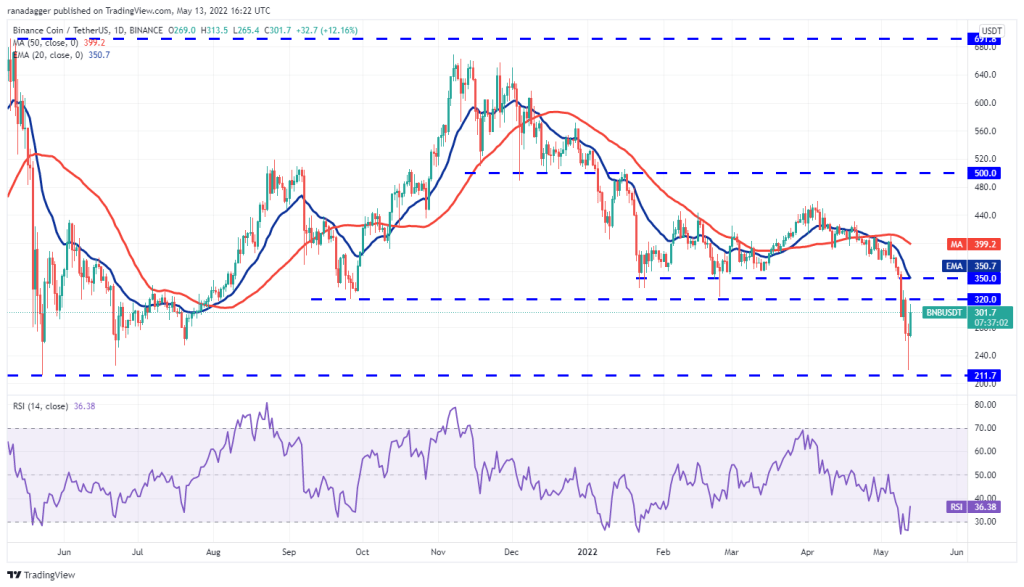

BNB Coin (BNB)

BNB dropped sharply on May 12 but the long wick on the candlestick of the day shows that the bulls are aggressively defending the critical support at $211. This started a relief rally reaching the $350 to $320 resistance zone.

If the bulls propel the price above $350, it indicates that the decline may be over. Recovery could reach $413 later. Such a move could indicate that the BNB/USDT pair could be stuck in a wide range between $211 and $692. Contrary to this assumption, if the price breaks out of the overhead resistance zone, it will indicate that the bears are active at higher levels. The price could then gradually decline to the critical $211 support. The bears will need to push the price below this level to start a new downtrend that could reach $175 and then $150.

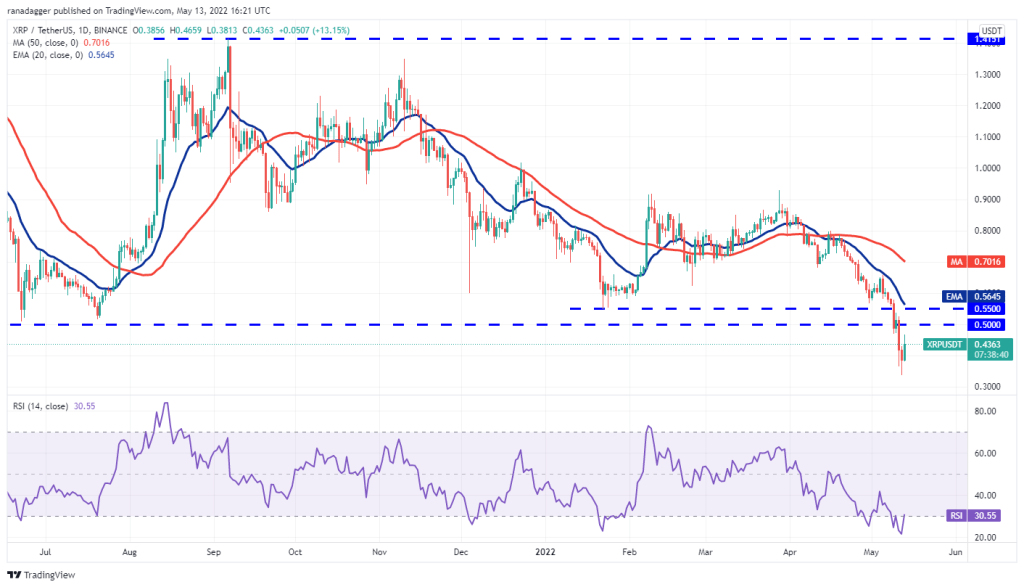

XRP (XRP)

Ripple (XRP) price was 0 on May 12 when the buyout occurred, as we have covered in the analysis of Cryptokoin.com . It fell to $.33. The bulls are attempting a recovery that is likely to face stiff resistance at the psychological level at $0.50.

If the price drops from $0.50, the bears will again try to pull the XRP/USDT pair to $0.33. This is an important level for the bulls to defend as a break below it could result in a drop to $0.24. Conversely, if buyers push the price above $0.50, the pair could rally to the 20-day EMA ($0.56). A break and close above this level will indicate that the bulls are back in the game. XRP could then rise to the 50-day SMA ($0.70).

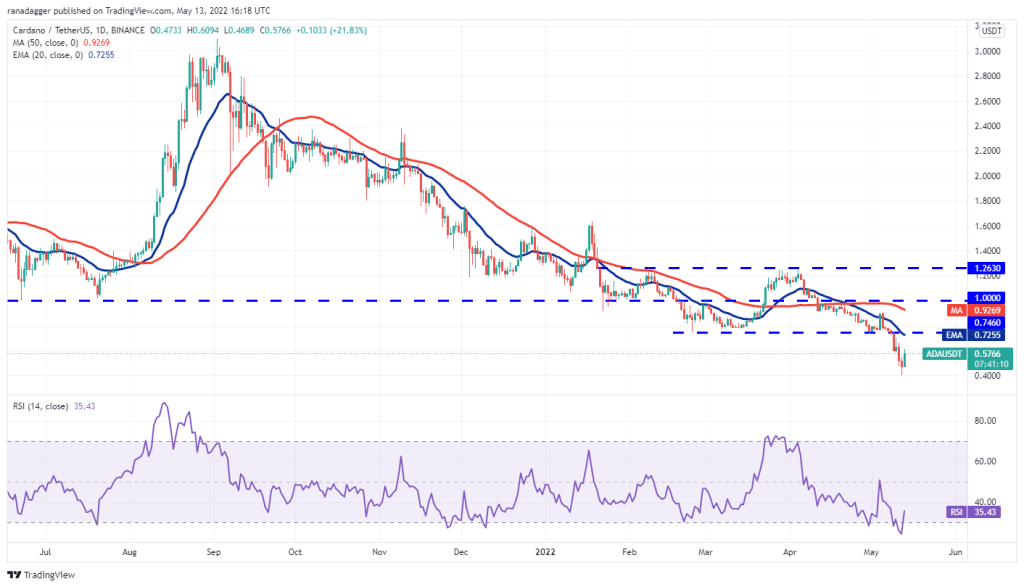

Cardano (ADA)

Cardano (ADA) dropped to $0.40 on May 12, which dragged the RSI into the oversold zone. Buyers bought this drop and are trying to start a relief rally.

ADA/USDT could rally to the breakout level at $0.74, which is an important level to consider. If the price drops from this resistance, it will show that the bears have not given up yet and are selling on the rallies. ADA could retest strong support at $0.40 later. Contrary to this assumption, if the bulls push the price above $0.74, it will indicate that the bears may be losing control. The pair could then rise to the psychological level of $1, where the bears are expected to put up a strong defense again.

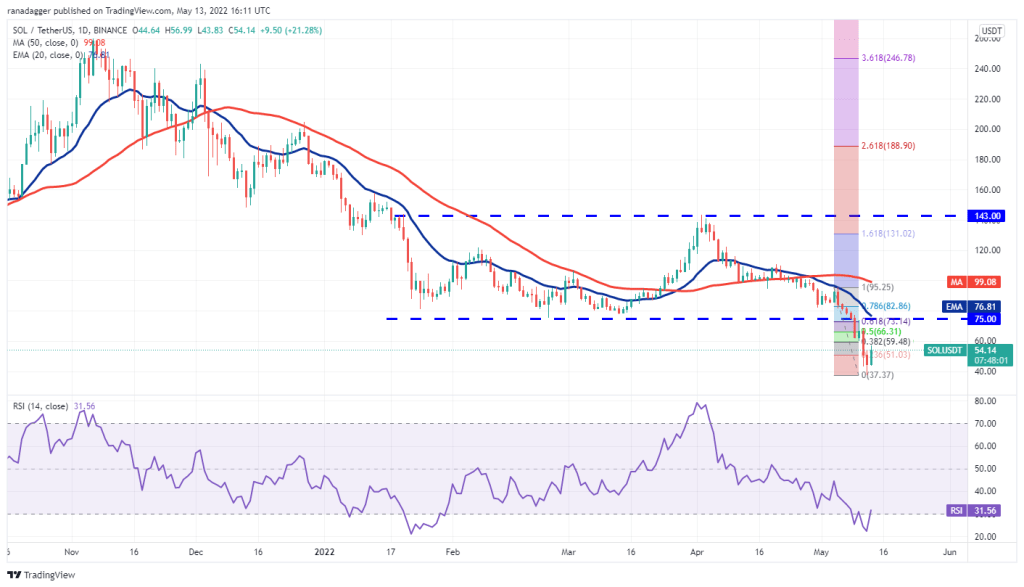

Solana (SOL)

Solana (SOL) has been in a strong downtrend for the past few days. The price dropped to $37 on May 12, which dragged the RSI into the oversold zone. This started a charity rally on May 13.

The bulls are likely to face selling in the region between the 38.2% Fibonacci retracement level of $59 and the 50% retracement level of $66. If the price drops from this zone, the bears will try to continue the downtrend by pushing the SOL price below $37. If they manage to do so, the SOL/USDT pair could drop to $32. Contrary to this assumption, if the price rises above $66, the recovery could extend to the breakout level of $75. The bulls will have to break through this hurdle to signal the end of the downtrend.

Dogecoin (DOGE)

Dogecoin (DOGE) dropped to $0.06 on May 12 but a small positive is that the bulls are buying this drop. This started a relief rally approaching the breakout level at $0.10.

The long wick on the May 13 candlestick indicates that the bears are aggressively defending the $10 level. If the price breaks down from this resistance, the bears will try to continue the downtrend by pulling the DOGE/USDT pair below $0.06. If they do, the next stop for DOGE could be $0.04. Alternatively, if the bulls push the price above $0.10, the pair could rally to the 20-day EMA ($0.12). This is an important level to focus on because a break and close above it could indicate the start of a stronger recovery.

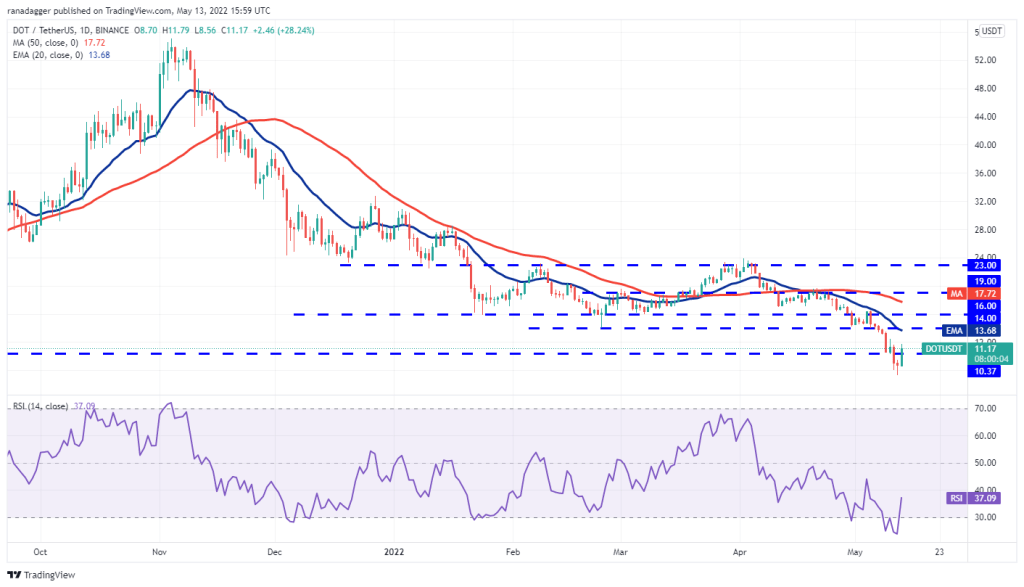

Polkadot (DOT)

Just like DOGE, Polkadot (DOT) has been in a downtrend for the past few days. Buyers stepped in to stop the decline near the strong support at $7 on May 12 as seen from the long wick on the day’s candlestick.

Buyers will now try to keep the price above the breakout level at $10.37. If they are successful, the DOT/USDT pair could rise to the 20-day EMA ($13.68). This level is likely to attract strong selling by the bears. If the next drop stops at $10.37, it will indicate that the downtrend may have weakened. Conversely, if the price drops sharply from the current level or the 20-day EMA, it will increase the probability of a retest at $7. Below this level, the decline could extend to $5.

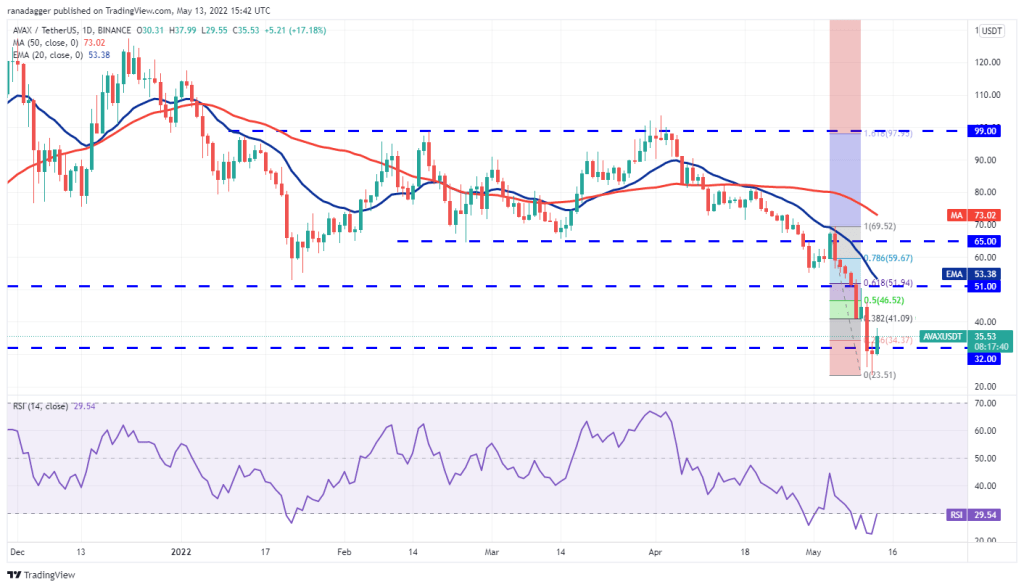

Avalanche (AVAX)

Avalanche (AVAX) dropped below critical support at $32 on May 11 and the bears tried to continue the decline on May 12. However, the long wick on the day’s candlestick indicates strong buying at the lower levels.

The bulls pushed the price above the breakout level at $32, the first sign of strength. If the AVAX/USDT pair stays above $32, the bulls will attempt to push the price towards the overhead resistance at $51. Bears are expected to fiercely defend this level. Alternatively, if the price drops from the 38.2% Fibonacci retracement level to $41.09, it will indicate that the sentiment remains negative and the bears are selling on the rallies. The pair could later retest strong support at $32 and later at $23.

Shiba Inu (SHIB)

Shiba Inu (SHIB) dropped below the psychological level of $0.000010 on May 12, but the long wick on the day’s candlestick is lower. Recommends buying at higher levels. This resulted in a rebound on 13 May.

SHIB/USDT pair could rally to the $0.0017 breakout level, which is likely to attract strong selling by the bears. If the price drops, the bears will make another attempt to break and sustain the pair below $0.0000010. Conversely, if the bulls push the price above $0.000017 and the 20-day EMA ($0.00018), it indicates that the markets are rejecting the lower levels. The price could then rise to the 50-day SMA ($0.0000023).