According to crypto analyst Rakesh Upadhyay, the recovery in Bitcoin and altcoins is being faced with selling at higher levels, indicating that the overall sentiment remains negative. Will Bitcoin turn down and retest important support? Could Bitcoin’s weakness trigger further selling in altcoins including DOGE? The analyst examines the charts of the top 10 cryptocurrencies to find out.

An overview of the cryptocurrency market

cryptokoin.com As you follow from , Bitcoin has been stuck in a wide range since April. This indicates indecision about the next directional move. The bears’ efforts to push the price below the range support were thwarted by the bulls on September 11. However, Bitcoin is not out of danger yet. According to Jamie Coutts, a Bloomberg market analyst, if the tightening cycle drags on, followed by “a rise in unemployment and more stress in the banking sector, there could be some more pain for risk assets like Bitcoin.”

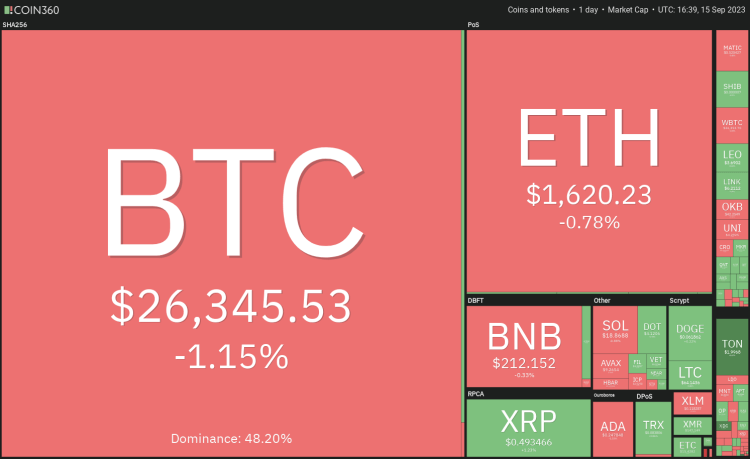

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360Cryptocurrency investors continue to be cautious. A Bitfinex report shows that the crypto sector witnessed capital outflows of $55 billion in August. The decline in liquidity caused individual events to “have a greater impact on market movements,” according to the report.

BTC, ETH, BNB, XRP And ISLAND analysis

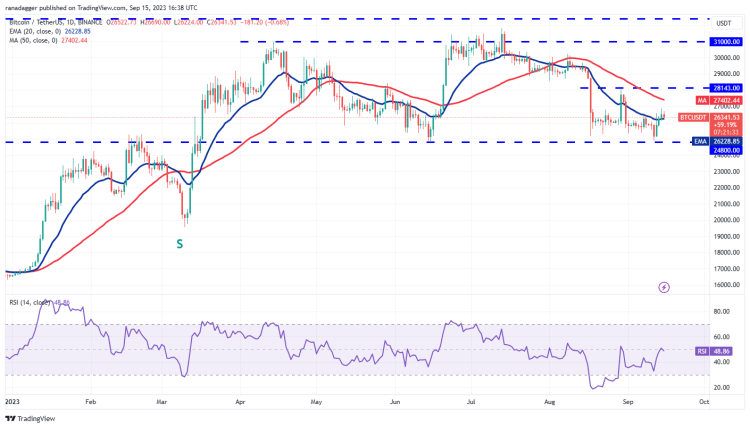

Bitcoin (BTC) price analysis

Bitcoin broke and closed above the 20-day exponential moving average (EMA) of $26,228 on September 14. This shows that the downward momentum is weakening.

The 20-day EMA is flattening and the relative strength index (RSI) is near the midpoint. This signals that BTC will remain between $ 24,800 and $ 28,143 for a while. If the bears want to make a comeback, they will need to pull the price below the 20-day EMA quickly. Such a move would indicate that higher levels have been sold. This could result in a retest of the strong $24,800 support.

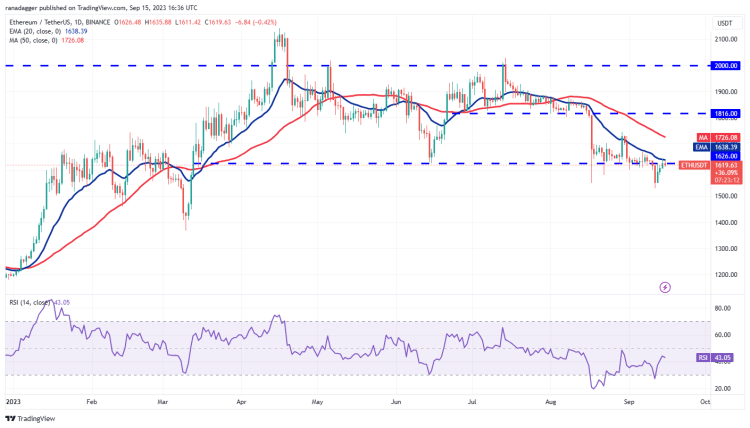

Ethereum (ETH) price analysis

Ether broke below the $1,550 support on September 11. However, the bears could not build on this strength. This suggests solid buying at lower levels. The bulls then started a recovery reaching the 20-day EMA ($1,638). This level is likely to witness a tough struggle between bulls and bears.

A breakout and a close above the 20-day EMA could trap a few aggressive bears and result in a short squeeze. It is possible that this could increase the price to $1,745. Instead, if the price turns down from the 20-day EMA, it will indicate that the bears remain in command. Sellers will then make another attempt to push ETH below $1,550 and continue the downtrend.

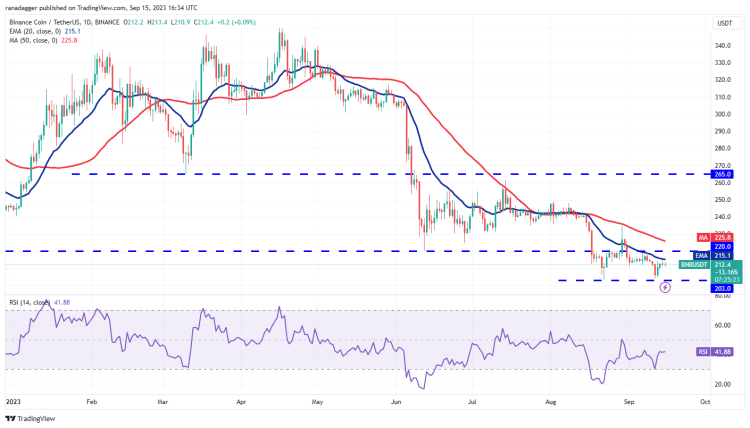

Binance Coin (BNB) price analysis

BNB bounced from psychological support near $200 on September 12. Thus, it showed that the bulls were active at lower levels.

The recovery has reached the 20-day EMA ($215), which is an important level to pay attention to. If BNB turns down from the current level, this would indicate that sentiment remains negative and traders are selling on relief rallies. This will increase the risk of a drop below $200. On the contrary, if the RSI forms a positive divergence, this indicates that the selling pressure will decrease. A rise above the 20-day EMA is likely to open the doors for a retest of the 50-day simple moving average (SMA) at $225.

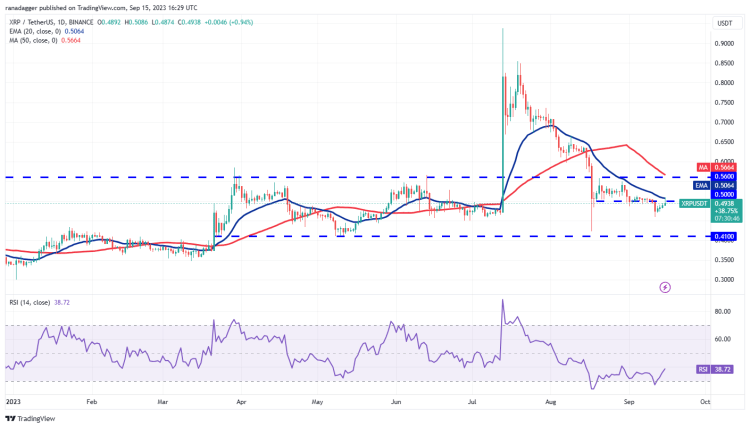

Ripple (XRP) price analysis

XRP has been trading between $0.41 and $0.56 for the last few days. The price has risen to the 20-day EMA ($0.50), which is an important level to keep an eye on. If buyers push the price above the 20-day EMA, this will indicate that the selling pressure is easing. It is possible that this could initiate a sustained recovery towards the overhead resistance at $0.56.

This level is likely to act as a roadblock again. If the price turns down from $0.56, it will indicate that the range-bound movement will continue for a while. The next trend move is likely to begin after the bulls push the price above $0.56 or the bears sink XRP below $0.41.

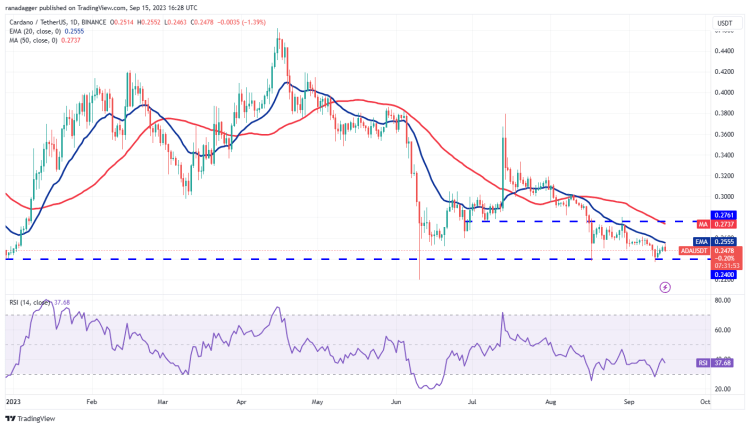

Cardano (ADA) price analysis

Strong selling in Cardano pushed the price down to $0.24 on September 11. However, the bears could not break the critical support. The recovery started at $0.24 on September 12 and reached the 20-day EMA ($0.26) on September 15. This level is likely to witness a struggle between buyers and sellers.

If the ADA turns sharply lower from the 20-day EMA, it will indicate that every small rise has been sold. It is possible that this increases the risk of a drop to $0.22. Conversely, if buyers push the price above the 20-day EMA, it will signal the beginning of a stronger recovery to $0.28.

DOGE, SOL, TON, DOT and MATIC analysis

Dogecoin (DOGE) price analysis

DOGE is trading between the 20-day EMA ($0.06) and solid support at $0.06. This narrow range trade is unlikely to continue for long. Therefore, a breakout may occur soon.

If buyers push the DOGE price above the 20-day EMA, this will indicate that the sellers are losing control. This could initiate a relief rally towards the 50-day SMA ($0.07), where DOGE bears are expected to intensify the selling. Contrary to this assumption, if DOGE price declines sharply from the 20-day EMA, it will increase the chances of a break below $0.06. If it breaks this support, it is possible for DOGE price to drop to $0.055.

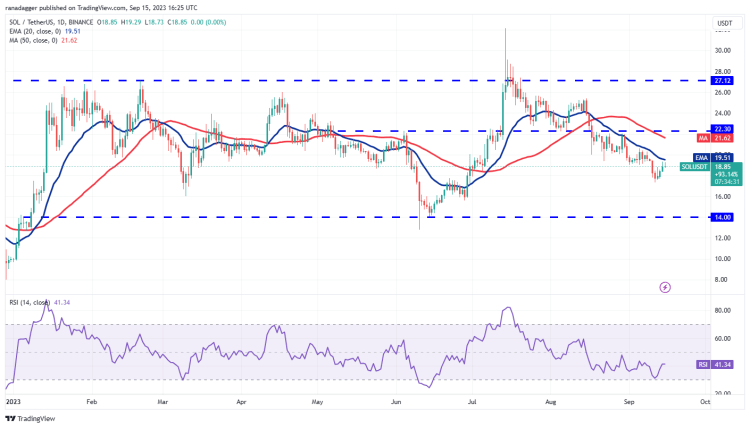

Solana (SOL) price analysis

SOL has been floating between $14 and $27.12 for the last few months. The price has reached the 20-day EMA ($19.51), where the bears will likely pose a stiff challenge. If buyers push the price above the 20-day EMA, SOL is likely to reach the overhead resistance at $22.30. It is possible that this level will again act as a strong obstacle.

But if the bulls overcome this, SOL is likely to rise to $27.12. Conversely, if the price turns down from the 20-day EMA, it will indicate that demand is drying up at higher levels. The bears will then try to continue the downtrend. Thus, it will pull the price towards the vital support of $14.

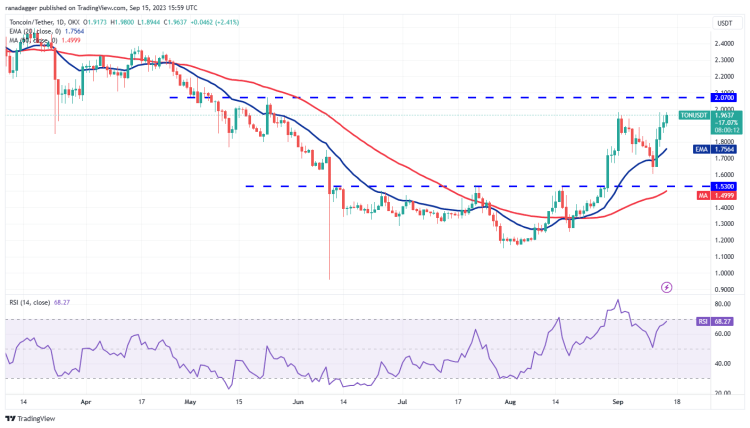

Toncoin (TON) price analysis

Toncoin (TON) bounced back from the 20-day EMA ($1.75) on September 12. This shows that the bulls see the declines as a buying opportunity. The price reached the first resistance at $1.98 on September 13, where the bears tried to stop the upward move. A small advantage in favor of the bulls is that they have not given up ground to the bears. This shows that the bulls are in no rush to take profits as they expect the upward move to continue.

If it surpasses the $1.98 level, it is possible for TON to reach $2.07. This is an important level for the bears’ defense. Because a move above is likely to push TON to $2.40. On the downside, falling below the 20-day EMA will turn the advantage in favor of the bears.

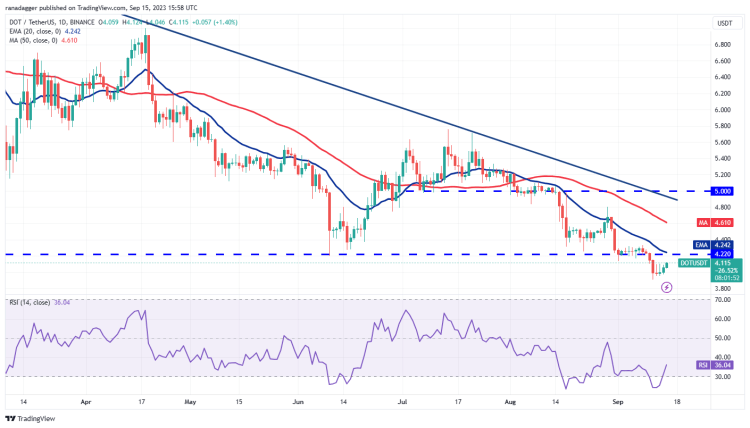

Polkadot (DOT) price analysis

DOT has been trading below the $4.22 breakout level for the last few days. This is also a negative sign. Bulls are trying to start a relief rally. However, this is likely to face a strong sell-off at $4.22.

If the price turns down from overhead resistance, it will indicate that the bears remain in control. Sellers will then try to push DOT below $3.90. If they are successful, DOT is likely to fall as low as $3.44. If the bulls want to prevent a decline, they will need to push the price above $4.22 and sustain it. If they do this, it will indicate that markets are rejecting the malfunction. It is possible that DOT may later try to rise to the 50-day SMA ($4.61).

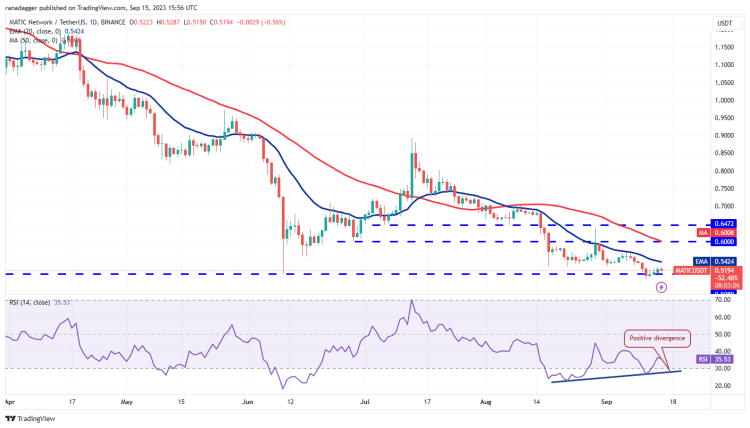

Polygon (MATIC) price analysis

MATIC fell below the critical support at $0.51 on September 11. However, the bears could not maintain the selling pressure. This started a recovery approaching the 20-day EMA ($0.54). The bears will try to stop the recovery at the 20-day EMA and push the price below $0.50. If they manage to do this, it will signal the resumption of the downtrend.

It is possible for MATIC to drop as low as $0.45 later. Falling moving averages indicate an advantage for the bears. However, the positive divergence in the RSI indicates that the bearish momentum is slowing down. If buyers break the hurdle at the 20-day EMA, MATIC is likely to rise to $0.60.