Certain altcoins like Bitcoin and SOL look strong at the beginning of October. But will the sudden upward momentum continue? What are the important overhead resistance levels in Bitcoin and altcoins that could attract sellers? Crypto analyst Rakesh Upadhyay examines the charts to find out.

An overview of the cryptocurrency market

Lawmakers in the US House and Senate reached a tentative agreement on September 30. Thus, they prevented the government from shutting down for 45 days. This news may have served as a catalyst for Bitcoin’s sharp rally on October 1. It’s also possible that Bitcoin’s historically strong performance in October has further boosted sentiment.

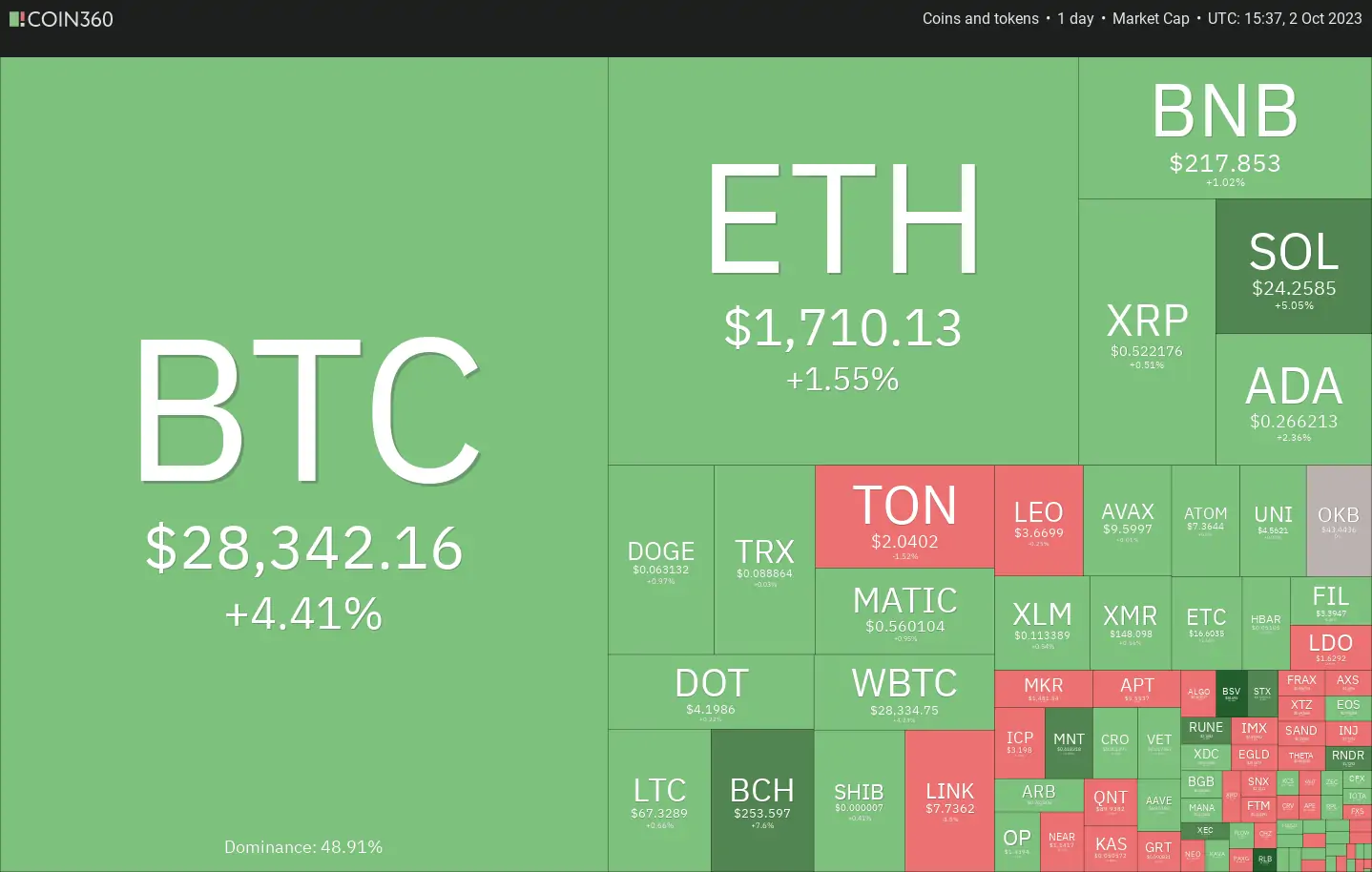

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360A short-term rise in cryptocurrency markets is possible. However, this is unlikely to spark a runaway rally. The rapid rise of the US dollar index (DXY) keeps the bulls on their toes. Therefore, higher levels are likely to witness profit bookings.

BTC, ETH, BNB and XRP analysis

Bitcoin (BTC) price analysis

Bitcoin broke above the immediate resistance of $27,500 on October 1. It then continued the rally above $28,143 on October 2. The easy conquest of $28,143 shows there is more to come. The bulls will try to push the price towards $31,000. They are likely to face solid resistance from the bears here.

If the price declines sharply from this level, it would indicate that BTC remains stuck in the wide range between $31,000 and $24,800. An initial support on the downside is $28,143 followed by the 20-day EMA ($26,862). If the price declines below $28,143, it is likely to trap the aggressive bulls. It is possible that this will then pull the price back to the 20-day EMA. Sellers will have to push the price below this level if they want to gain control.

Ethereum (ETH) price analysis

Ether broke through the 50-day SMA ($1,652) on September 29. She then followed this with another sharp rally on October 1. This pushed the price towards the overhead resistance at $1,746.

The 20-day EMA ($1,644) has turned up and the relative strength index (RSI) is above the 64 level. This shows that the bulls are in command. Moreover, it increases the chances of a rally above $1,746. If this happens, ETH will complete the double bottom formation. The target target of this formation is $1,959. Sellers will make every effort to stop the recovery at $1,746. They will need to pull the price back below the moving averages to weaken the positive momentum. It is possible that ETH will then extend its stay in the range for a while longer.

Binance Coin (BNB) price analysis

BNB turned down from the 50-day SMA ($216) on September 29 and 30. However, it found support at the 20-day EMA ($214). This indicates positive sentiment, with dips being bought.

The moving averages are on the verge of a bull crossover and the RSI is in positive territory. This shows that the bulls have an advantage. A breakout and a close above $220 will indicate the beginning of a new uptrend. BNB is likely to rise first to $235 and then to $250. Contrary to this assumption, if the price turns down from $220, the bears will try to sink BNB below the 20-day EMA again. If they are successful, this would indicate that consolidation could extend for a few more days.

Ripple (XRP) price analysis

XRP broke out above the symmetrical triangle formation on September 29. Thus, the bulls retested the breakout level on September 30. This shows that the bulls are back in the game.

Buyers will then try to pull the price towards the overhead resistance of $0.56. This is an important level to consider. Because a rally above it could indicate the beginning of a new uptrend towards the $0.64 pattern target. On the other hand, if the price turns down from $0.56, it will indicate that the bears have not given up and continue to sell in rallies. It is possible that this will keep XRP in the range between $ 0.41 and $ 0.56 for a while.

SOL, ADA, DOGE and TON analysis

Solana (SOL) price analysis

SOL broke above the overhead resistance at $22.30 on October 1. Thus, it showed that the bulls were making a comeback. The sharp upward movement in SOL price has pushed the RSI into the overbought area. This suggests that the SOL rally will likely encounter resistance soon.

The bears will try to stop the recovery at $25.50 and then again at $27.12. If SOL price turns down from this level, it would indicate that the $14 to $27.12 range remains intact. The important support to watch on the downside is the 20-day EMA ($20.50). Sellers will need to push the SOL price below this level to weaken the upward momentum.

Cardano (ADA) price analysis

Cardano broke above the downtrend line and the 50-day SMA ($0.25) on October 1. Thus, it invalidated the developing descending bearish triangle formation. In general, the failure of a downtrend is a positive sign. Because the bulls on the sidelines jump in to buy. However, before that the price may turn down and retest the breakout level.

If the level holds, it will indicate that the bulls have turned the downtrend line into support. It is possible that ADA will then start rising to $0.29 and then to $0.32. Conversely, if the price falls and re-enters the triangle, it will indicate that the markets have rejected higher levels. It is possible that ADA could later retest the important support at $0.24.

Dogecoin (DOGE) price analysis

Dogecoin broke above the 20-day EMA ($0.06) on September 29. Thus, it reached the 50-day SMA ($0.06) on October 1. This indicates that the bulls are trying to initiate an upward move.

The 20-day EMA is trending sideways but the RSI has jumped into positive territory. This shows that the momentum has turned positive. A close above the 50-day SMA would open the doors for a possible rally to $0.07. It is possible for this level to act as a minor obstacle. However, if it exceeds it, DOGE is likely to rise to $0.08. Time is running out for the bears. If they want to prevent the rally, they will need to quickly push the price below the 20-day EMA. DOGE is likely to retest the important support at $0.06 later.

Toncoin (TON) price analysis

Toncoin’s (TON) relief rally fizzled out at $2.31 on September 28. This showed that the bears were selling at higher levels. The price fell but the bulls maintained the $2.07 support on October 1.

The bears renewed their selling on October 2, pushing the price below the vital support at $2.07. If the price remains below this level, selling may intensify. In this case, there is a risk that TON could fall as low as the 50-day SMA ($1.84). On the upside, the bulls will need to push the price above $2.31 to open the doors for a possible retest of the $2.59 overhead resistance. This level is likely to attract aggressive selling by bears again.

To be informed about the latest developments, follow us twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!