Crypto funds saw the biggest week of outflows in three months as negative sentiment pervades digital-asset markets following the collapse of Sam Bankman-Fried’s FTX exchange and contagion to other firms.

Outflows for crypto investment products totaled $23 million, the highest amount in 12 weeks and a reversal from a two-week streak of inflows, according to a report by CoinShares on Monday.

Investors had scooped up shares in digital-asset funds as crypto prices tanked in the weeks after FTX’s meltdown, but as prices stabilized last week, the trend appears to have reversed.

The headline figure for outflows is even more bearish than it looks, since the week saw some $9.2 million of inflows into “short bitcoin” funds, or those designed to profit from further price declines in the largest cryptocurrency.

The outflows are still small compared with a spate of some $200 million of redemptions earlier this year, after the bankruptcy of the crypto lender Celsius.

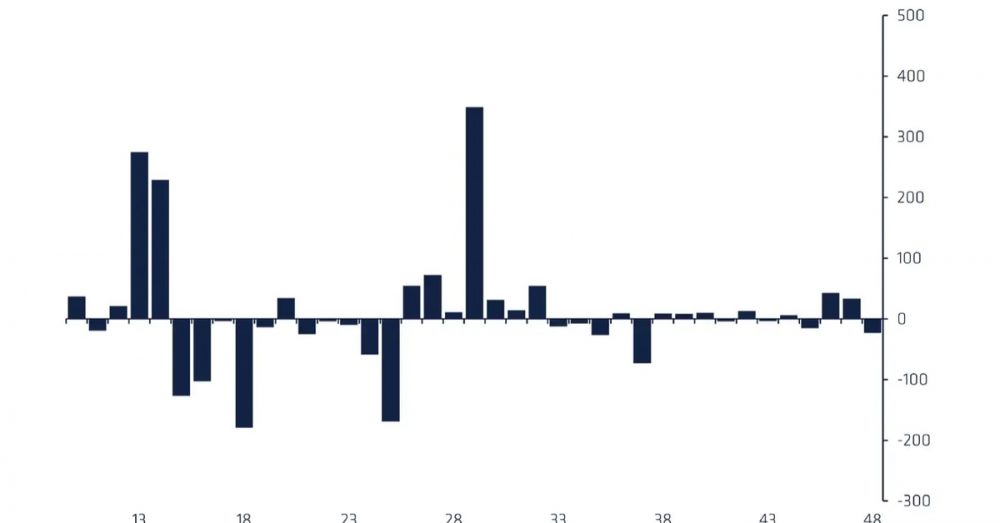

Bitcoin outflows

Outflows from bitcoin (BTC) funds totaled $10 million.

Even with the 65% price decline in BTC year-to-date, the largest cryptocurrency by market capitalization has still netted $322 million of inflows in 2022.

“Regionally, the negative sentiment was focussed on the U.S., Sweden and Canada, which all saw either outflows from long investment products or inflows into short products,” said James Butterfill, head of research at CoinShares. “Germany and Switzerland stood out as investors in aggregate, added to long only or sold out of short positions.”

Total asset under management (AUM) in digital-asset funds dropped to a new two-year low of $22.2 billion – largely because of this year’s steep price declines.