The price of Bitcoin (BTC) has been hovering in and around the $20,000 region for the past few weeks. Investors are wondering if the leading crypto will continue to rise to previous highs in the coming months.

Can Bitcoin reclaim $30,000 by September 2022?

The cryptocurrency market will enter the last phase of summer in September. Many investors are wondering if Bitcoin can reach $30,000, which has been an important psychological level in the past, before it plummets. According to data from CoinMarketCap, Bitcoin is currently trading at $20,552, which is slightly less than $9,500 at this price.

BTC 7-day price chart / Source: CoinMarketCap

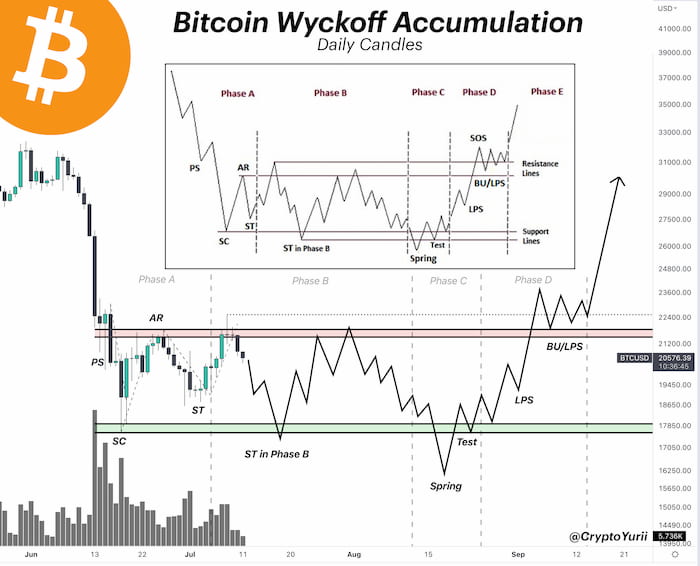

BTC 7-day price chart / Source: CoinMarketCapMoreover cryptocoin.com As you follow, Bitcoin gained 5.02% last week. So it currently has a market capitalization of $393 billion. A crypto trading expert, CryptoYurii, thinks that Bitcoin’s hesitant price behavior could be part of the Wyckoff setup, which could see BTC rise to $30,000 by September 2022. The setup is a technical indicator that hints at the possibility of an uptrend after significant downward moves.

BTC Wyckoff backlog / Source: CryptoYurii

BTC Wyckoff backlog / Source: CryptoYuriiIn the Bitcoin Wyckoff setup, an “accumulation” phase comes first. Then a fracture follows. According to the analyst, once the breakout reaches a certain amount, which is around $30,000 for BTC, the price action will most likely start to consolidate in the “deployment” phase and then decline.

Crypto community BTC price prediction

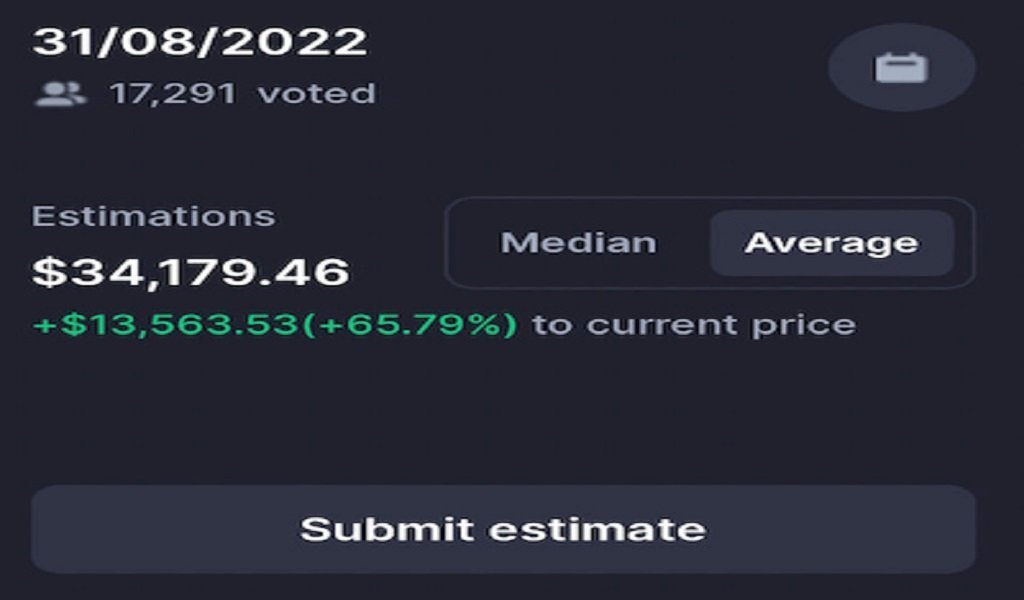

Earlier this month, the crypto community predicted the price of BTC with an average of 28,319 user votes. Accordingly, the community predicted a price of $36,668 by July 31. According to the community’s forecast for August 31, 2022, Bitcoin will trade at $34,179, up 65.79%. This means that it will add $13,563 to the asset’s current price.

BTC average price forecast end of August / Source: CoinMarketCap

BTC average price forecast end of August / Source: CoinMarketCapIndustry experts aren’t too optimistic about Bitcoin

Meanwhile, 53 cryptocurrency and Web3 industry experts predict that the Bitcoin price will hit a one-year low of $13,676 in 2022. However, he predicts it will rebound later and end the year at $25,473.

Fintech experts, on the other hand, are not so optimistic about Bitcoin price even at the end of the year. 77% of panelists say the market is officially in a ‘crypto winter’. Only 29% think this bear market will end in 2022.

Finally, investors on Wall Street believe that the token is more likely to hit $10,000. He also predicts that Bitcoin will depreciate significantly in the near future. This means that rather than returning to $30,000, it will almost lose its value in half.

The forecast is proof that investors have an extremely negative view of the future. Troubled lenders, collapsing currencies, and the end of the easy money policies of the past that fueled a speculative frenzy in financial markets have had a negative impact on the cryptocurrency industry. As a result, the market took a serious hit.

BTC erased weekly loss, eyes on resistance at $22.6k

Crypto analyst Omkar Godbole looks at the technical setup of the leading crypto. Bitcoin reached the breakeven point this week. Therefore, a major drop invalidated his technical setup. BTC continues to gain ground. It hits the breakeven point this week. The move brought critical technical resistance to the crosshairs.

The leading cryptocurrency briefly exceeded $21,000. It extended the recovery from Wednesday’s low at $18,892. At this price, the cryptocurrency is down about 9% for the week, according to the chart provided by TradingView. Meanwhile, with the price jumping, the bear flag breakdown, a bearish continuation pattern confirmed on the daily chart earlier this week, has failed.

Failed bear flags or bearish patterns hint at seller fatigue. This often indicates a reversal of the uptrend. A few on-chain data and technical indicators point to a bottom. The relative strength index on the four-hour chart has moved into the bullish zone above 50 to support the continued uptrend.

The focus is currently on the $22,600 resistance level, which is the 200-week moving average of the chart. After that, the next big hurdle will be at $25,338, the lowest reached on Coinbase on May 12. The outlook will turn bearish if Wednesday’s low at $18,892 is broken.