Ethereum (ETH) price has been traded below $ 3,000 since the beginning of February. The price seems to be deprived of a significant moment when we look at technical indicators such as RSI, DMI and EMA. The fact that there is no clear advantage between buyers and sellers causes the price to move in a cramped range. So, can ETH return to $ 3,000 at the end of February?

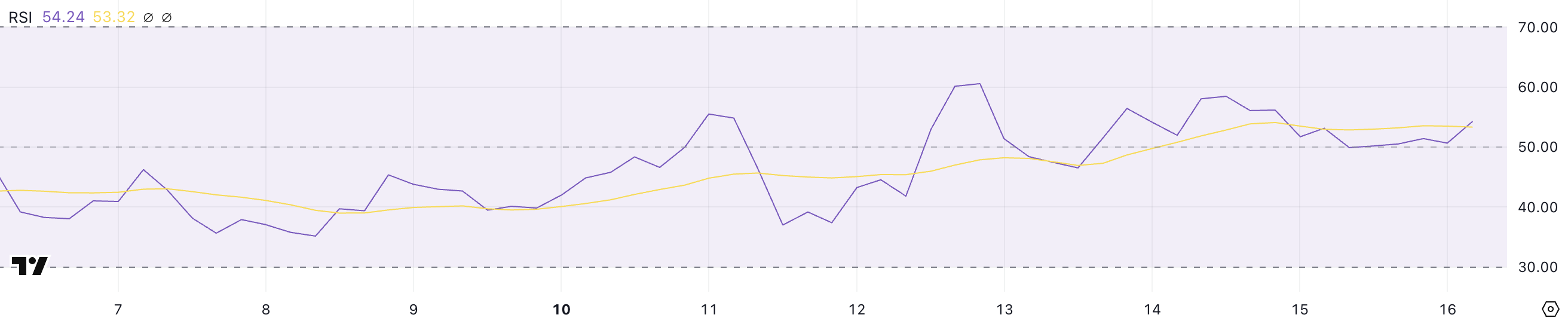

Will Ethereum RSI leave the neutral area?

Ethereum’s relative power index (RSI) is located in the neutral region of 54.2 since the beginning of February. RSI points to balanced market conditions of the 30-70 range when measuring price momentum. The exit over this range indicates that the price is entering the extreme purchase zone, while the fall below 30 points to the over -selling area.

Since ETH’s RSI value is currently in the neutral region, it cannot be said that buyers or sellers seize domination. However, to return to $ 3,000, it may need to approach the RSI to 60 and increase the receiving pressure. If the RSI rises above 70 levels, this may be a signal that Ethereum will enter a strong upward trend.

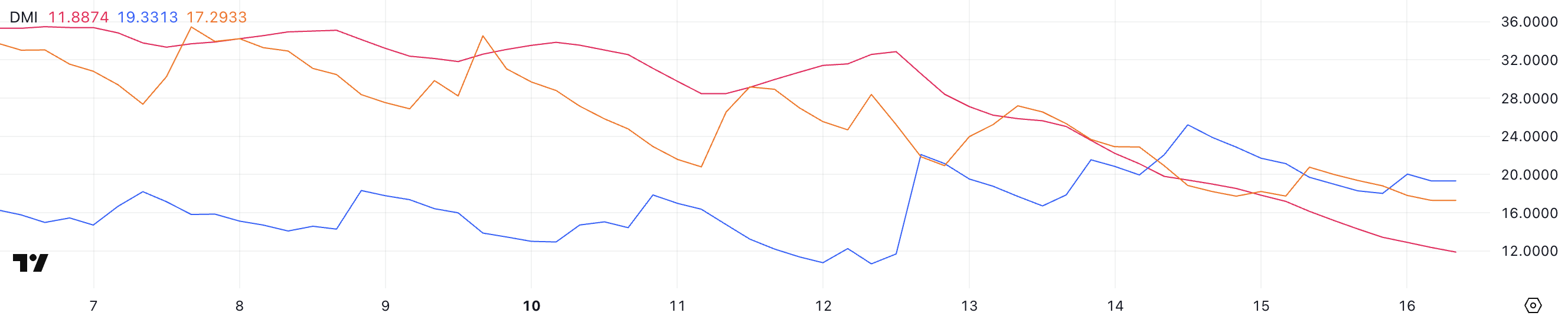

It shows that DMI and ADX Ethereum remain no direction

Directional Movement Index (DMI) indicates that Ethereum’s trend power is weakened. The ADX (average direction index) has decreased to 11.8 and this value indicates that the trend is quite weak. In order to re -strengthen the trend, ADX needs to exceed 20 levels.

The positive direction indicator (+DI) and the negative direction indicator (-DI) reveal that both the buyer and the seller pressure are weakened. In order for Ethereum to reach $ 3,000, the rise of ADX and the rise of +DI -Di will be an important signal.

Ethereum Price Estimation: Is $ 3,000 possible?

It is noteworthy that Ethereum is traded in the range of $ 2,800 to $ 2,550 in recent days. Although the EMA indicators still tend to decline, the gap between the short -term and long -term lines began to shrink. This may be pointing to a potential change in the momentum.

If Ethereum first breaks $ 2,800 and then remains above $ 3,020, it is possible to rise to $ 3,442. However, if $ 2,551 support is broken, further decrease may be expected. In this case, the price may decrease to $ 2,160 and the market may encounter a deeper correction.