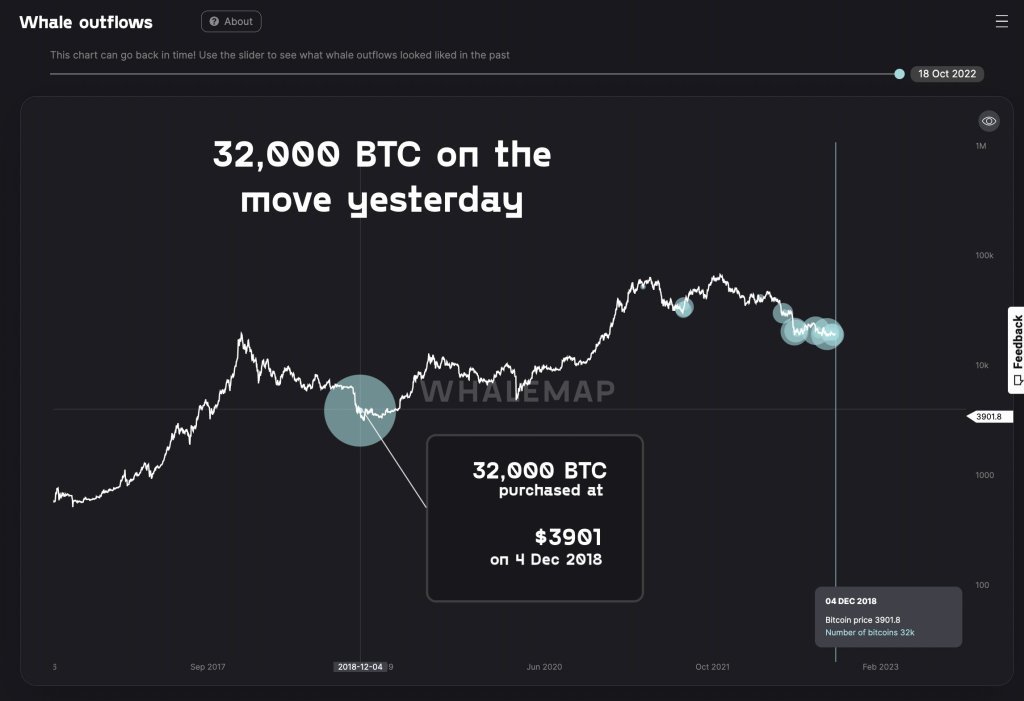

Whalemap says that ‘usually’ an OTC trading signal change is underway among 2018 bear market buyers. Analysis revealed that over $600 million Bitcoin (BTC) moved for the first time since the last bear market on October 18. Whalemap flagged a transaction involving 32,000 BTC.

Someone might be ‘willing to buy’ 32,000 BTC at $19k!

There are signs that the current spot price is affecting the behavior of longer-term holders. A BTC whale seems to have sold the asset near the trough of the last bear market. According to Whalemap, 32,000 coins came out of his wallet this week for the first time since December 2018. The Whalemap team makes the following statement on the subject:

Yesterday, a whale moved 32,000 Bitcoins in its wallet. They have been dormant since December 2018.

It is not known exactly what was behind the decision. However, Whalemap was quick to offer an alternative perspective to the classic bear market narrative. This means that big investors are capitulating at low levels. The team adds:

Transactions like this usually refer to OTC trading. This means that someone is currently willing to buy these 32k Bitcoins.

cryptocoin.com As you follow, BTC is down over 70% from its all-time highs. Despite this, the whale’s stash of 32,000 BTC was purchased at $3,900, which means it will make a substantial profit. Four years later, $612 million versus roughly $124 million paid.

Bitcoin whale exits caption graphic / Source: Whalemap/ Twitter

Bitcoin whale exits caption graphic / Source: Whalemap/ TwitterContinuing Whalemap notes that this price zone represents an important support area due to the popularity of 2018 lows as a buying point. In this context, he makes the following assessment:

Many people don’t know this. However, right in the region where the above transaction came from, whales had collected a lot of Bitcoin. Even now, 337k BTC have been accumulated in these wallets. It is a very important area in BTC territory where you can keep your eyes open.

Bitcoin whale streams caption graphic / Source: Whalemap / Twitter

Bitcoin whale streams caption graphic / Source: Whalemap / TwitterBitcoin stock balances accelerating decline

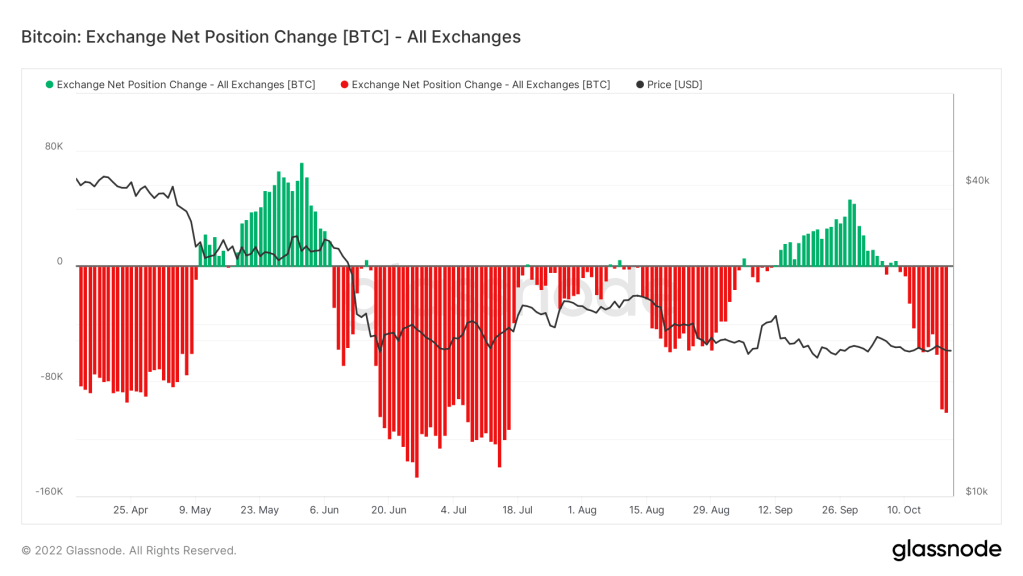

Even $19,000 has become popular as a BTC trading or investment game. This month, there are signs for this from the stock markets. Data from on-chain analytics firm Glassnode shows that over the past few days, major exchanges’ BTC balances have dropped more than at any time since mid-July the previous month.

The 19 trading platforms Glassnode tracks have dropped nearly 100,000 BTC in the last 30 days on both October 18 and October 19. The last date that exchanges finished the day with more BTC than they started was October 8 compared to a month ago.

Bitcoin stock market 30-day net position change chart / Source: Glassnode

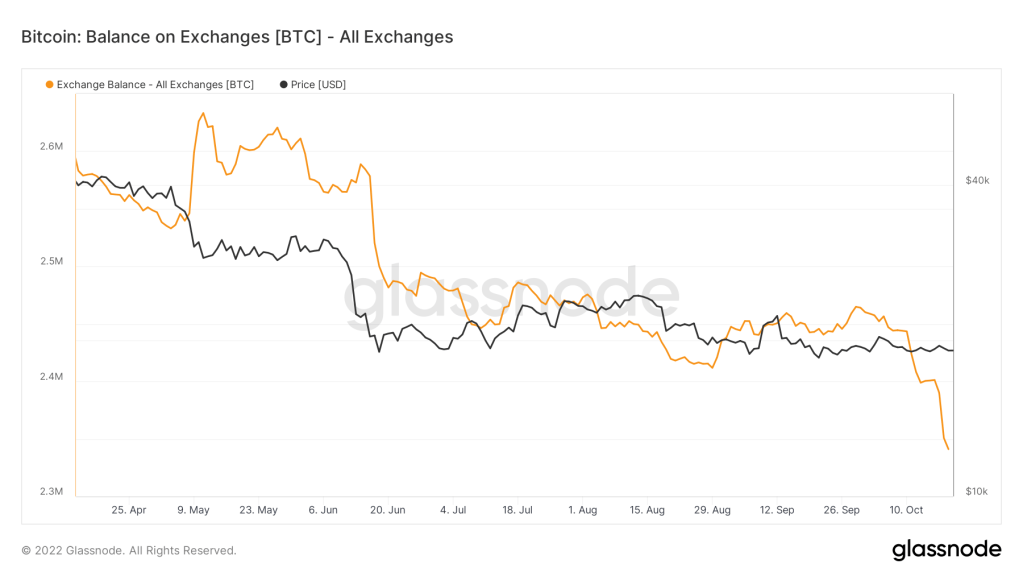

Bitcoin stock market 30-day net position change chart / Source: GlassnodeThe total balance of the exchanges was 2.46 million at the end of September. As of October 19, it has risen to just over 2.34 million BTC.

Bitcoin stock market balance chart / Source: Glassnode

Bitcoin stock market balance chart / Source: Glassnode