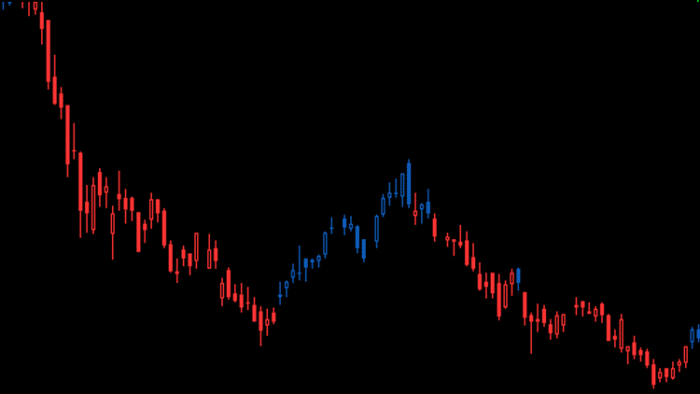

Lido Staked Ethereum (stETH), a staked DeFi variant of Ethereum, has been swinging for the past 48 hours. The token, which is expected to be traded at 1:1 pegs to ETH, is currently trading at $1,498.70. So, could staked Ethereum (stETH) cause LUNA-like crypto crash?

A LUNA-like crypto crash is imminent

stETH price has dropped 8% in the last 24 hours. By comparison, ETH is trading at $1,557.06, down 10% in the last 24 hours.

stETH has been in crisis since Thursday with 1.5 billion sales from one of its big whales, Alameda Capital. Alameda announced that it has sold all its tokens. stETH has no direct connection to ETH. Additionally, it will be used for ETH only after the merger, whose date is not yet known, takes effect.

But the token’s main role as collateral in AAVE and Lido pools is causing a crisis in the DeFi market. It also had dire consequences for the DeFi market. Sharp losses in StETH also triggered panic selling in Ethereum. As Kriptokoin.com we have covered a detailed article on the sETH crisis here.

How will STETH affect ETH price?

stETH, which stands for ETH currently locked on Ethereum 2.0, is often used as collateral to borrow more ETH on DeFi platforms. However, positions borrowing ETH using the token are open to liquidation if its price drops drastically. Investors will have to sell STETH on the open market. It will result in an even bigger price drop for the token as a result.

So far, this event has had little direct impact on ETH price. However, it has been triggering selling pressure on the leading altcoin for the last 24 hours. ETH has dropped over 10% in the last 24 hours. Uncertainty about Merge increased the selling pressure.

Lido caught in the crossfire

On the other hand, stETH’s impact on ETH is minimal for now, as the merge hasn’t happened yet. But its key role in leveraging ETH on DeFi will drive some investors into bankruptcy. Currently, DeFi platform Celsius has locked a large number of client funds into stETH. At the same time, these funds are subject to repayment. If customers fear the current STETH decline, they panic sell. This would potentially cause Celsius to have a liquidity crisis. So it will cause a DeFi crisis.

At the time of writing, CEL has dropped over 30% in the last 24 hours.

DeFi pools with large tokens are compromised on AAVE and Lido. If the StETH sell intensifies, it will trigger a liquidity squeeze. DeFi is already feeling its effects. Data from DeFi Llama shows that the four largest platforms, MakerDAO, Curve, AAVE, and Lido, have recorded an average 6% decrease in total value locked in the past 24 hours.