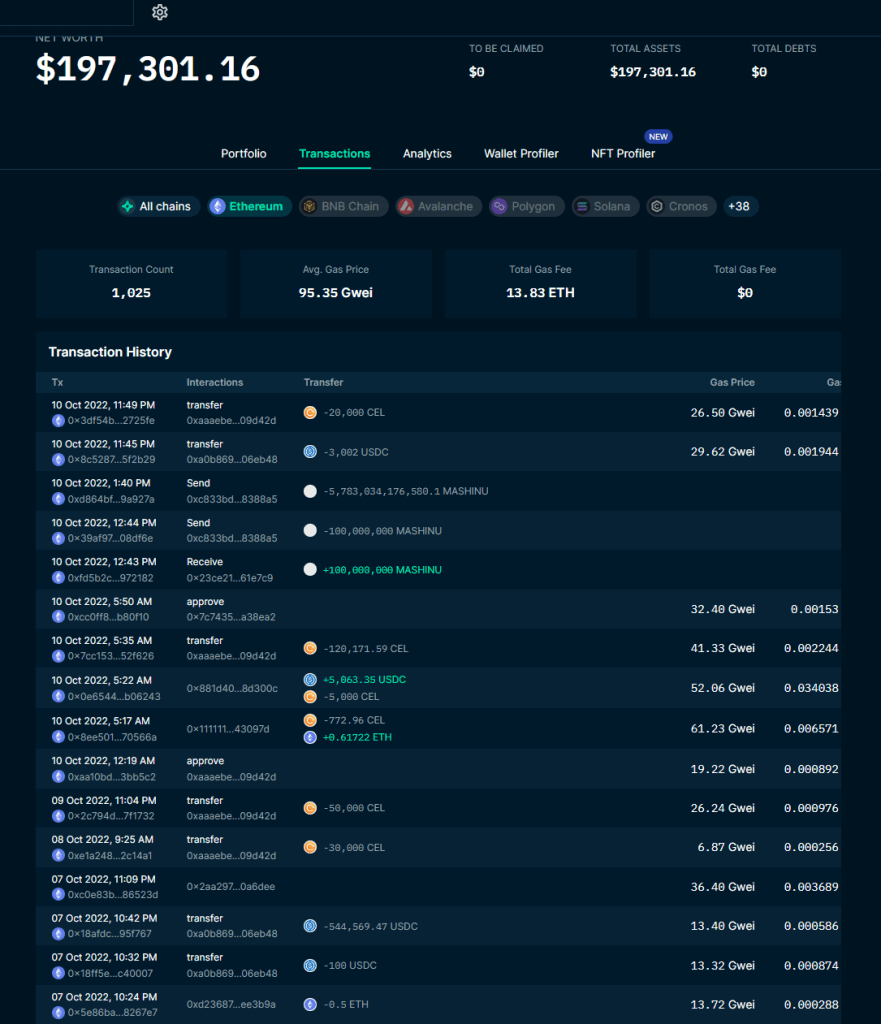

According to data compiled by Nansen, wallets belonging to Celsius founder Alex Mashinsky have been on the move since the beginning of October. About $1 million in CEL and USDC were sent from wallets to Uniswap and MetaMask. Here are the details…

Mobility continues in Mashinsky wallets

On-chain data from the Nansen analytics platform shows that Mashinsky-owned wallets exhibit a “stable stream of CEL tokens.” Also, the USDC stablecoin appeared to be out of six wallets last month. Coffezilla, a Blockchain detective who exposed crypto scams on YouTube, claims to have identified another Mashinsky-controlled wallet that transferred approximately $225,376 in CEL and USDC last month. The owner of this wallet is not endorsed by Nansen. However, on-chain data shows they are funded by an approved Mashinsky wallet.

Alex Mashinsky is such a cartoonish villain. After getting called out for stealing money from his company on the brink of bankruptcy, he starts dumping hundreds of thousands of dollars of $CEL tokens across multiple wallets.

He's dumping I write this, last trade 3 min ago) pic.twitter.com/Ugg9Q7yDTZ— Coffeezilla (@coffeebreak_YT) October 11, 2022

cryptocoin.com As we have also reported, before the company declared bankruptcy in August, $ 27 million was withdrawn by the executives. It was also carried by Mashinsky for $28,242. According to on-chain data, Mashinsky’s wallet collection still contains $197,301 worth of crypto, mainly composed of CEL and USDC. Given its heavy investment in troubled crypto hedge fund Three Arrows Capital, Celsius faced financial difficulties during the summer market downturn. It froze withdrawals in June before filing for bankruptcy protection on July 13.

When will the victims of Celisus withdraw their money?

The question in the minds of its users is undoubtedly when they will withdraw money. Especially when Mashinsky and other executives are making money. But the victims seem to have to wait a little longer. Earlier this month, the board of trustees tasked with overseeing the company’s bankruptcy called for a move to restart withdrawals early. However, the attorneys of the board of trustees objected. Lawyers used the following statements:

At this point, there are too many questions to approve any transaction involving borrowers’ cryptocurrency holdings. These questions arise both from the lack of transparency of the debtors and the failure of the debtors to report the financial statements and graphs.

Late last week, US Bankruptcy Judge Martin Glenn, who oversaw the case, ordered an independent auditor to produce a report detailing Celsius’s financial management and management of client accounts. The auditor should prepare this file by mid-November. This report is expected to determine the schedule for when customers can withdraw their assets. Meanwhile, CEL is changing hands at $0.95, down 7.1 percent.