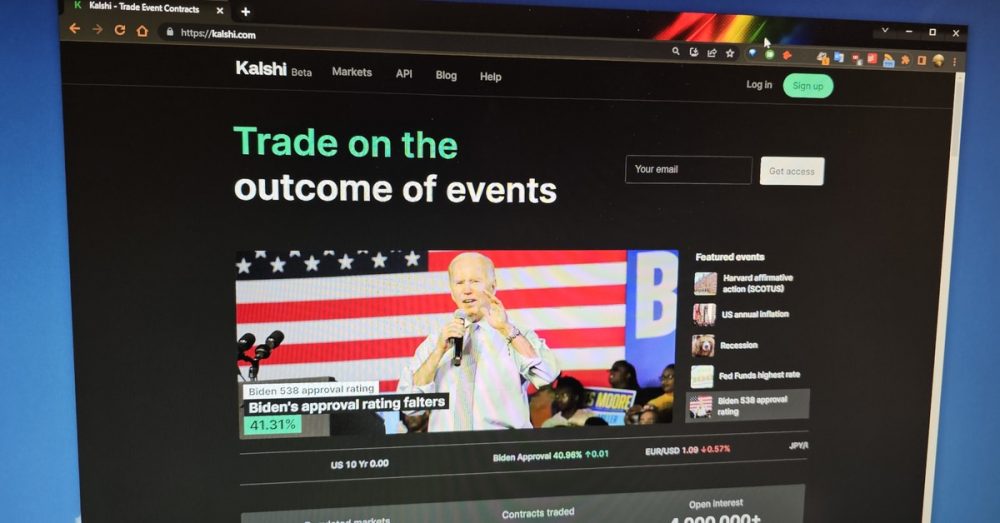

The U.S. Commodity Futures Trading Commission began a formal review and public comment period to evaluate prediction market Kalshi’s proposed contracts to bet on who will control Congress late Friday, canceling a public meeting to discuss the issue in the process.

The CFTC announced Friday night that it had began its 90-day review of KalshiEX LLC’s self-certified contracts for betting on which major political party will control Congress after the next election. The CFTC will need to make a decision at the end of the 90 days, or try to extend it.

The CFTC also announced a 30-day public comment period, seeking input on 24 different questions about the contracts, including whether they are “similar to gaming” as defined by CFTC rules, whether the proposed betting is unlawful, how they compare to previous efforts and more.

The CFTC announced a public meeting last week, set to take place on June 26, which was intended to let the regulator decide whether to commence its review. Another press release Friday announced it was canceled.

Kalshi hinted last year that the CFTC would approve its political event contracts in the run-up to the 2022 midterm elections in the U.S., though staff later recommended rejecting the contracts, Bloomberg reported. Kalshi later withdrew its proposal before refiling in an effort to address regulator concerns.

CFTC Commissioners Summer Mersinger and Caroline Pham both dissented from the decision to launch a new review period on Friday. Mersinger argued that Kalshi had been operating in good faith to address the regulator’s concerns, and launching another comment period would delay any resolution.

Moreover, Kalsh’s self-certified contracts do not fall into any definition of “gaming” for the CFTC’s purposes, Mersinger said.

“The Commission should treat Kalshi’s certification in the same manner it treats all DCM certifications of new products, and then do what Congress provided: Undertake a public rulemaking process to establish a legal framework for exercising its discretion to determine whether event contracts, including those relating to political control, may be prohibited from trading because they are contrary to the public interest,” she said.

Pham’s dissent pointed to an appeals court ruling on another prediction market, PredictIt, which the CFTC ordered shut down last year. PredictIt sued to continue operating, and the Fifth Circuit Court of Appeals ordered PredictIt be allowed to continue operating until at least roughly two months after a court ruled on the underlying lawsuit.

If the CFTC were to try and suspend Kalshi’s political event contracts, that might violate the appeals court order, Pham said.