Oracle service provider Chainlink has unveiled a new economic roadmap for the platform by introducing the highly anticipated staking mechanism to Blockchain. In the announcement, Chainlink said that the staking mechanism will bring the operational efficiencies of the Oracle network and Blockchain. Here are the details…

Big announcement from Chainlink

On June 7, the Chainlink team released the “Long-Term Goals, Pathway” outlining the various stages for the Blockchain project that provides the data oracle. He published the Map and the First Application. The blog post talked about “Chainlink Economics 2.0,” which focuses on staking as part of an effort to scale the system and integrate more Blockchain networks.

Staking is a mechanism that brings a new layer of “cryptoeconomic security” to Chainlink. The same is true for most Proof-of-stake Blockchains, which reward stakers for helping to secure the network. Chainlink, which launched its oracles on Solana earlier this month, has four long-term targets for staking.

Staking has four purposes

The primary purpose of staking is to increase the security and user assurances of Chainlink oracle services. LINK tokens are locked as a “guarantee of service level around network performance”. In addition, incentives and penalties such as downtime enable Chainlink nodes to consistently generate accurate oracle reports and deliver them on time. The second goal is to encourage community engagement and participation. Additionally, node operators can create authorized staking systems, similar to what Tezos does.

Third, Chainlink staking aims to generate sustainable rewards from real long-term use. He expects long-term growth to result in a larger portion of staking rewards being derived from “non-emissions-based sources.” The ultimate goal is to “empower node operators to access higher value work by staking”. This means that over time node operators will have more opportunities to join Decentralized Oracle Networks, further increasing security.

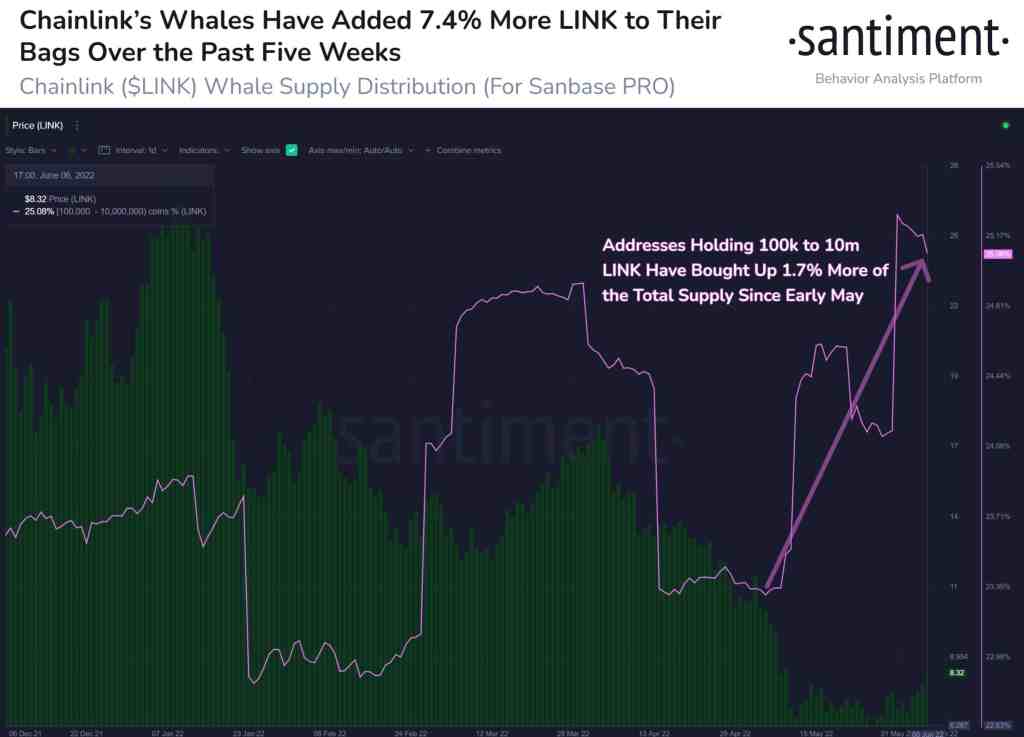

Whales started buying Chainlink

In the last 24 hours, LINK price has increased by over 12% and is currently trading at $8.46. Chainlink’s native token LINK has been part of the broader market correction this year. But it seems that whales are taking advantage of this fix. In the past five weeks, Chainlink whales have added massive amounts of LINK to their portfolio. Santiment, which provides on-chain data, uses the following expressions:

Chainlink has pumped 9 percent in the last 2 hours and the whales who hoard the coin are profiting. After dumping started on March 30, they started to accumulate again as prices dropped in early May. They hold more than 25 percent of the supply for the first time since November.