While the U.S. Federal Reserve (Fed) maintains its anti-liquidity stance, China no longer seems hesitant to expand credit in a positive sign for risk assets, including cryptocurrencies.

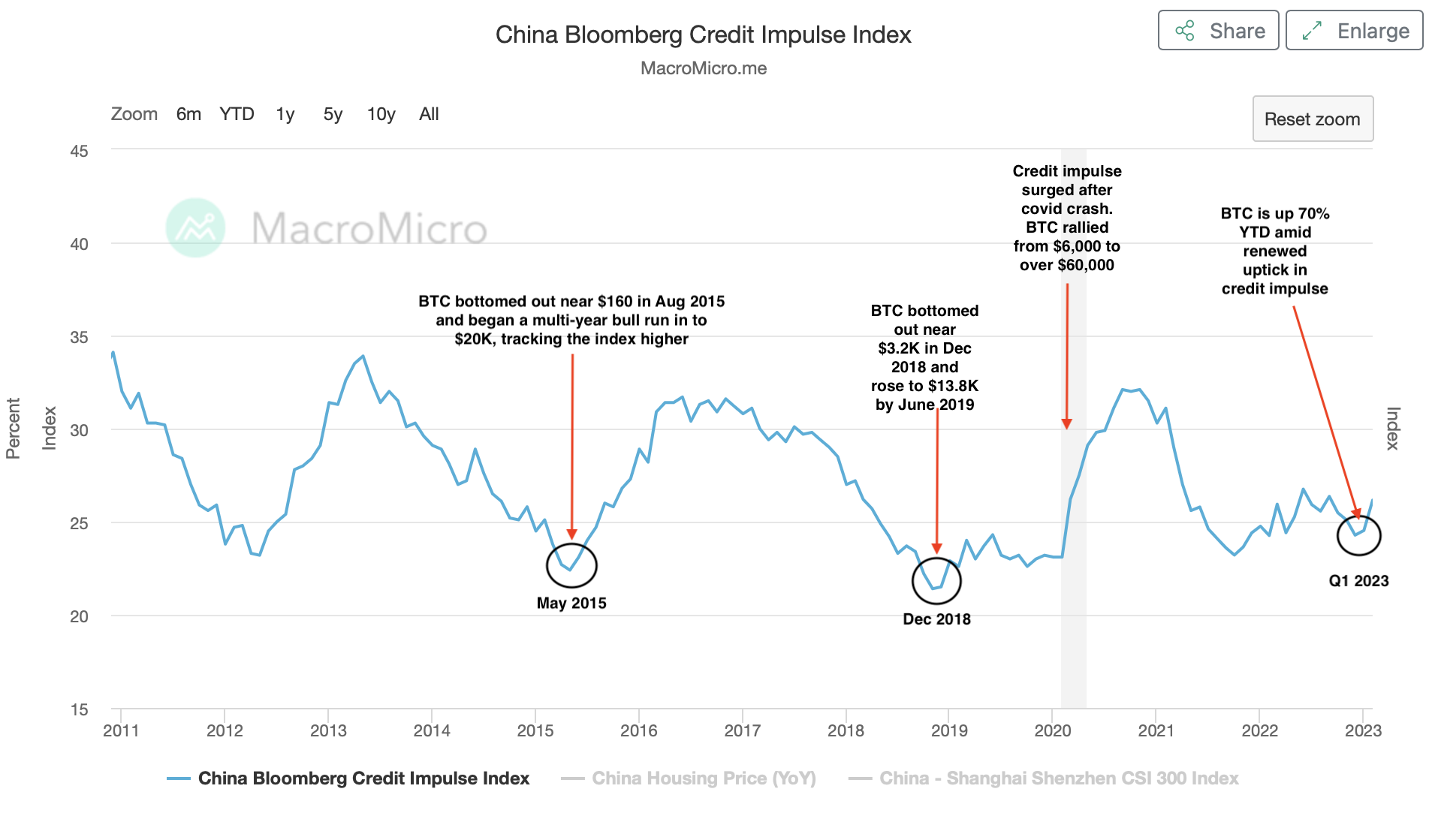

Per data source MacroMicro, China’s credit impulse index, which measures the change in new credit or bank lending as a percentage of the gross domestic product, has bounced from 24% to 26% this year, indicating a renewed credit expansion relative to the growth rate.

A continued rise in China’s credit impulse could contribute to the global financial cycle and support global risk sentiment, expanding global asset prices and global credit, according to a paper published by the Federal Reserve in November said. Bitcoin, being a risk asset, tends to move more or less in line with stocks.

Historically, there has been a strong correlation between China’s credit impulse and Asian equity markets, per Credit Suisse.

Besides, previous instances of renewed credit expansion in China have coincided with major bearish-to-bullish trend changes in bitcoin. So, a continued rise in the credit impulse index may bode well for bitcoin.

China’s new bank lending hit a record high of 10.6 trillion yuan ($1.54 trillion), up 27% from the first quarter of 2022, data released on Tuesday showed.

“This tidal wave of liquidity will continue to propel risk assets and crypto,” David Brickell, director of institutional sales at crypto liquidity network Paradigm, said in a newsletter early this month, noting China’s recent liquidity injections.

Bitcoin has gained over 70% this year amid renewed uptick in China’s credit impulse, repeating a historical pattern. The shaded portion represents U.S. recession. (MacroMicro/CoinDesk) (MacroMicro/CoinDesk)

China’s credit impulse surged after the coronavirus-induced crash of March 2020. Bitcoin chalked up a six-fold rally to over $60,000 in the subsequent 12 months.

Bitcoin has rallied over 70% this year, recovering from a year-long bear market amid a renewed uptick in the credit impulse. The cryptocurrency saw similar bull revivals after the credit impulse bottomed out in May 2015 and December 2018.

Analysts see further credit expansion in China in the coming months.

Recommended for you:

- Crypto Exchange Bitzlato Converted Over $1B in Crime-Linked Assets, Europol Says

- I Made an NFT Collection to Represent My Student Loan Debt

- 4th Quarter Market Outlook: The CoinDesk Culture & Entertainment Index (CNE)

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

“China’s credit cycle has bottomed out. It looks set to continue to recover as shadow bank credit and equity financing – two components of aggregate financing that account for more than one-third of the total – are increasing,” Chi Lo, senior market strategist APAC at BNP Paribas Asset Management, said in a note published on March 29.