Circle’s CEO Advocates for Regulation of Dollar-Pegged Digital Tokens

Jeremy Allaire, the co-founder and CEO of Circle, the issuer of the prominent stablecoin USDC, has voiced strong support for the registration of companies that issue digital tokens pegged to the U.S. dollar within the United States. In a recent interview with Bloomberg, Allaire stated, “It shouldn’t be a free pass, right? Where you can just ignore U.S. law and go do whatever the hell you want wherever and sell into the United States.” This assertion highlights the need for regulatory compliance among all players in the stablecoin market.

Currently, Circle’s USDC holds the position of the second-largest dollar-backed stablecoin by market capitalization, trailing behind Tether’s USDT. The conversation around cryptocurrency regulation has gained momentum since the beginning of President Donald Trump’s administration. Notably, in January, Trump issued an executive order outlining several key actions, including a push for a more crypto-friendly regulatory framework. Following this, in February, Tennessee Senator Bill Hagerty introduced a bill focused on stablecoin oversight, which aims to create a structured regulatory environment for U.S. dollar-backed digital currencies.

Allaire emphasized that regardless of whether a company is based offshore or in Hong Kong, “if you want to offer your dollar stablecoin in the U.S., you should need to register in the U.S. just like we have to go register everywhere else.” This sentiment was echoed by Dante Disparte, Circle’s Chief Strategy Officer and Head of Global Policy and Operations. Disparte remarked, “All companies that issue dollar stablecoins—whether they’re startups or based outside the U.S.—should have the opportunity to register in the United States and compete on a level playing field. No company that issues dollar stablecoins should get a free pass from safety and soundness rules and appropriate prudential supervision.”

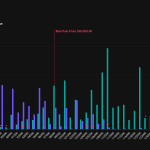

The stablecoin market has seen significant growth, boasting a total market capitalization of approximately $232 billion, and plays a crucial role in underpinning cryptocurrency trading. These tokens are also increasingly utilized for international money transfers, enhancing their utility in global finance. Major companies, including PayPal, have announced plans to expand their stablecoin offerings further.

Michelle Gill, the general manager of PayPal’s small business and financial services group, shared with Bloomberg that the company intends to integrate its PYUSD stablecoin, which ranks as the 10th largest by market capitalization on CoinGecko, into a broader array of its products in the upcoming months. However, PayPal did not respond to CoinDesk’s request for comments regarding this initiative.