Following the Grayscale victory on August 29, expectations are growing that spot Bitcoin ETF applications will be approved. An ambitious prediction came today from CNBC market reporter Bob Pisani.

Analysts raise bar for Bitcoin ETF approval after Grayscale victory

CNBC market correspondent Bob Pisani suggested that spot Bitcoin ETFs will be approved later this year, when they last appeared on the screens. Currently, giant companies such as BlackRock, VanEck, Fidelity, Invesco and WisdomTree are waiting for September 2nd for ETF applications. While Pisani is keen that these applications will be approved, he hints that this is the SEC’s only chance.

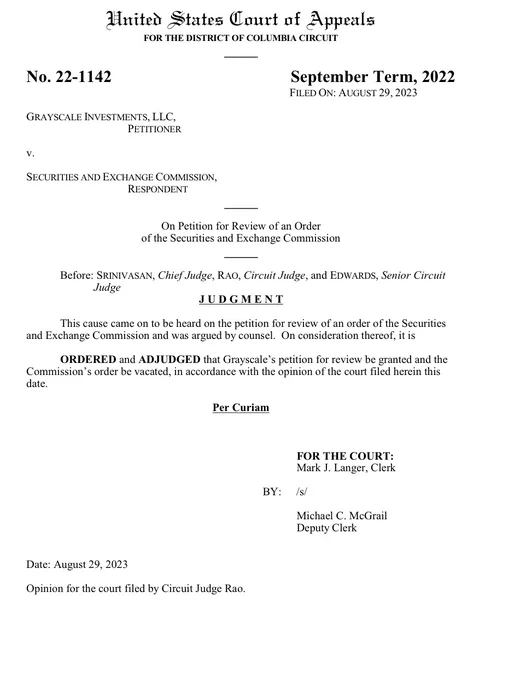

cryptocoin.com As we reported, the US court ruled in favor of crypto in the Grayscale-SEC case on August 29. Circuit Judge Neomi Rao has ordered the SEC to overturn its decision to reject Grayscale’s ETF applications. The impact of the news mobilized almost the entire altcoin industry, including Bitcoin.

Bob Pisani is not alone: Bloomberg analysts are also waiting for confirmation with 75% probability

Bloomberg analysts Eric Balchunas and James Seyffart yesterday updated the ETF approval rate to 75%, which they previously determined to be 65%. This decision came after the Grayscale victory, which led to bullish movements in the market. Balchunas announced his expectations on his X account as follows:

James Seyffart and I put our odds at 75% on spot Bitcoin ETFs launching this year (95% by the end of 24). Although we included the Grayscale win in our previous 65% rating, the unanimity and determination of the decision was beyond expectations and left the SEC with “very little leeway.”

NEW: @JSeyff & I are upping our odds to 75% of spot bitcoin ETFs launching this yr (95% by end of '24). While we factored Grayscale win into our prev 65% odds, the unanimity & decisiveness of ruling was beyond expectations and leaves SEC w "very little wiggle room" via @NYCStein pic.twitter.com/IyEGmWjuHa

— Eric Balchunas (@EricBalchunas) August 30, 2023