Crypto exchange Coinbase has made a new announcement about its product, which allows US customers to send crypto as collateral to get cash loans. The exchange stops issuing new loans through the “Borrow” service, a product with this functionality. Here are the details…

Coinbase is shutting down its Borrow program due to lack of demand

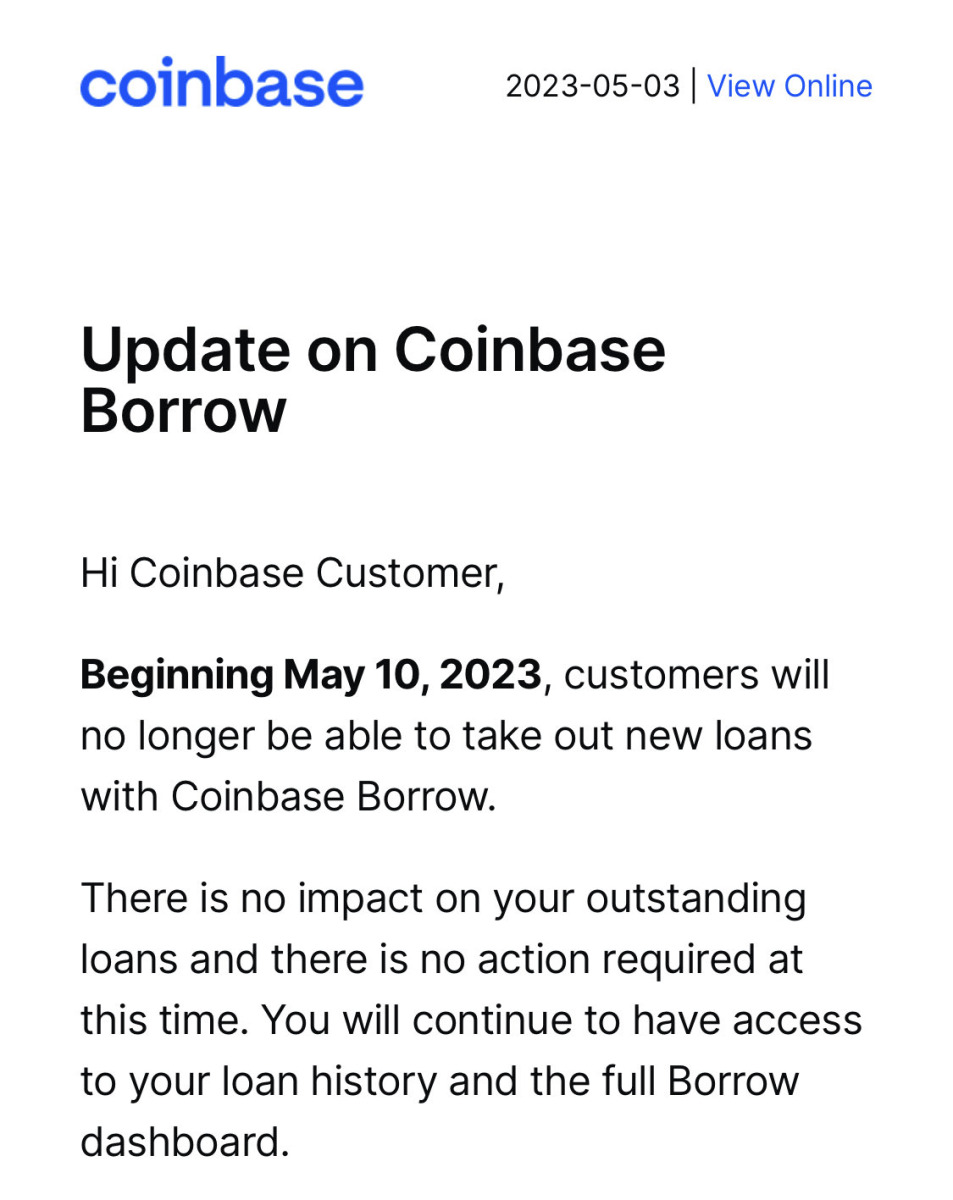

cryptocoin.com As we have also reported, Coinbase, one of the largest crypto exchanges in the USA, announced that it has closed the Coinbase Borrow program. The program, which allows customers to get fiat loans in exchange for their Bitcoin holdings, ends on May 10. The program will not accept new credits. The Coinbase Borrow program was launched in November 2021 as a way for customers to get fiat loans quickly without having to sell their Bitcoin holdings.

The program allowed customers to borrow up to $1 million with interest for 40 percent of their Bitcoin holdings. Users paid an annual percentage rate of about 9% for this service, which did not require a credit check. The exchange announced in an email to exchange customers using the program that the decision to close Coinbase Borrow was due to decreased demand. The spokesperson for the exchange pointed out that there will be no impact on customers’ outstanding loans. He also confirmed that they do not need to take any action at this time.

The stock market has been in the focus of regulators lately.

The shutdown of Coinbase Borrow comes at a time when the exchange is under extra scrutiny from regulators. The collapse of crypto exchange FTX has brought Coinbase under the spotlight. The exchange is pending sanctions from the U.S. Securities and Exchange Commission (SEC) for alleged securities breaches. However, according to anonymous sources, Coinbase Borrow’s downtime is not linked to any enforcement action. In addition, the email sent to users comes before the first quarter results expected to be announced today.

Investment analysts from Citi downgraded stock market shares from “buy” to “neutral” ahead of the stock market’s first quarter announcement. Mizuho analysts also maintained their “underperforming” rating for Coinbase. Analysts said the exchange’s “foundations remain weak”, citing the low average daily trading volumes. Coinbase has become one of the biggest players in the cryptocurrency industry, with a valuation of $85 billion in its IPO.

However, the shutdown of Coinbase Borrow signals that the exchange is re-evaluating its product offerings. It also shows that it focuses on the services that customers care most about. Earlier this week, Coinbase decided to make its exchange global. Thus, on May 2, Coinbase launched its derivatives trading platform called International Exchange. The cryptocurrency industry has come under increasing scrutiny from regulators in recent months over concerns over the potential for fraud, money laundering and other criminal activities.