With the collapse of FTX, it becomes important which altcoins centralized exchanges hold as reserves. New reports have revealed that some platforms are storing large amounts of Shiba Inu (SHIB). Coinbase-backed Bitcoin exchange CoinDCX prefers to hold Cardano and Polygon alongside Shiba.

CoinDCX holds Shiba Inu (SHIB) and these altcoins

cryptocoin.com We have passed on proof of reserve documents that have been made public by almost all central exchanges in recent weeks. Reports indicate that exchange giants Huobi and KuCoin hold over $10 million in SHIB. In addition, according to the statements made by Binance CEO CZ on Twitter, the leading exchange will continue to keep its reserves focused on Bitcoin and Ethereum.

#Binance published cold wallet addresses and balances for 6 of our 600 coins. More to come.

475K BTC

4.8M ETH

17.6B USDT

21.7B BUSD

601M USDC

58M BNBThese were public before anyway, but organized together for your ease of viewing.https://t.co/Jm6dVoDqM5

— CZ 🔶 Binance (@cz_binance) November 10, 2022

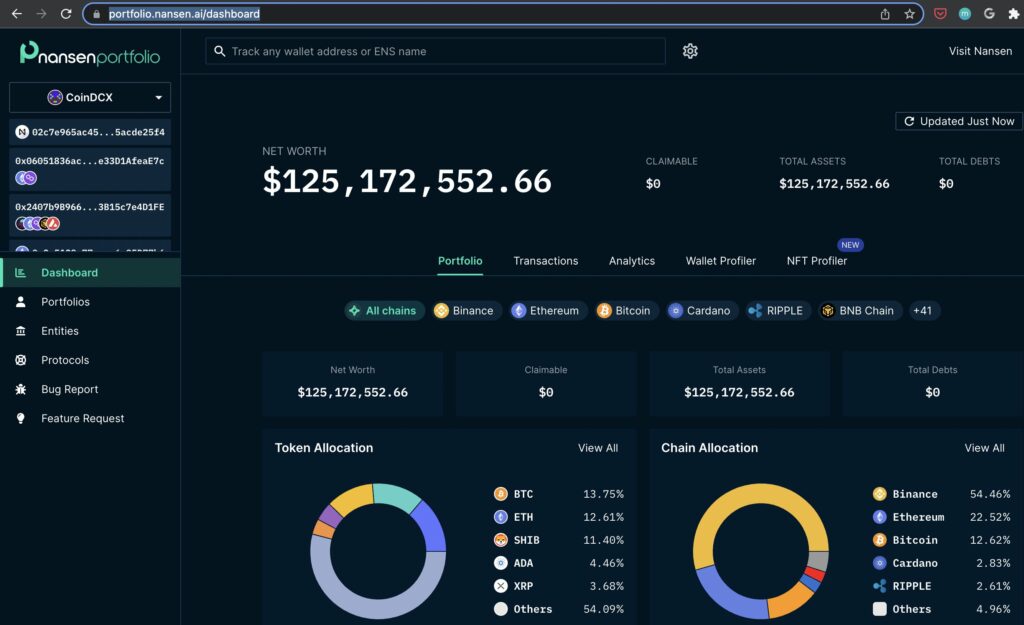

CoinDCX is the latest cryptocurrency exchange to share its reserves in order to gain the trust of its investors. The Coinbase-supported Bitcoin exchange showed that it has altcoin giants such as Polygon (MATIC) and Cardano (ADA) in the data it published on Nansen. CoinDCX holds Bitcoin (BTC) as its largest reserve. Apart from ADA and MATIC, it also owns Ethereum (ETH) and Shiba Inu (SHIB).

Meanwhile, CoinDCX CEO Sumit Gupta said on Twitter, “We work with well-known audit firms to certify our financial health.”

5/5 We are working with reputed audit firms to certify our financial health. Will share more updates on this later.

I hope this gives the community and our users the much-needed assurance.

— Sumit Gupta (CoinDCX) (@smtgpt) November 24, 2022

What is proof of reserve (PoR)?

In particular, PoR is required for the “ability to handle withdrawals” that exchanges make publicly available to restore investor confidence. In general, it consists of two parts. The first is the current record of customers’ token deposits, known as liabilities. The second is the token pool held within a set of exchange addresses known as assets. As a custodian financial institution, centralized exchanges should not use clients’ funds for other purposes. Therefore, both funds and liabilities must match.

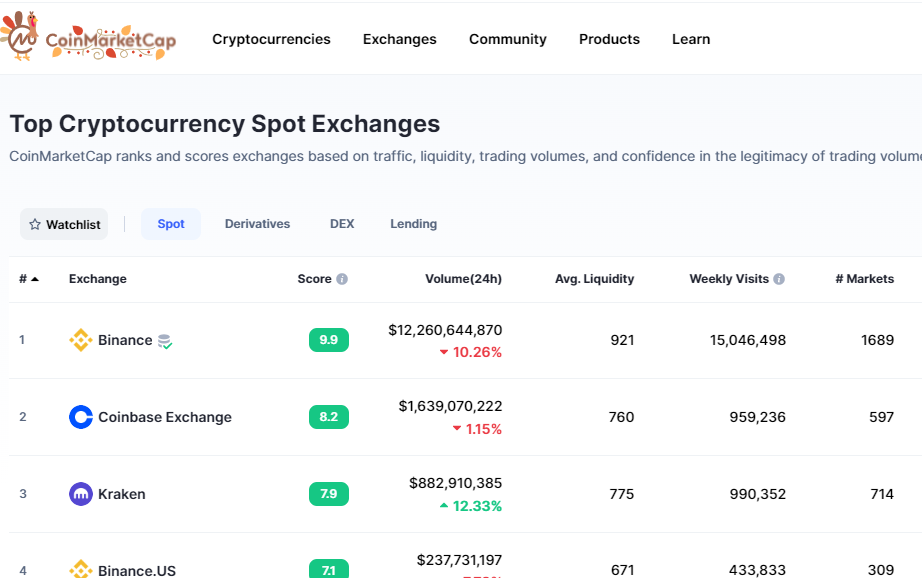

There are multiple ways to obtain a Proof of Reserve. The simplest is the PoR tab recently introduced by Coinmarketcap, a subsidiary of Binance.

Here, you can see which altcoins are currently holding in their reserves.

Why is por important?

Binance CEO CZ raised an issue on the status of FTX on Nov. The events that followed revealed that the funds had long been mismanaged under exchange surveillance. While users’ account balances show records of their assets, these funds were not available as the exchange engaged in certain activities that resulted in the loss of users’ funds.

In one tragic event, FTX stopped users’ withdrawal requests. Some estimates put the deficit closer to $10 billion. The ripple effects of the FTX crash also directly affected nearly all centralized exchanges. Platforms are now publicly sharing their reserves for the confidence of investors. Meanwhile, investment giant JPMorgan has announced that it will not join this trend, citing security concerns.