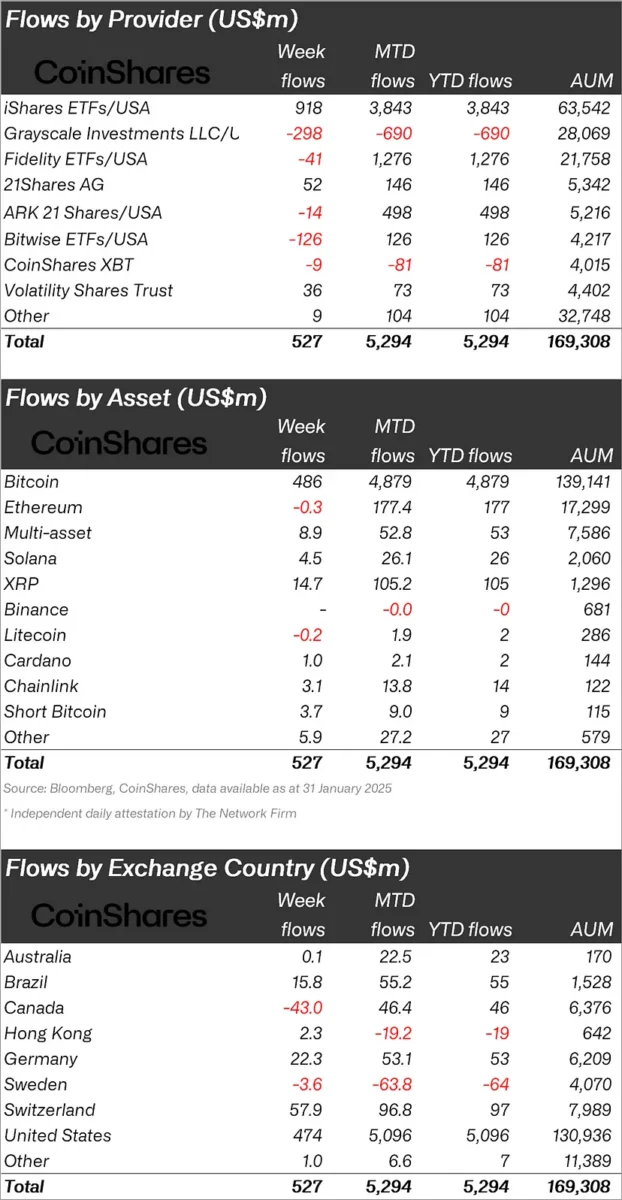

Last week, a total of 527 million dollars of entry into global crypto funds, operated by large asset managers such as Blackrock, Bitwise, Fidelity, Grayscale, Proshares and 21shares. However, this figure points to a decrease of 72 %compared to the previous week. These fluctuations in the market are associated with concerns about former US President Donald Trump’s trade tariffs plans and deepseek market degradation. Meanwhile, the XRP is currently the best performance of the 2nd Altcoin, and last week, USD $ 15 million has entered a total of 105 million US dollars since the beginning of the year.

Coinshares announced its corporate investment report

Coinshares Research Director James Butterfill, in a report on Monday, “weekly entries, the fluctuations in investor sensitivity reflected fluctuations, and Deepseek developments, Monday, caused a $ 530 million output,” he said. However, as the week progressed, the market recovered and more than 1 billion dollars of net entries took place.

Trump’s 25 %of products imported from Canada and Mexico, 10 %of Canada’s energy sector and products from China, a 10 %customs tariff application plan, affected the crypto market negatively. Bitcoin, the highest level he saw at the weekend fell from $ 101,500 to 10 %to $ 91,500. Ethereum depreciated by 36 %. The total breast coin market value decreased by 40 %. However, the market is now partially recovered and Bitcoin is traded at $ 94,983 and Ethereum is traded at $ 2,568.

Bitcoin funds continue to dominate, XRP rose to the second place

Meanwhile, Bitcoin -based investment funds dominated the market last week with an introduction of $ 486 million. Short Bitcoin funds also saw $ 3.7 million. Spot Bitcoin ETFs in the United States made up $ 559.5 million of total entries. XRP has rose to the second Altcoin, which has best performance with a $ 105 million entrance since the beginning of the year. Last week, the newly entered 15 million dollars of the XRP, investor continues to attract the attention. Other attention was the multiple asset fund, Solana, Cardano, Chainlink. 200 thousand dollars output from Litecoin took place.

Regional, the US received the biggest share with an introduction of $ 474 million last week, and since the beginning of the year, total entries reached $ 5 billion. In Europe, 78 million dollars of entrance last week, the total entrances since the beginning of the year increased to $ 93 million. On the other hand, the Canadian market was a funding output of $ 43 million. This decline is associated with the possible effects of the US trade tariffs planned.