CoinShares, Europe’s largest digital asset investment group, talked about the altcoin project, where most institutional investors see high growth potential this year.

CoinShares: Institutional money could flow into this altcoin project in 2023

In its latest Fund Manager Survey, CoinShares says there is a 20% increase in bullish expectation among investors for smart contract platform Ethereum (ETH). According to the firm’s analysis, Ethereum is the first cryptocurrency most institutional investors will choose this year. According to the statements in the report:

Ethereum has seen a dramatic increase in investor sentiment, with a record 60% of respondents believing it has the most convincing growth outlook.

Let's look at the latest edition of the Digital Asset Quarterly Fund Manager Survey. (n=43, US$390bn of AuM)

What's on the minds of professional investors? Let's dig in.

The full result of the survey is free to download here:https://t.co/OrhB9sH3XZ pic.twitter.com/isuyRPJvME

— CoinShares (@CoinSharesCo) January 26, 2023

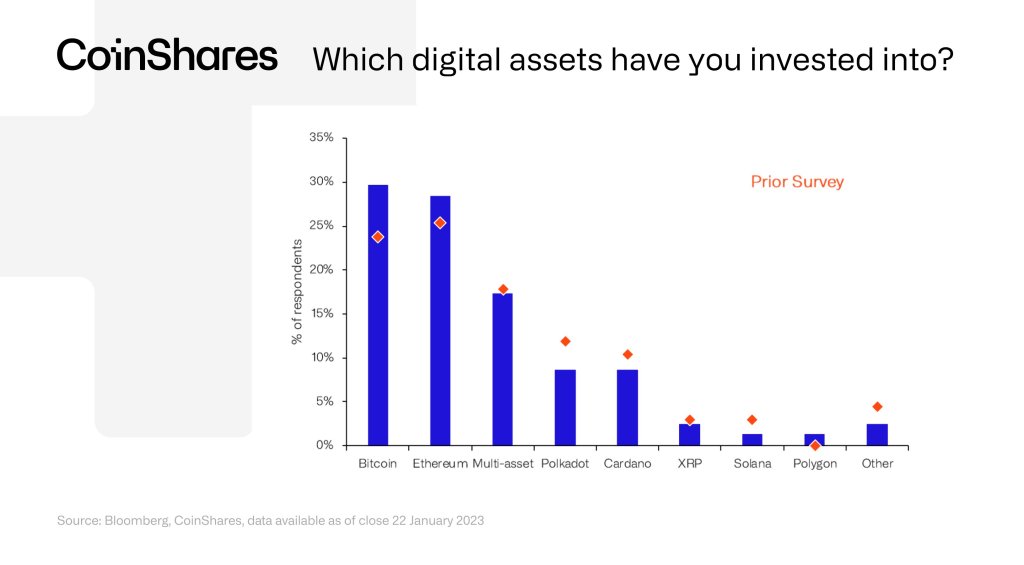

Nearly 30% of respondents said that Bitcoin (BTC) has the most attractive growth outlook. The survey is based on 43 responses from investors covering $390 billion in assets managed. Expectations for Ethereum have increased significantly since the October 2022 survey, where only 40% of respondents believed ETH had the most convincing growth outlook.

CoinShares says that Ethereum may make a “comeback” this year after experiencing a $401 million exit in 2022.

“Bitcoin and Ethereum solidified their leading positions against other cryptocurrencies”

According to the survey, investors were mostly investing in Bitcoin and Ethereum in the last quarter. Coinshares said in the report, “It is useful to consider the investments made by institutions in the last quarter. “Bitcoin and Ethereum solidified their leading positions against other cryptocurrencies.”

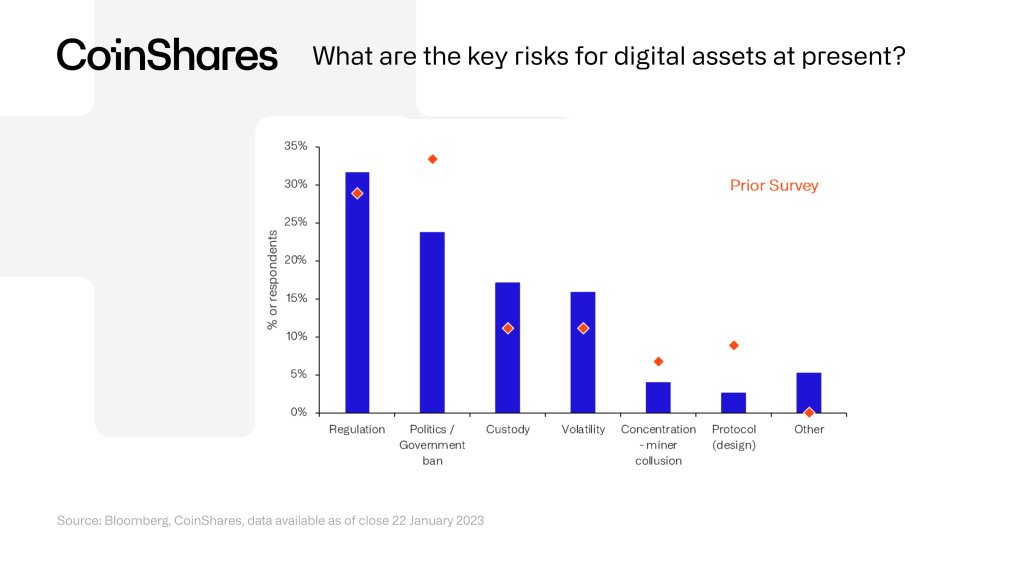

Meanwhile, investors are less worried about a complete ban on cryptocurrencies since the last survey:

Regulatory concerns have risen, but few expect political blockers and a government ban. This suggests that investors see regulation as a solution rather than banning it outright.

How about the leading altcoin? Are the bulls ready for a comeback?

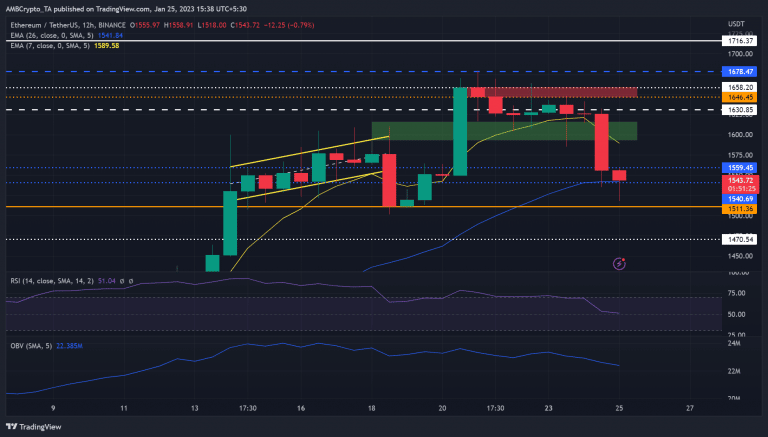

ETH completed an extra rally around January 14 despite signs of slowing momentum. The price declined below the 1.600 support but found stable support at $1,511. The ensuing recovery was rejected at $1,678, followed by a slight consolidation before hitting a massive drop to the $1,500 region on Tuesday.

Therefore, the analysis suggests a correction to the $1,540 – $1,560 region in the short term before attempting to retest the $1,600 region in the next few days/weeks. Additionally, a move to the $1,700 region is possible if BTC rises above $23,000, especially if the FOMC announcement on the first day of February triggers the markets positively.

cryptocoin.com As you follow, Ethereum is trying to protect the 1,600 region on a sideways January 27 day. The sluggish trading volume could force ETH to a price consolidation in the $1,540 – $1,560 range in the next few hours.