In the ever-evolving landscape of digital assets, the investment space has witnessed a significant increase in inflows. The latest Weekly Digital Asset Fund Flows Report from CoinShares reflects investor sentiment. It also reveals surprising numbers that indicate a significant uptick in its activities. In this context, according to the report, while there were outflows from an altcoin project, 5 coins saw inflows.

Cryptoasset investment products see record inflows

Last week, digital asset investment products experienced an unprecedented inflow of $346 million. This marked the largest weekly inflows on record for nine consecutive weeks. Additionally, this increase in investment reflected palpable enthusiasm among investors. It was also the most significant increase since the peak of the bull market phase in late 2021. The driving force behind this meteoric rise is primarily due to the anticipation surrounding the possible launch of a spot-based Exchange Traded Fund (ETF) in the US. This wave of expectations increased both prices and inflows in altcoin projects and Bitcoin. This resulted in an increase in total assets under management (AuM) to $45.3 billion, a peak not reached in more than a year and a half.

While Kanda and Germany came to the fore, the USA fell behind

When we look more closely at the regional distribution of these inflows, we see that Canada and Germany account for a staggering 87% of the total flow. The US, however, witnessed a relatively meager inflow of $30 million. This showed that there was no significant participation from the USA. Analysts are predicting a strategic pause as U.S. investors await the upcoming ETF launch.

Smart money flowed into these 5 coins as they exited this altcoin project

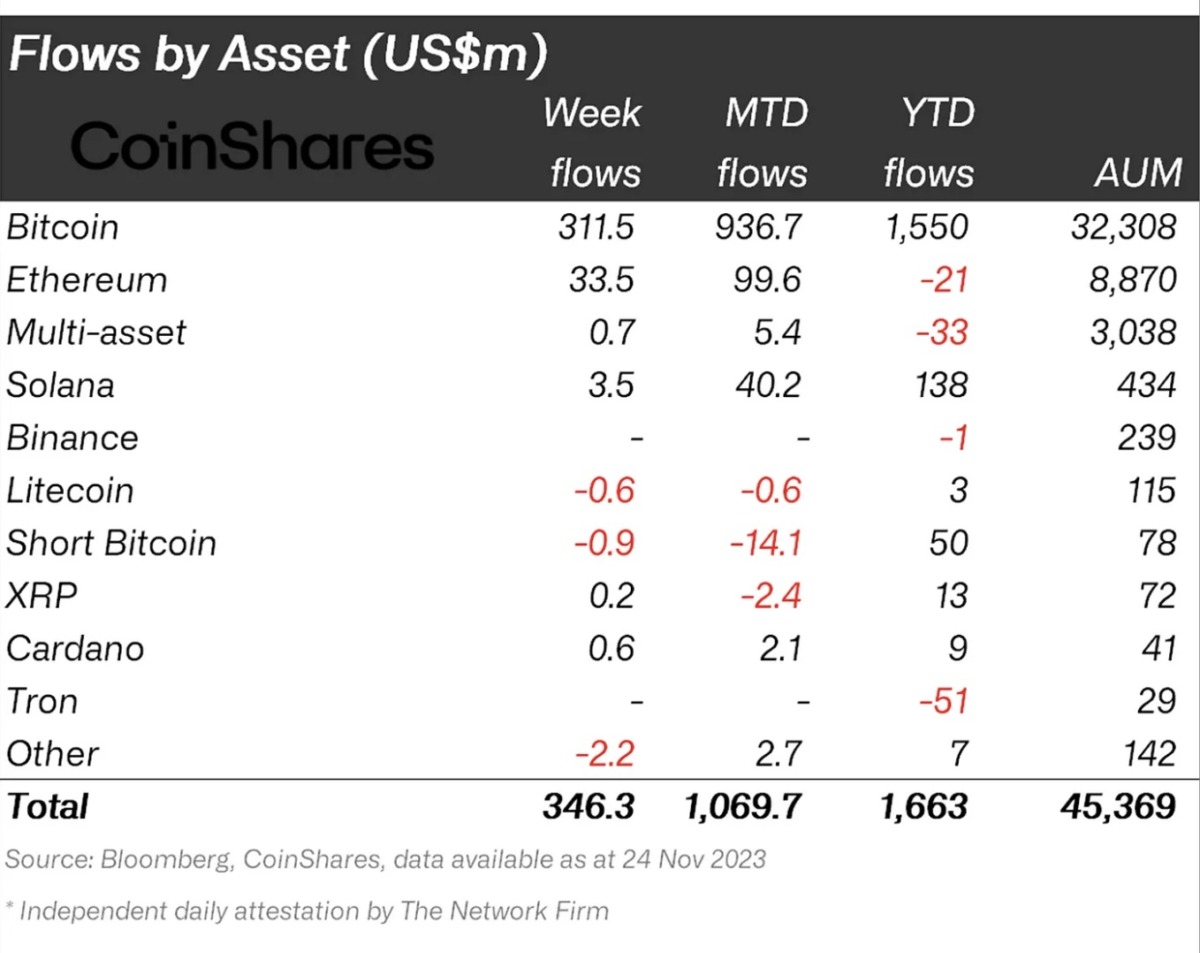

In individual asset inflows, Bitcoin witnessed a staggering inflow of $312 million last week. Thus, he emerged as the dominant player. This influx has pushed year-to-date inflows just beyond the $1.5 billion mark. Interestingly, this increase coincided with short sellers capitulating for the third week in a row. This indicated a significant reversal of the trend. Despite a 61% decline in Assets Under Management (AuM) since the peak in April 2023, Bitcoin’s Exchange-Traded Product (ETP) volumes have remained strong, accounting for 18% of total spot Bitcoin volumes. This highlighted investors’ continued preference for ETPs as a way to gain exposure to BTC.

Source: CoinShares

Source: CoinSharesLeading altcoin Ethereum saw inflows reaching $34 million last week. Thus, it showed a revival in investor sentiment. This latest series of positive inflows, totaling $103 million over the past four weeks, is in stark contrast to the outflows that dominated earlier in the year. This marks a significant shift in sentiment towards Ethereum among investors. Additionally, altcoin projects such as Solana (SOL), Cardano (ADA) and Ripple (XRP) recorded entries. These also experienced inflows of $3.5 million, $0.6 million and $0.2 million, respectively. Thus, they contributed to the overall momentum in the cryptocurrency investment environment. On the other hand, Litecoin (LTC) experienced an outflow of $0.6 million.