Long-term bitcoin (BTC) holders’ resolve to keep building their coin stashes has weakened amid fears the implosion of crypto exchange FTX will prolong the crypto winter. The exchange, founded by Sam Bankman-Fried and formerly the third-largest in the world, filed for bankruptcy last week.

The change in stance is notable because the investors weren’t fazed in the third quarter even as macro traders left the market, keeping bitcoin resilient to the macroeconomy-induced turmoil in traditional assets. Their shift now to distribution from accumulation perhaps represents concern about the strength of the market following FTX’s collapse.

“There has certainly been a degree of immediate panic within the HODLer cohort,” analytics firm Glassnode said in a weekly report published Monday, referring to the decline in the supply owned by long-term holders and the movement of inactive coins.

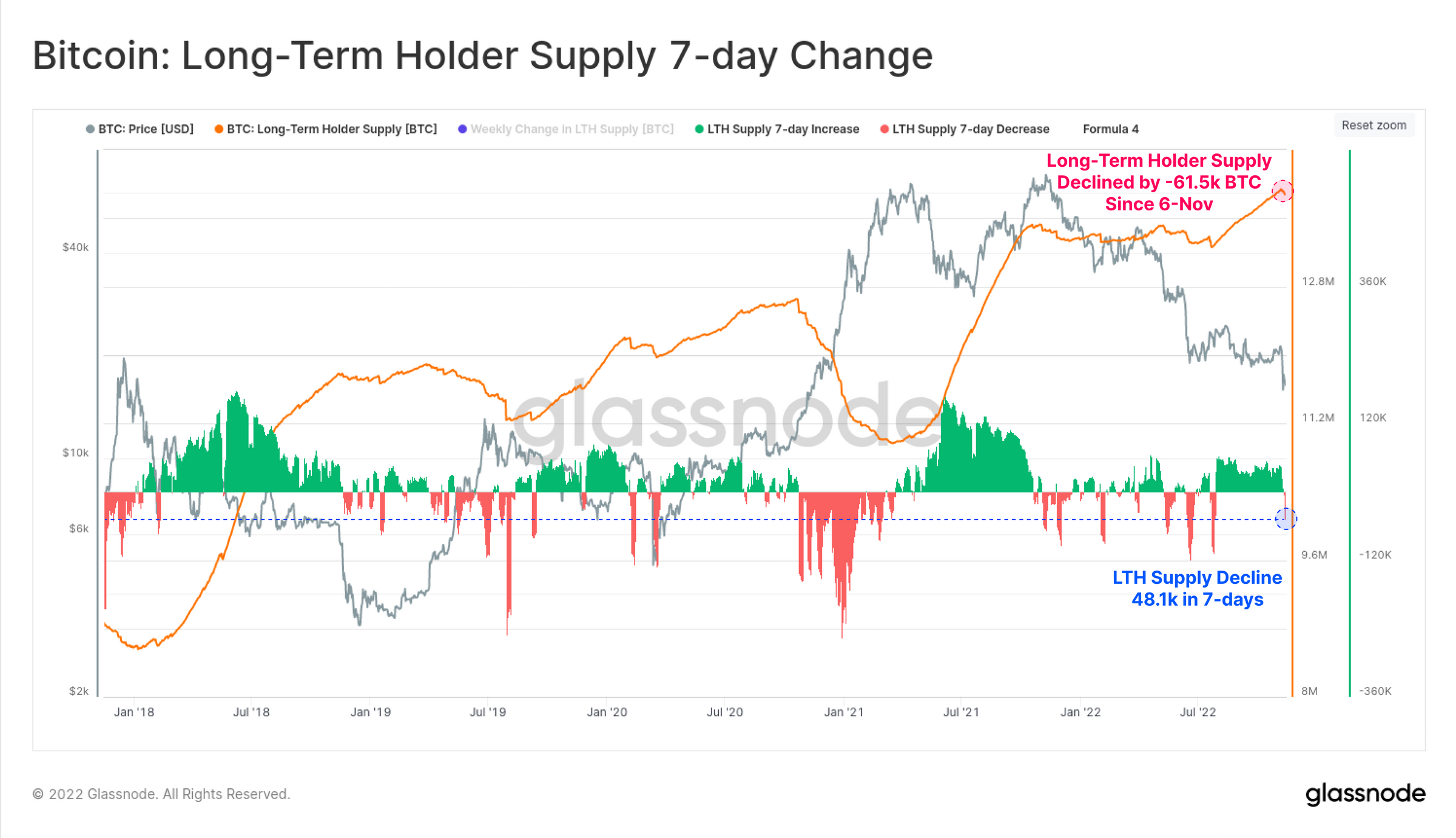

The total amount of circulating supply owned by long-term holders has declined by 61,500 BTC ($1.03 billion) since Nov. 6, marking a shift away from accumulation observed between the end of June and early November, data published by Glassnode show.

Another metric, the long-term holder net position change, shows more than 48,000 BTC were spent in the week ended Nov. 13. Glasnode defines long-term holder supply as the one that is statistically the least likely to be spent. In addition, more than 97,000 BTC that were inactive or dormant for over a year moved last week and possibly returned to the cryptocurrency’s circulating supply.

According to digital assets data provider Amberdata, FTX’s implosion will have many consequences, including the “potential demonization of crypto space politically and a daisy chain of balance sheet capital short-falls for various institutions.” Some analysts studying chart patterns see bitcoin falling to $13,000 in the near-term.

Long-term holders are distributing coins for the first time since the end of June. (Glassnode)

While long-term holders have begun distributing coins, it’s still too early to call a long-lasting bearish shift in sentiment, according to Glassnode.

“A sustained push higher in older coins being spent, and a decline in LTH supply would be clear warning signs that a more widespread loss of conviction and concern may be in play,” Glassnode noted.