Binance has recently launched a staking program for Proof-of-Work (PoW) tokens Dogecoin and Litecoin. Now, he has announced that the deposited funds will remain on the exchange and will not be staked to earn additional returns. After the event, users who staked DOGE and LTC on the Binance exchange took their breath on Twitter. The statement of the leading cryptocurrency exchange drew a great reaction.

Binance made a statement

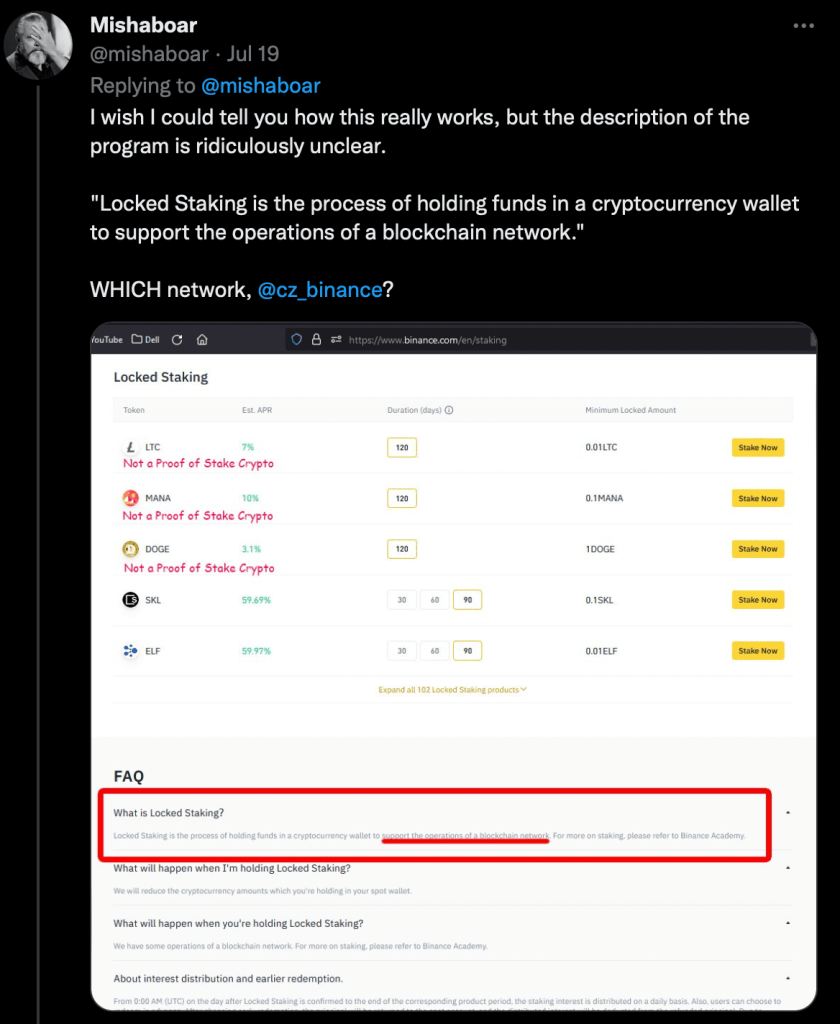

The exchange spokesperson sent a letter to CoinDesk today. The letter states, “It is impossible to stake LTC and DOGE on-chain for network authentication. Both altcoin projects are PoW tokens, not PoS. User funds will remain with Binance. “We have very strict risk management rules to ensure safety,” he said. The announcement came after several prominent social media influencers and investors who disapproved of the staking program. These investors questioned how to stake altcoins like DOGE and LTC. cryptocoin.com As we reported, DOGE and LTC use the PoW consensus. Proof-of-Work refers to a system where transactions are verified by CPU mining rather than staking. A popular social media user who questioned the program shared:

“Oh son. Binance has announced another “holding” program. This is called “Locked Staking”. Apparently, it allows you to “stack” LTC and Dogecoin. LTC and DOGE, PoW cryptos, how is this possible?”

Staking program for PoW altcoins

Networks such as Dogecoin, Litecoin, and Bitcoin are built on the energy-intensive PoW model. Accordingly, miners solve a computational problem to verify transactions. PoS networks, on the other hand, need market participants and validators. Users who lock (stack) their tokens into smart contracts earn additional altcoin rewards. Therefore, DOGE, LTC and BTC holders do not have the option to stake their own coins on a network in exchange for rewards. In other words, tokens of PoS networks such as Polkadot, Cardano and Avalanche can be used to generate passive income. After the criticism, Binance updated the frequently asked questions page on its website. Thus, he explained the locked staking process for non-stachable tokens.

Accordingly, Binance has scheduled its locked staking program to last for 120 days. So subscribed users will have this position for 120 days. While there is an early payment option available, users who do so will have to forego the rewards. The subscription period for this campaign is set to end on July 26. The program is said to offer annual token rewards of up to 10% on deposits paid daily. Some users in the investor community cite that double-digit returns may be too good to be true. They also state that the exchange may use locked DOGE and LTCs elsewhere to generate additional income. Therefore, they are concerned that user funds may expose them to potential risks.

Dogecoin creator blasts Binance

Billy Markus, the creator of Dogecoin, described the 10% return program as unsustainable in a sarcastic tweet. Thus, he expressed his dissatisfaction to the Dogecoin community. Everyone is aware of Terra’s collapse in May and recent liquidity problems. Therefore, suspicion and reluctance towards high-yield products seems normal. A Binance spokesperson responded to the above allegations. The spokesperson said, “We do not stake or lend LTC and DOGE to users. APR rewards for this campaign come directly from Binance exchange.” said. At the time of writing, DOGE was changing hands at $0.70.