Altcoin projects aiming to integrate Bitcoin and DeFi are now more visible than ever before. Analysts at consulting firm Motley Fool point to an industry-leading blockchain.

The mix of Bitcoin and DeFi could make this altcoin a real trend

Bitcoin was not originally designed to process complex smart contracts. This shortcoming has been the impetus for the creation of projects like Ethereum. But that is now changing as a Blockchain known as Stacks (STX) has developed a way to provide smart contract functionality on the Bitcoin network.

With Stacks, Bitcoin is now becoming programmable. Thus, the use cases in decentralized finance (DeFi) increase exponentially. According to Motley Fool analysts, Stacks is a game changer for Bitcoin and could be the same for investors.

How does Stacks (STX) work?

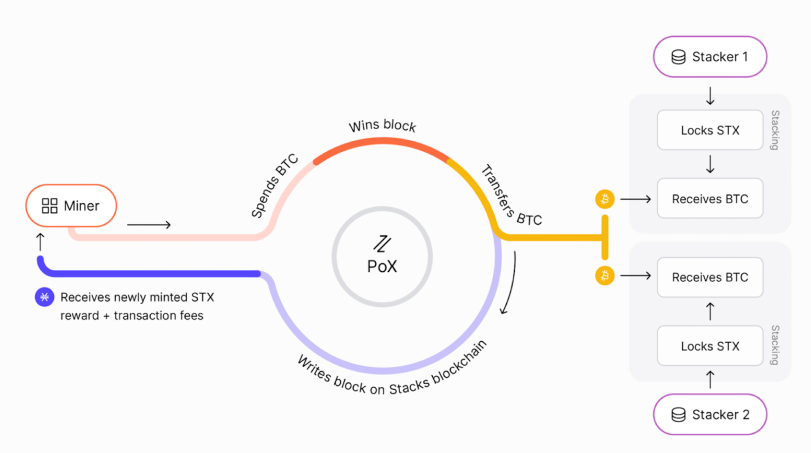

Similar to the Layer-2 solutions available for Ethereum today, Stacks not only provides DeFi capabilities. It also helps reduce the high fees and slow speeds that plague Bitcoin. To achieve this, Stacks processes transactions on its own network. It then uses a unique consensus mechanism called proof of transfer. So it adds them back to Bitcoin at a later date.

Like Bitcoin, this process starts with miners. But Stacks takes things a step further by adding other participants at the end of the mining process known as stacks.

Let’s start with the miners. To earn the right to mine Stacks, miners must lock a predetermined amount of Bitcoin as collateral. When they successfully mine a block, they earn a reward in the form of STX.

Then there is the role of stackers. Stackers commit their money to the network to improve the security and decentralization of the Stacks network. They are encouraged to do so by being rewarded with collateralized Bitcoin originating from miners. After a block is mined, the miner not only gets Stacks. At the same time, stackers also receive a portion of the Bitcoin collateral.

Why is DeFi feature breaking the game?

While the proof-of-transfer method makes Stack attractive in itself, arguably the most compelling reason to invest in Blockchain has to do with the fact that it enables DeFi capabilities in Bitcoin. Thanks to Stacks, a whole new world of possibilities opens up for Bitcoin.

For example, Stacks developers can build decentralized exchanges, lending platforms, NFTs, and stablecoins on top of Bitcoin. All of these have the potential to revolutionize the financial industry. But it was previously limited to networks like Ethereum. Today, the DeFi economy is worth $45 billion, and thanks to the emergence of Stacks, Bitcoin is finally gaining value from this lucrative industry.

Rising demand creates long-term potential for altcoin

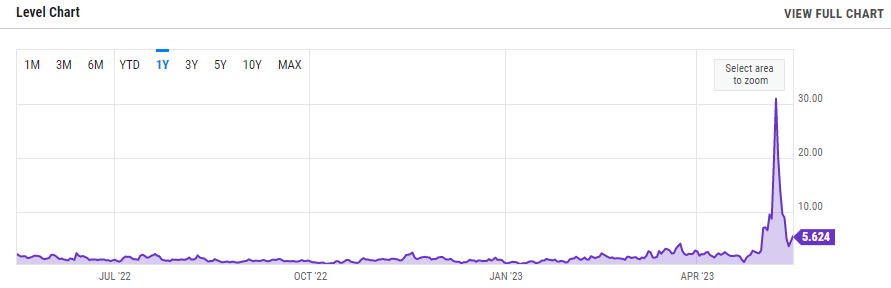

The recent launch of Bitcoin-based NFTs earlier this year makes the use case of Stacks more and more evident every day. The demand for these Bitcoin NFTs, known as Ordinals, has skyrocketed. Then it caused transaction fees to reach record levels.

So much so that Binance, one of the world’s largest crypto exchanges, had to temporarily suspend Bitcoin withdrawals. cryptocoin.comWe have included the details in this article.

We've temporarily closed $BTC withdrawals as the #Bitcoin network is experiencing a congestion issue.

Our team is currently working on a fix until the network is stabilized and will reopen $BTC withdrawals as soon as possible.

Rest assured, funds are SAFU.

— Binance (@binance) May 7, 2023

The reason for the increase in fees is that Ordinals don’t use Stacks. Instead, it uses individual satoshis, the smallest unit of a Bitcoin on the main Bitcoin network. These enable the creation of NFTs.

While interesting, using Stacks to generate these NFTs would be a better option. In doing so, wages would decrease exponentially. However, it would still allow transactions to be added to Bitcoin. As fees remain high, alternative solutions such as Stacks are likely to be used.

As more developers become aware of Bitcoin’s new DeFi capabilities, Stacks is in a unique position to capitalize on these trends. With Stacks, Bitcoin goes beyond just a store of value. It is also becoming a platform for innovation and new use cases.

Should I buy STX?

Stacks (STX) is the 54th largest cryptocurrency by market cap. It is currently trading at 85% discount from the November 2021 ATH level. Motley Fool’s analysts recommend keeping Stacks a must for crypto traders looking for the next big trend:

It will likely be a slow process, but for those trying to find the “next big thing” in crypto, look no further than Stacks and how it revolutionized Bitcoin.