As the world’s leading smart contract blockchain, the altcoin shows no signs of giving up its dominance in the market.

In the new year, this altcoin will come to the fore with its energy

With 2023 coming, a new energy seems to be circulating in the cryptocurrency market. Almost every cryptocurrency has been on the rise since the beginning of the year, but the second most valuable cryptocurrency is Ethereum.

Although the price of Ethereum (ETH) has dropped 68% in 2022, it is the only cryptocurrency that can boast of executing one of the most important events in the history of digital assets. In September, Ethereum developers successfully implemented The Merge, a change to the blockchain code that shifts the consensus mechanism from a cumbersome and energy-intensive proof-of-work system to a modern and energy-efficient proof-of-stake method.

As important as The Merge was, it added little to the price of Ethereum. There was a brief rally in the days leading up to its official launch, but the token crashed after going live. While the merge represents a crucial milestone in Ethereum’s development and lays the groundwork for it to support more use cases and new features in the future, this move has had no immediate impact or advantage on users.

A new start

Now that we are in the post-merge era, Ethereum may start to enjoy some of the benefits that come with the transition to proof-of-stake. In the previous life of Ethereum, it used mining as the method by which transactions are verified and new blocks of data are created. But now, instead of miners, Ethereum’s blockchain is secured with the use of validators who ‘mention’ or lock their funds on the network to serve as collateral.

As part of The Merge, Ethereum developers prevented those who staked their funds from withdrawing them. It was a necessary step to launch the next chapter of Ethereum, but the lack of any expiration date on the withdrawal moratorium likely deterred some from staking. That could change this year.

Shanghai, Ethereum’s next upgrade, will launch this spring and will allow users to withdraw their deposited funds. While there is speculation about what this will do to the price of Ethereum in the short term, it should only benefit the blockchain in the long run.

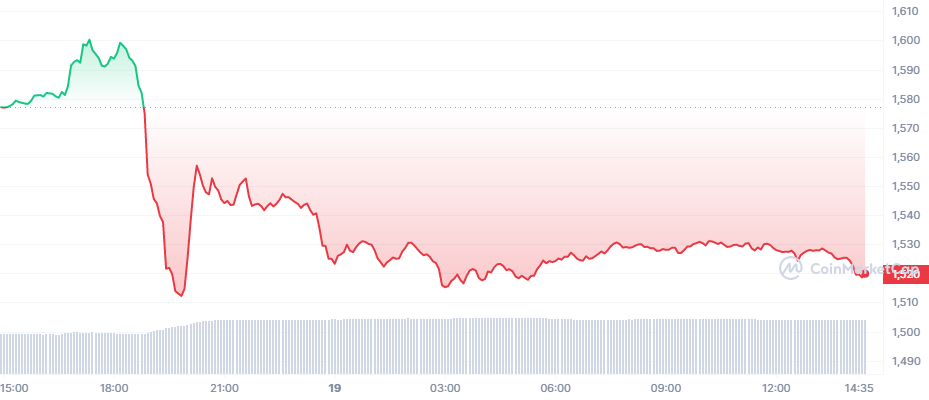

Now that people know that they can withdraw their staked Ethereum funds at any time, more people are likely to stake on the network. Ultimately this should make the network more secure and decentralized. cryptocoin.comAs we mentioned, ETH is instantly traded at $ 1.519.

A busy blockchain once again

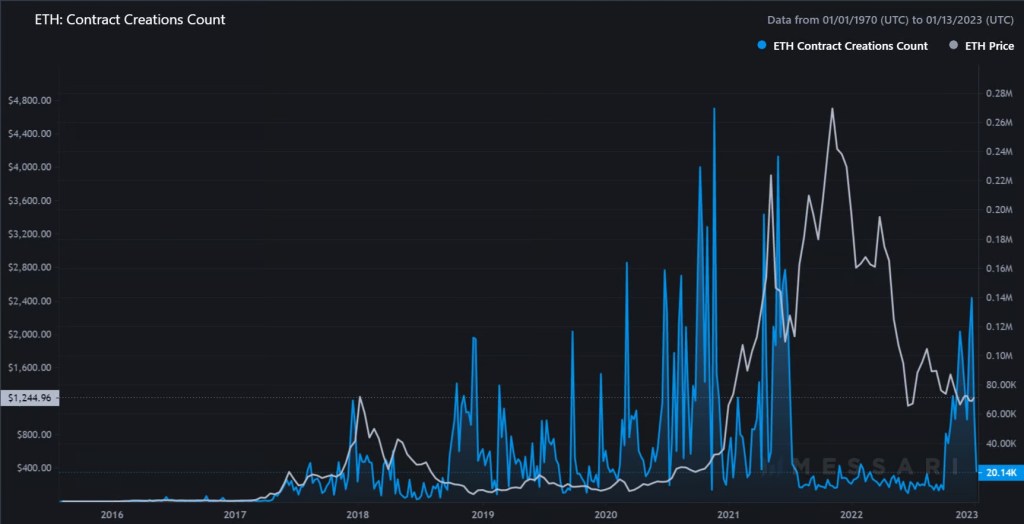

While the launch of withdrawals will help Ethereum in the future, there are signs that the Ethereum network is experiencing a resurgence in activity in the short term, which is often a harbinger of an increase in prices.

One of the primary ways to get a glimpse of Ethereum’s activity levels is the number of smart contracts created on a blockchain. Smart contracts are pieces of code used by developers to build applications and often serve as a metric to indicate network demand. The more smart contracts are created, the more demand there is.

For most of 2022, the number of smart contracts created on this altcoin was stagnant. But since October 2022 and entering the new year, there has been a dramatic increase in the number of smart contracts created daily. After barely recording a day with over 25,000 contracts for most of 2022, Ethereum has notched over 100,000 in many cases, averaging 50,000 per day over the past few months.

Ethereum now accounts for more than 60% of industry value

This increase in activity is also reflected in its total locked value (TVL), a statistic used to measure the amount of dollars a blockchain supports in the decentralized finance (DeFi) sector where Ethereum is beginning to dominate. To close 2022, Ethereum’s DeFi market share has increased by about 4%, a significant move after losing market share for most of the year. Of all other blockchains with DeFi capabilities, Ethereum now accounts for more than 60% of the industry value. The next closest BNB (BNB) trails with just 10%.

It is predicted that Ethereum’s lead over its competitors will only increase in the coming months and years. With events like the surge in activity to close last year and the Shanghai upswing on the horizon, it looks like this altcoin has finally bottomed out, making it a great time for investors to capitalize on a cryptocurrency with long-term explosive potential.