Cryptocurrencies are a highly volatile asset class, however, the consulting giant offers to invest in these 3 coins, not DOGE.

Investing in these coins instead of DOGE in the volatile market

When investing in cryptocurrencies, you should understand that they are a highly volatile asset class. Some call the entire category ‘speculative’ and many cryptocurrencies fit that description for any investor. However, if you are willing to take that risk, it is possible to reap substantial returns.

One of the main differences between investing in cryptocurrencies and traditional stocks is that the crypto market is still relatively new and not well regulated, which can make it riskier. However, it also means there is potential for higher returns. Assuming things go as planned, more risk may equal more substantial rewards. You get paid for the risk you take.

You can now manage crypto risks by sticking to safer options. Just like you wouldn’t want to invest all your money in a single penny stock, you wouldn’t want to invest all your money in a single unproven token, perhaps a cute dog mascot. Instead of DOGE, you may want to diversify your portfolio by investing in a variety of different, established cryptocurrencies.

Bitcoin in an advantageous position

Bitcoin (BTC) should probably be the first and perhaps the largest position to be built. This was the first cryptocurrency, still the largest in terms of market cap and daily utility, and was built specifically to hold value for a long time.

A tightly constrained inflation system is built into the Bitcoin code, and 91.7% of all Bitcoins that will ever exist have already been mined. A few countries already consider it legal tender, and others are considering doing the same.

I cannot guarantee that Bitcoin will achieve all its goals or gain in value over time. However, it has a first mover advantage and it would take a truly special cryptocurrency to replace it as the gold standard of the crypto market. cryptocoin.comAs we mentioned, BTC is instantly traded at $20.940.

Ethereum interested in financial applications and services

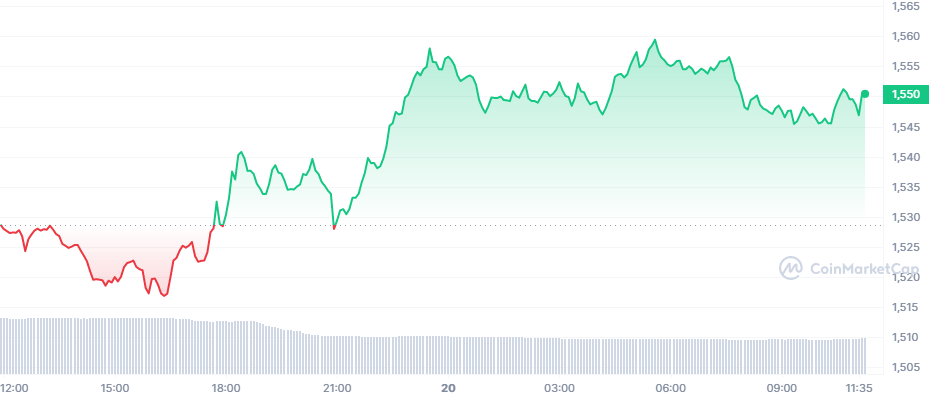

Smart contracts platform Ethereum (ETH) is more interested in blockchain-based financial applications and services. If you think decentralized banking, insurance and payment systems sound like a great idea, Ethereum would be the obvious place to start investing.

Over time, these new tools are poised to disrupt several trillion dollar industries, and Ethereum is more involved in most of these projects than any other cryptocurrency. Just like Bitcoin, Ethereum maintains its dominant market position with the power of scale and experience. However, ETH is currently traded at $1,549.

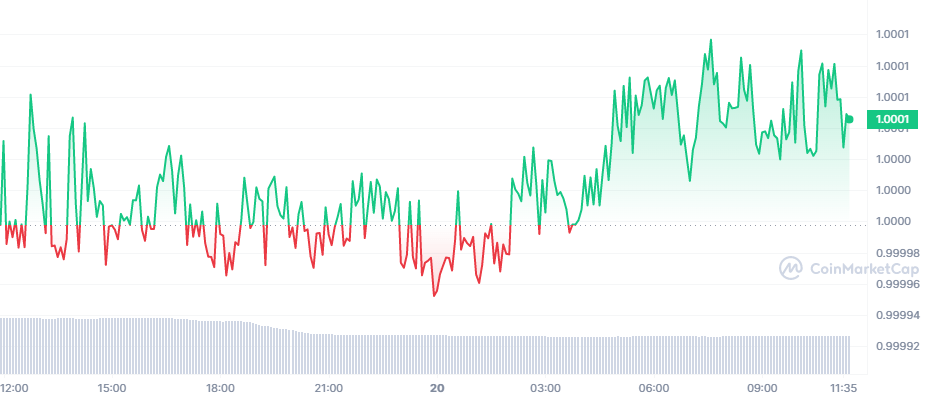

Tether or USDC staking

You can buy many different stablecoins, such as the industry-leading Tether (USDT) and the second USD Coin (USDC), and then earn interest on these assets. Some of these cryptocurrencies, including USD Coin and Tether, are backed by cash and federal bonds, while others stand on less solid ground but are all intended to reflect the true value of the US dollar, euro, Japanese yen or other currencies.

The idea is very close to imitating subprime savings or money market accounts from decades ago. This is your hard money staking, which allows other investors to borrow against your assets and pay interest as you would any serious loan. Yes, this sounds a lot like your old bank’s money market accounts, but the returns you earn by staking stablecoins tend to be more generous.

So if you are looking for ultimate stability combined with generous interest rates and digital flexibility, this is your first choice. If Bitcoin and Ethereum are too rich for your blood, this is the most logical way to manage your cash reserves on the blockchain. Make sure the stablecoin you choose stands on a solid financial footing and earn your staking rewards through an equally reputable crypto exchange. Things can get ugly when experimental stablecoins don’t live up to their name.