The US Congress is currently discussing new stablecoin laws as a first step towards comprehensive crypto legislation. Analysts at consulting giant Motley Fool say the 3 altcoin projects could be the biggest beneficiaries of the new legislation.

New stablecoin legislation could benefit DeFi-focused altcoin projects

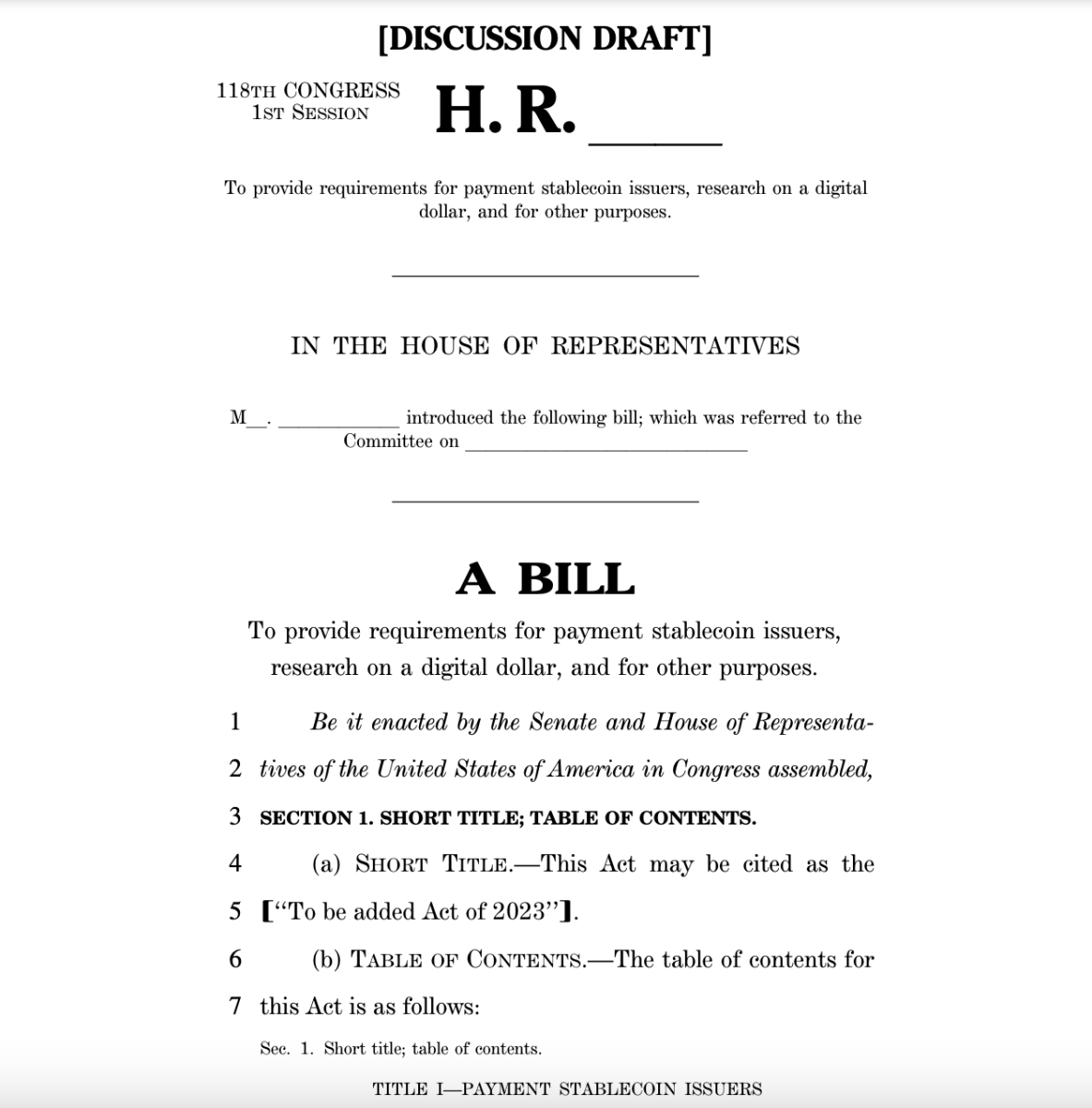

The US Congress is still working on a framework for comprehensive crypto legislation. In the latter case, it looks like the focus will be on stablecoin legislation. The consensus is that if Washington lawmakers decide how to regulate stablecoins, other cryptocurrencies will be next.

Therefore, the new stablecoin legislation could provide a nice boost to the cryptocurrency market as a whole. But which individual cryptos will benefit the most? Motley Fool analysts answer…

stablecoin investment thesis

To answer this question, it is important to understand why stablecoins are so popular and how they are used. Leading stablecoins such as USDT and USDC are among the top five cryptos by market cap. For example, Tether has a market cap of $83 billion, while USDC has a market cap of $29 billion. In total, they make up about 10% of its entire market with a current market cap of $1.1 trillion.

Ethereum, Avalanche and Solana

Motley Fool’s analysts say that due to the power of stablecoins, the biggest beneficiaries of the new legislation will be major Layer 1 blockchains such as Ethereum (ETH), Solana (SOL), and Avalanche (AVAX), which are among DeFi’s biggest players. The more “stable” stablecoins are (as a result of legislation), the more stable the DeFi ecosystems will be. This will provide a major impetus for future growth.

Ethereum, in particular, is seen as the most obvious beneficiary of stablecoin legislation. This is because Ethereum is the heart of DeFi. According to the TVL metric, which is often used to measure overall DeFi strength, Ethereum is the clear leader. It makes a big difference to its competitors. For example, according to DeFi Llama, Ethereum accounts for 49% of the total TVL of all altcoins.

Another major Tier 1 Blockchain ranked in the top 10 by TVL is Avalanche (AVAX), the superfast competitor to Ethereum. Although the Avalanche DeFi ecosystem is not as large or diverse as Ethereum’s, it is still impressive. Accounting for 1.5% of all TVL in the blockchain world, Avalanche is home to a number of popular decentralized exchanges and DeFi protocols.

Finally, there is Solana, another great Tier 1 ecosystem, which is particularly renowned for its prowess in NFT. But Solana founder Anatoly Yakovenko sees stablecoins as the “killer practice” that will trigger the next big boom in crypto adoption. According to the founder, once people have stablecoins in their Blockchain wallets, they will want to convert them into tokens to be used on the Blockchain. Yakovenko actually says that stablecoin legislation is “my big dream.”

Is DeFi the best use case for stablecoins?

Some analysts argue that DeFi is not the best use case for stablecoins. Representative Stephen F. Lynch, for example, argued in his final statement before the House Financial Services Committee that stablecoins are “speculative instruments” that contain “structural vulnerabilities” that pose risks to traditional banking and finance.

Which altcoin project will be the biggest winner?

cryptocoin.com As we reported, analysts mentioned that the latest Apple news will provide support in MANA and SAND. On the biggest beneficiary of the new stablecoin legislation, they say:

Ethereum appears to be the biggest beneficiary of stablecoin legislation. You can’t go wrong with the world’s DeFi leader. In the long run, we are optimistic about Ethereum and expect the new stablecoin law — if Congress succeeds in passing it — to provide a nice boost to Ethereum’s growth prospects.