Sometimes, the financial market responds by following the investment strategies of the rich. Consulting giant Motley Fool has published a list in this context. This list scrutinized the cryptocurrency investment strategies of three important personalities.

The rich are investing in these 3 cryptocurrencies

These three personalities are; Twitter founder Jack Dorsey, ARK Invest CEO Cathie Wood, and billionaire entrepreneur Mark Cuban. Each of the names mentioned is defending cryptocurrencies at every opportunity. So what digital assets are they betting on?

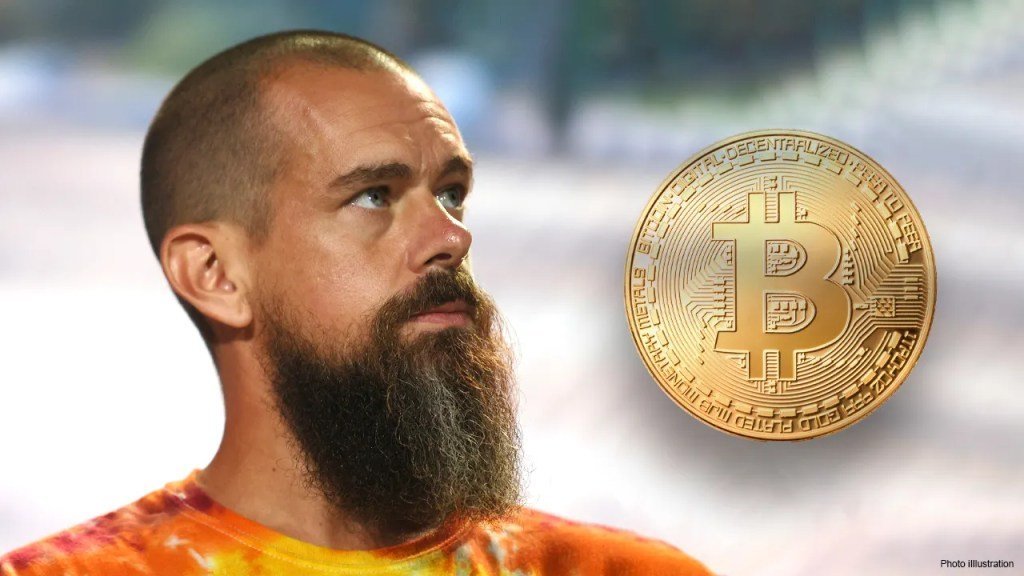

Jack Dorsey’s favorite Bitcoin (BTC)

Jack Dorsey loves Bitcoin (BTC), the most valuable cryptocurrency today. In his own words, he has dedicated a portion of his $4.7 billion net capital to the leading crypto asset. He even went so far that he renamed the digital payments company Square, Block, out of his fascination with Blockchain. Block has gone beyond just staying in the payments industry. Now the company is integrating Bitcoin into its own applications.

Dorsey also supports Bitcoin at every opportunity. He describes it as the unique currency of the internet. He adds that the only asset with an ecosystem good enough to earn this title is Bitcoin. This stance of Dorsey towards BTC is probably related to Block’s BTC portfolio. For those who don’t know, the company currently holds over 8,000 Bitcoins in its vault.

Cathie Wood bets on the leading altcoin Ethereum (ETH)

Cathie Wood has gained notoriety in recent years, especially due to the success of the ARK Innovation ETF. Wood and his team aim to capitalize on opportunities by detecting disruptive technologies and trends early. They also feel that by doing this they can provide long-term value to investors. Bitcoin is one of the favorites of ARK, like Block. However, they bet that the leading cryptocurrency Ethereum (ETH) also has long-term potential.

In a report released this year, ARK Invest analysts suggested that as DeFi evolves, decentralized blockchain networks will take a share of the financial market. Accordingly, ARK Invest predicts that Ethereum will benefit from this growing market. However, analysts’ predictions for Ethereum are not limited to this. The aforementioned report says that by 2030, the market value of Ethereum could reach $20 trillion. If this prediction turns out to be correct, the ETH price will rise to $130,000 in the next 8 years.

Mark Cuban optimistic for Polygon (MATIC)

The crypto currency that the increase in the popularity and price of Ethereum most corresponds to is Polygon (MATIC). This layer-2 solution is attracting the attention of some high-profile investors like tech guru Mark Cuban. In May 2021, Cuban bought a stake in Polygon. So, while it’s unknown how big the stake was, the crypto enthusiast is well aware of Polygon’s potential.

cryptocoin.com As we reported, Polygon is a layer-2 scaling solution for Ethereum. Cuban’s website describes Polygon as “the best and easy-to-use platform for Ethereum scaling and infrastructure development.” In addition, Cuban himself states in his statements that he uses Polygon constantly. Meanwhile, Cuban is one of the many rich people who realize the value of Polygon. Cryptocurrency is collaborating with many companies, including Meta and Disney.