Analysts at consulting giant Motley Fool are talking about a cryptocurrency with 10x bullish potential as the market shows strong signs of recovery.

Analysts point to long-term advantages in the cryptocurrency market

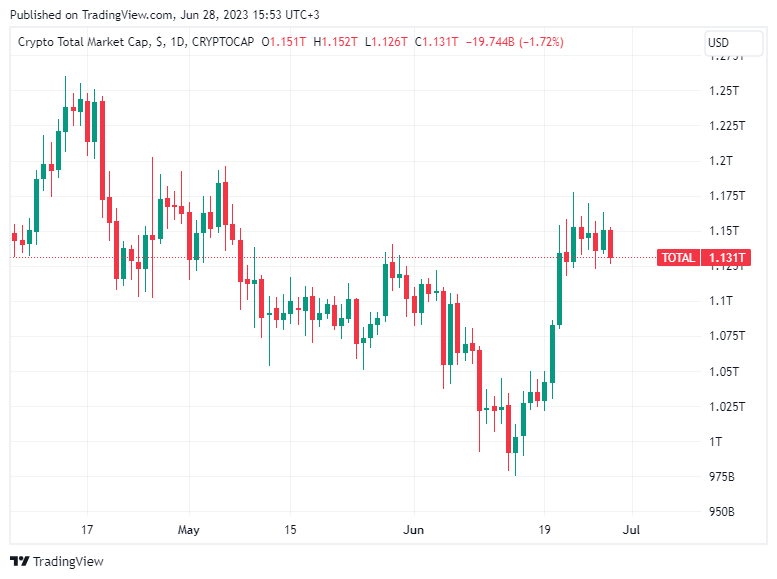

Financial markets do not exhibit as scary volatility as cryptocurrencies. Characterized by extreme bullish and bearish periods, the crypto market is for investors with a high risk appetite. The last few years have proven this point. The overall cryptocurrency market roughly tripled in 2021. But in 2022 it gave back all these gains. This year, there is a revival.

Motley Fool analysts predict a single crypto will be at the forefront due to increased institutional interest and superior ROI…

Here’s why analysts expect superior performance from Bitcoin (BTC)

Unlike most traditional investments such as stocks, bonds or real estate, Bitcoin is unique in that the first wave of adoption comes from individual investors as opposed to large institutions. However, the analyst predicts that over the next 10 years, more institutions will start buying and owning Bitcoin.

Large public companies like Block and MicroStrategy keep some of their cash balances in Bitcoin. Mutual funds like Ark Invest have it. Some countries even keep some of their reserves in Bitcoin.

MicroStrategy repaid its $205M Silvergate loan at a 22% discount. As of 3/23/23, $MSTR acquired an additional ~6,455 bitcoins for ~$150M at an average of ~$23,238 per #bitcoin & held ~138,955 BTC acquired for ~$4.14B at an average of ~$29,817 per bitcoin. https://t.co/ALp9VLkTpt

— Michael Saylor⚡️ (@saylor) March 27, 2023

An expanding financial services ecosystem helps drive corporate adoption. Also, as the regulatory uncertainty surrounding cryptocurrencies fades, major players are being invited into the crypto scene.

In terms of Bitcoin, there will only be 21 million BTC in existence. This fixed supply cap means that the BTC price will only increase if there is more demand. Even a tiny fraction of this money flowing into Bitcoin will suffice, as institutions control enormous amounts of capital.

Fiat currencies are losing strength

The rise in Bitcoin has little to do with the weakness of fiat currencies like the dollar. This has more to do with the state of the current financial system. The US government has more than $31 trillion in outstanding debt. This figure has grown steadily over time, although the increase has been more pronounced in the last decade. Also, the M1 money supply (all money in checking and savings accounts) rose despite falling last year.

To be fair, the Fed has aggressively increased interest rates to reduce inflationary pressures. Currently, this policy works. But the US and other major national governments still have huge debts. Therefore, interest rates probably won’t stay high for very long. Net interest payments already make up 8% of the annual US budget.

Bitcoin outperforms gold

Gold has long been one of the best stores of value because it is a beautiful, shiny metal and is extremely rare. Obviously, its value does not derive from its industrial uses. People think it has value. Because everyone else agrees that it has value.

Bitcoin has many advantages over gold. While gold has a much longer history, Bitcoin is strictly limited, more portable than gold, easily divisible, and can be used seamlessly in a growing number of transactions. It’s all digital though, so some older people who control most of the country’s wealth are probably not as comfortable as the younger population.

In the next ten years, as knowledge about it grows, Bitcoin could capture half the value of the $12 trillion gold market. At $6 trillion, Bitcoin would be worth about 10 times more than it is today. Motley Fool believes this is a reasonable estimate. cryptocoin.comAs you follow, analysts have previously made similar predictions for Ethereum (ETH).