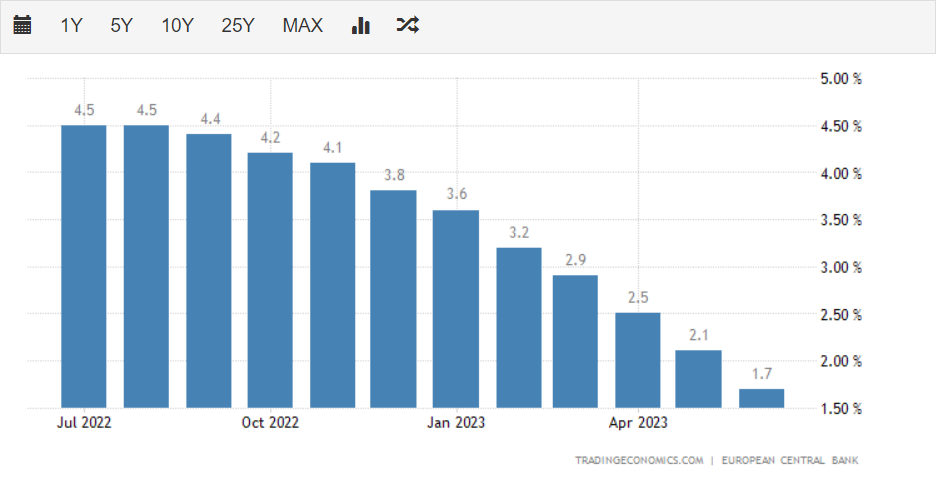

Credits continue to slow down in the European region, where concerns about economic recession are being voiced due to interest rate hikes. According to the latest data released by the European Central Bank, ECB, loan rates to companies and households remained below expectations.

According to the ECB data released at 11:00 am, the loan growth rate of non-financial companies dropped to 3% in June. The market had expected the metric, which was recorded as 4% in May, to decline to 3.4%. However, the slowdown in loans was more severe than the market expectation.

The credit contraction in the euro area is also evident in households. The figures revealed that the loan growth rate, which was 2.1% in May, decreased to 1.7% in June.

Credit growth rates of the European Central Bank ECB.

Credit growth rates of the European Central Bank ECB.The industrial manufacturing index data, which came in the other day, causes the possibility of economic recession in Europe to come to the fore again.

When is the ECB Rate Decision?

After the negative data in the euro area, investors turned their eyes to the interest rate decision. The European Central Bank ECB will announce its interest rate decision on July 27, 15:15. The market expects its rate to increase by 25bps to 4.25% despite macroeconomic metrics showing signs of recession.