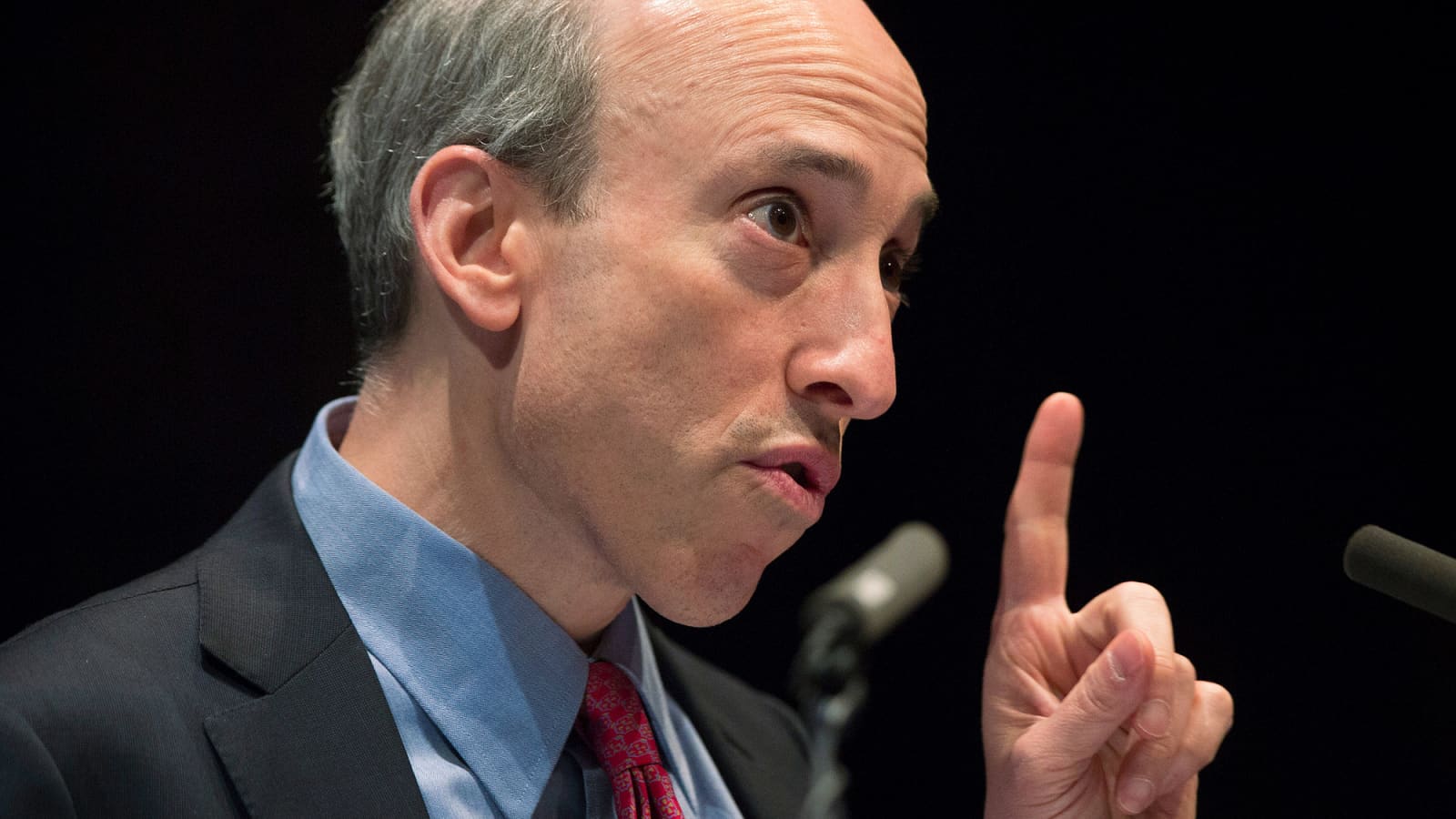

SEC Chairman Gary Gensler said in an interview with CNBC on Thursday that the cryptocurrency market is a “pretty big” danger.

Gary Gensler reiterates that most cryptocurrencies are unregistered securities

Despite his support of blockchain technology, Gensler highlights shortcomings at every opportunity when it comes to investor protection. The SEC chairman has repeatedly stated that cryptocurrencies are a very speculative asset class. Gensler also notes that the majority of tokens currently in use are securities. In their latest statement, he emphasized that most of the tokens that have existed since they were launched are securities, as a group of sponsor-entrepreneurs raise funds from the public.

“I’m neutral about the technology but not about the investor protection,” says SEC Chair @GaryGensler on #crypto. “There are thousands of tokens, most have attributes of securities. Just like any field of new projects, many ventures fail. There’s significant risk in this field.” pic.twitter.com/hWVZehXK40

— Squawk Box (@SquawkCNBC) July 21, 2022

Gensler said last month that Bitcoin is a commodity, thus distinguishing it from other cryptocurrencies. The SEC chairman also remained silent about Ethereum’s regulatory status at the time. Meanwhile, the institution is moving away from the thought of former senior official Willian Hinman, who has declared Ethereum insecure. Critics believe such an assessment clouded regulatory decisions.

SEC chief suggests crypto lenders could be investment firms

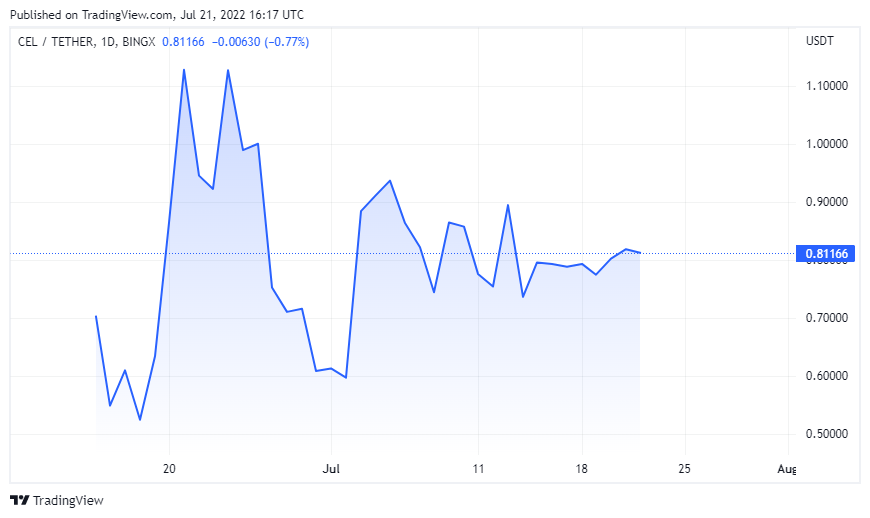

In the wake of the Terra crisis, a number of crypto lending companies went bankrupt in June. Celsius Network (CEL) announced on July 13 that it has filed for Chapter 11 bankruptcy after a month of turmoil. In this regard, Gensler talks about lending platforms providing “pretty good returns.” However, it is still unclear how they do this, according to him. One of Gensler’s critiques of this is, “What is the essence of these guarantees?” it happened. This statement was for the 20% interest rates of DeFi platforms such as Celsuis and Terra UST.

According to the SEC chief, they will continue to focus on properly registering such lenders under securities regulations to protect investors. Earlier this week, Gensler mentioned in an interview with Bloomberg that there is “too much mismatch” in the cryptocurrency market. According to Gensler, the SEC can use its exemption authority to regulate cryptocurrencies. The SEC chief also advises investors not to believe claims of excessive profits.

SEC chief warns of stablecoin traps and loan products

cryptocoin.com As you follow, Gensler said last week that the SEC can use its executive power to make regulations. Gensler says the public will benefit from investor protection when it comes to stock markets, lending and brokerage firms. The SEC boss once again made a comparison between stablecoins and poker chips.

Talking about the crisis in the crypto lending space, Gensler urges investors to stay away from platforms that promise high interest rates. To recall, embattled crypto lending platform Celsius declared bankruptcy last month. This event resulted in a revolt of investors on social media.