Cryptocurrencies are getting more and more popular around the world day by day. As a result, many countries are taking steps to regulate this new financial area. However, some countries are more distant and stricter towards Bitcoin and altcoin assets than others. England, which is among the examples in this context, has signed a striking regulation. Accordingly, the current government in the country is preparing to tax some altcoin assets in the DeFi space. Here are the details…

UK wants to tax DeFi altcoin investors

The UK has become notorious for its strict regulations in the cryptocurrency space. However, the country does not seem to want to be a comfortable country for investors. In this context, the UK, which has taken various steps in the past, is now preparing to regulate the decentralized finance (DeFi) field. Accordingly, the current government wants to tax the altcoin projects credited in the DeFi space and the investors who stake their assets. How such a development will affect the DeFi markets remains a matter of curiosity.

The news came from the UK Revenue and Customs Authority. Accordingly, the organization launched an 8-week survey on the taxation of the DeFi space. It is planned to turn the results obtained from the survey into a detailed report. Additionally, the government released an announcement regarding the survey. In the announcement, it asked companies, investors, and professionals in the crypto space to fill out the survey. The survey will continue until 31 August. Interested investors will fill out the questionnaire via their e-mails. In addition, meetings will be held according to the demands of the sector. After the survey is over, the Revenue and Customs Administration will publish a summary announcement. Then he will prepare a detailed report and ask the government.

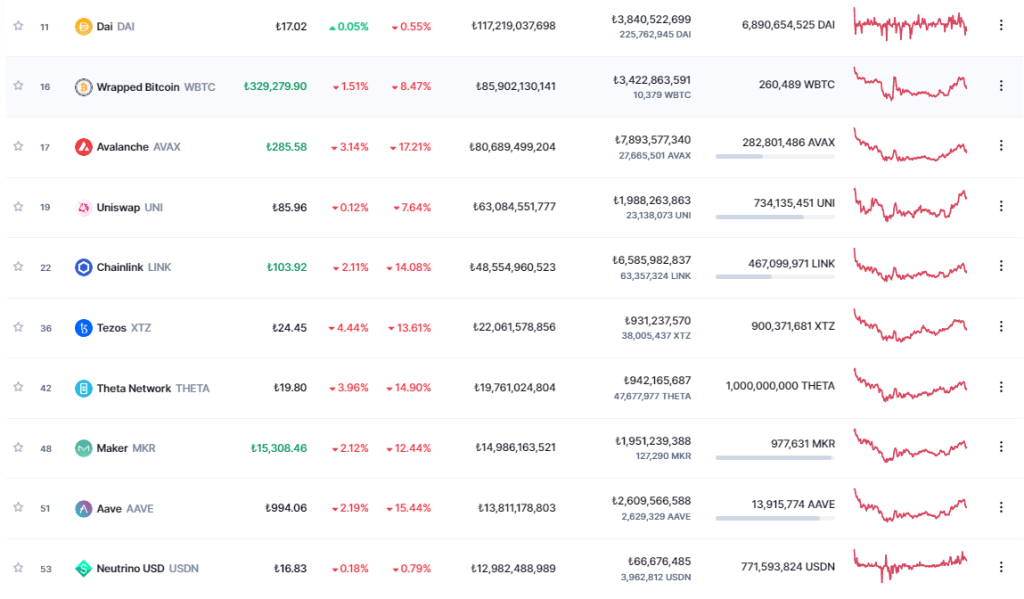

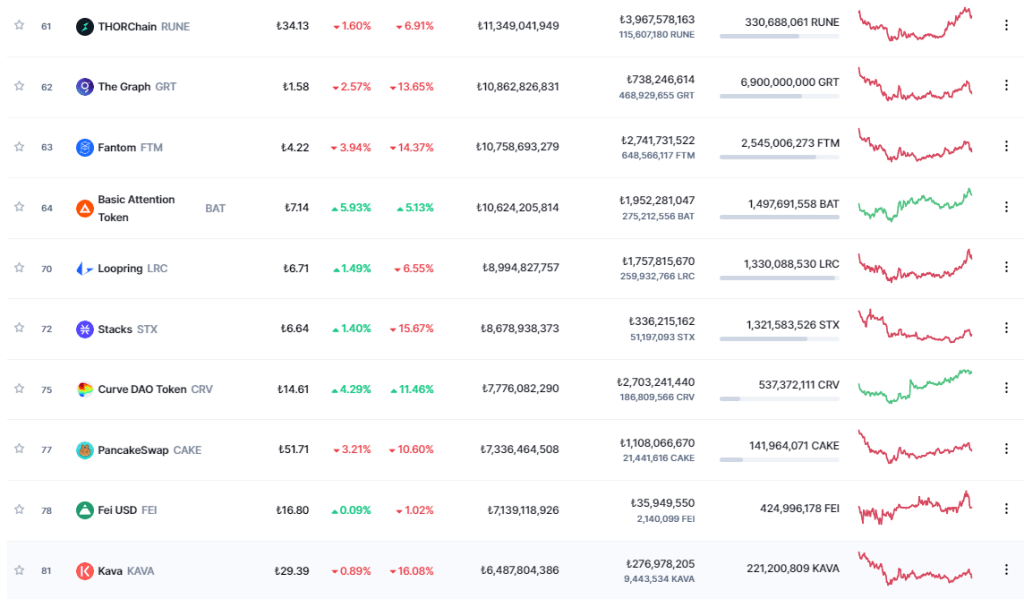

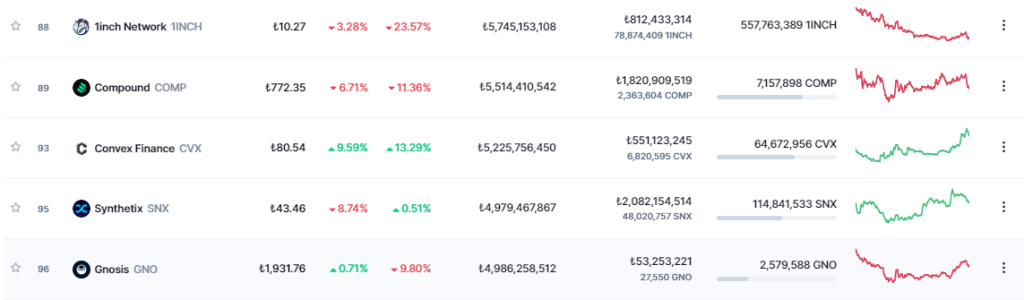

These DeFi altcoin projects could be negatively impacted

With the move of the United Kingdom, DeFi-focused altcoin projects became a matter of curiosity. It is possible to say that if taxation is made, many cryptocurrencies will be negatively affected. This is because investors see DeFi as more profitable than traditional finance methods. cryptocoin.com As we reported, DeFi yields much higher returns than traditional methods such as stock and bank interest. With taxation, it is possible for UK investors to move away from DeFi and shift their funds to traditional methods. Especially in the current period when global inflation is so high, such a regulation could hit DeFi. Below you can see the 25 largest DeFi altcoin projects based on available data.

The questions in the survey drew attention

The questions in the survey on DeFi altcoin taxation attracted attention. In the survey, which is reported to be attended by many financial institutions, investors and technology firms, “How many credit and staking platforms are there in the UK?” Various questions such as We will see over time how the regulation to altcoins will be.